Somewhere in the world might still be Thursday, so we still publish our Signals Thursday… And end this season for now with an exceptional interview guest.

ALPHA TRADE ZONE (formerly Bitcoin Compass) is one of our listed Discord Signal Groups. They came, and they ruled – pretty fast and far more important: they have proven many times that they are true experts in trading and have a deep knowledge of crypto projects. ALPHA TRADE ZONE contributed an article, “The Ripple Mafia“, which went viral.

SMARTOPTIONS.IO: ALPHA TRADE ZONE sky-rocketed out of nowhere and instantly became a very popular Telegram channel, providing a great flow of news and information. Tell us a bit about your team and how y’all have achieved this fast success.

ALPHA TRADE ZONE: Hi! We, too, are pleased that the channel is gaining traction so quickly. The key to this is the team, without a doubt. We have people from diverse backgrounds: finance, marketing, start-ups, and corporates. Research and commitment to quality is at the heart of what we do, and that’s why we are absolutely thrilled to have some of the best traders and analysts in the world. Not only this, but the team’s desire for continuous improvement is genuinely inspiring. And results show it.

SMARTOPTIONS.IO: When we discussed a guest post on our site, we decided on the Ripple Mafia (link), though you also offered a pretty decent and spot-on logarithmic Bitcoin analysis. I know it’s too late, but please leave some words about that.

ALPHA TRADE ZONE: It’s never too late. The current bear market is far from its end, despite the recent drop that we saw in the price of Bitcoin over the last few months.

Think about it like this. The current price is similar to what we saw in August-September last year. How many experienced investors, do you think, bought Bitcoin during this time? Not many. Believe me, more people will abandon the ship at the next sight of a storm, convinced that the ship is sinking. But sinking, it is not.

The Capitulation phase that is yet to come will provide plenty of opportunities to acquire assets at many low prices.

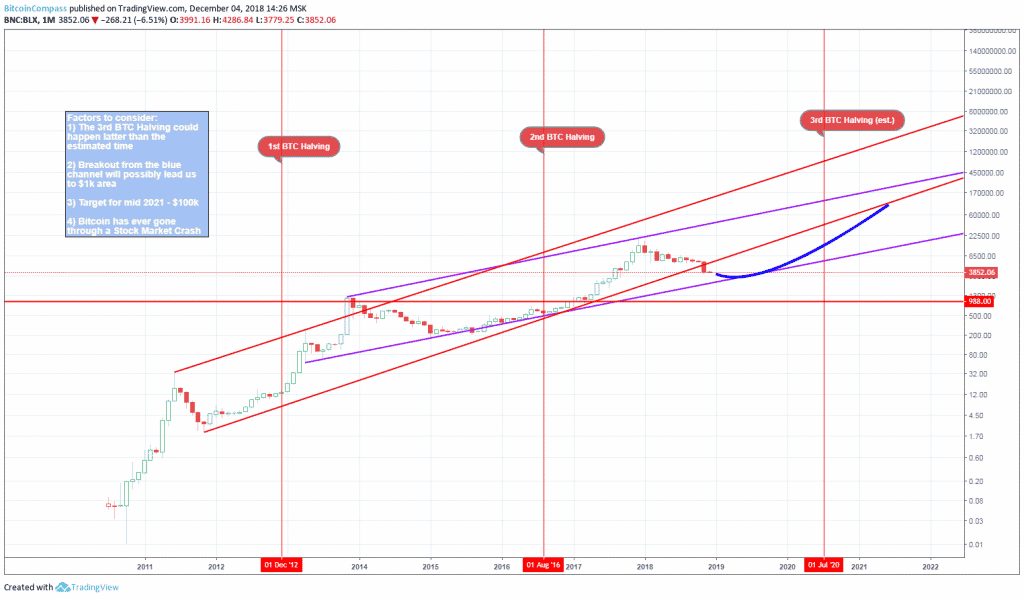

Have a look at this logarithmic monthly candle chart for Bitcoin.

See how that after breaking from the red channel, there was a strong movement to the downside? We can, of course, test this level once more before reaching the full capitulation. Eventually, however, we’ll test the blue channel and if it also breaks, there is a high chance of reaching $1,000 for a single bitcoin.

After reaching the bottom, our target for 2021 is $100,000 per bitcoin. This is 100-fold more than the price of $1,000. And that’s just in 30 months. This increase will likely be fueled by the rapidly growing interest from investors (institutional and individual) and the 3rd halving of the Bitcoin mining rewards, expected around mid-2020.

