Crypto Weekly Open Strategy is one you should know! In our endless journey in striving to find good crypto trading channels on telegram for you, we recently stopped by a series of channels under the mother brand “GetGood..!”. This is a good bunch of channels, which we liked from the first view. “GetGood! #CRYPTO TA” is a free channel, which provides high-quality charting. The further channels “GetGood! Education” is like a trading log of the trader, where he collects his thoughts, emotions, and reasoning behind his trades in a reflected way – a wonderful approach. Furthermore, there is an incubator room, where selected new traders show their skills – all in all very nice concept. The icing on the top is that the prior paid channel “GetReallyGood! #PREMIUM TA” just turned free for all. We got in contact with Jakov, the head behind “GetGood!” and asked if he wants to publish one of his pillar strategies on our website, and happily, he agreed. Hence, we can present to you today “The Crypto Weekly Open Strategy”. Oh – sure, I almost forgot you want the link to all these channels! They can be found at the end of this post (check the NEXUS link to find all their places) – let them be your treat after a good session of trading education. And now, grab your favorite beverage and let the knowledge sink in. This strategy is really dead simple!

Disclaimer: This is simply a tool that adds confluence to your trading ideas. It’s not THE strategy that is superior to all others.

Table of Contents (click to expand)

Why should one use this strategy?

One big problem among the average trader is the difficulty in determining a trading bias, are we bullish or bearish?

The average trader determines his trading bias by ‘feel’ or what his indicators tell him, meaning his price action is floating in limbo while he’s looking at lagging indicators which are merely the derivative of the original price action.

Any bias determined by your emotional state is absolute bullshit as man is not a logical being, he is an emotional one and his state fluctuates whereas facts do not.

In the worst-case scenario, a trader doesn’t establish a trading bias at all.

How to use the crypto weekly open strategy?

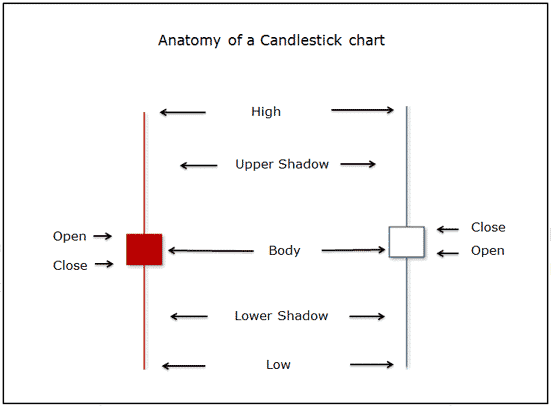

Every trader should by now know the anatomy of a candlestick:

Before we focus on the weekly open we want to determine our bias by gut-feeling.

Our gut-feeling comes from the deep subconscious and reacts much earlier than our emotional or logical side of the brain.

Our gut-feeling is usually the one we can’t explain but we ‘know’ is right, even though sometimes we don’t trust it.

I argue we don’t trust it because often we want to explain and confirm the gut-feeling to ourselves but by that time our emotional and logical side take over, rendering the gut-feeling invisible.

- If we have three consecutive green weekly candles, what do we honestly expect for the fourth if we are closing in on a High-Timeframe resistance?

- Our gut might tell us that we might see a high/wick through the resistance before a pullback through previous support and the inevitable crash.

Following this gut-feeling simulation of a possible outcome, we place our weekly open and OBSERVE.

Setting up the Weekly Open:

- Open up your TradingView account.

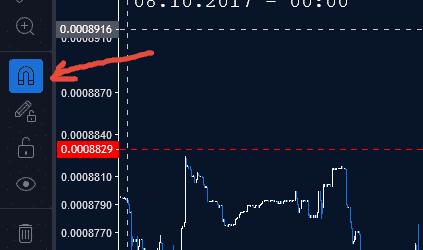

- Click on the MAGNET MODE button in your toolkit.

- Now simply go into the WEEKLY timeframe, and simply drag your mouse over the open of the weekly candle.

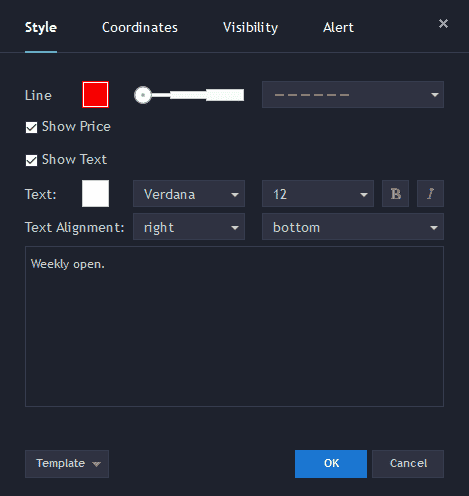

For text to show up simply double click on the line you set and change it to your style, remember to save the template so the next time you place the line you can simply add the “Weekly Open” template which you saved onto it.

Using the Weekly Open on any timeframe:

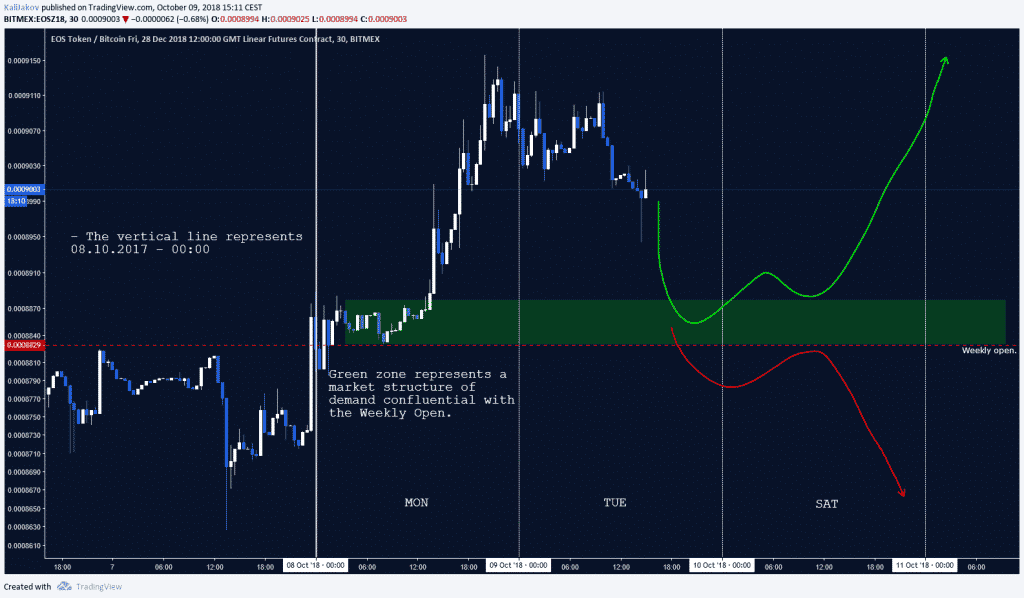

FIRST EXAMPLE ON EOS

Observe the following chart:

In this chart, I am using the weekly open on the EOSZ18 product, tradeable on BitMEX.

Notice how as soon as Monday started, the weekly open acted as support and a bullish bias was determined here easily using only one look at the chart.

What’s next is that we see the structure of EOS and assume a retracement is needed, I would expect this because whilst on the 30min a test of the weekly open is obvious but this move hasn’t yet