It’s really important to note that the upcoming world financial crisis – and yes, it’s coming – will be the very first one for Bitcoin, and it can turn out to be ugly regarding price. When will this happen? Possibly, after reaching the target of $100,000, possible before that. Stay tuned for our updates!

SMARTOPTIONS.IO: Hard times to trade Altcoins. Many signal channels switched to leveraged trading, tho you still can achieve quite some impressive results on the Alt side. How do you prepare your Analysis? Do you consider and anticipate BTC moves before posting an Altcoin signal?

ALPHA TRADE ZONE: We’re certain that the altcoin market has lifeblood in it. Still, we are also testing a leveraged trading service and an automatic API trading system simply because this is what our audience wants. The demand exists; otherwise, we wouldn’t look into this space.

And yes, absolutely. Our altcoin analysis is prepared with the potential BTC movements in mind, as the two are tightly linked. We pick our entries very carefully and always have carefully planned stop-loss strategies in place. It’s no secret that contingency planning is crucial for sustainable success.

SMARTOPTIONS.IO: What’s your personal view on the future of Crypto? How do you expect the market to evolve? Altcoin wipe-out? Multi-year bear phase?

ALPHA TRADE ZONE: If we were skeptics, it wouldn’t make sense for us to do what we do, would it? Every single member of the team is a passionate believer in the potential of blockchain to change the world. We all have different takes on it but unconditionally agree that crypto is the place to be.

There is a consensus within the team that 2020 will be a huge year for crypto. Debates are still raging about 2019, though…

Regardless, we are getting ready for a multi-year bear market. Potentially as the parabolic 2017, it will need some time to cool down, which is natural. People need to understand that this is normal market behavior in the cryptocurrency space. And this induces further confidence in the prospects of a speedy recovery.

This will undoubtedly lead to some altcoins being wiped out – but yet again, this is only normal. This happens in all business areas, and expecting crypto to act otherwise is unreasonable. However, the coins that will survive will enjoy immense growth in the long run.

We are on the constant lookout for such projects. They are coins whose underlying business ideas will likely make the most meaningful impact. So keep your eyes peeled.

SMARTOPTIONS.IO: How do you make use of this retracement? Which alts do you accumulate and keep as your gems? Do you plan your entries here, or do you do the classic DCA with buying amount x every x days?

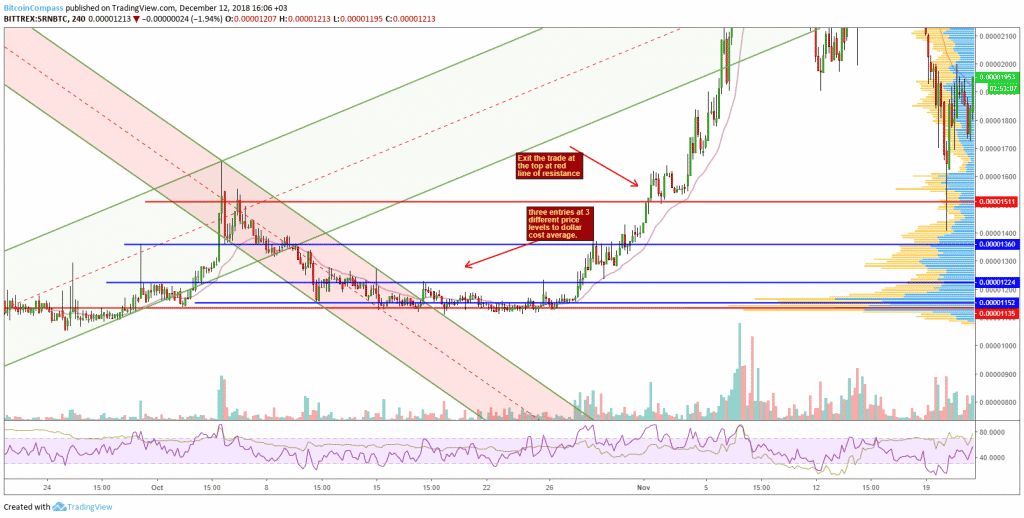

ALPHA TRADE ZONE: During the past retracement, our priority was to keep our capital and the capital of our followers in intact. Ultimately, that’s why we’re posting regular updates on our group so that people can make more informed decisions. One of the recent ‘gems’ that we first shared with premium subscribers and later with free members was the SRN token/Sirin Labs. We used dollar cost averaging techniques to minimize risks and maximize long-term potential.

We placed buy orders at different price levels, averaging our way down, from 1,360 to 1,150 sats. This coin hit 5,678 sats a few weeks after our signal, which meant up to 500% ROI. We believe averaging down entries is practical and should be used whenever possible.

SMARTOPTIONS.IO: Thank you so much for your time, guys.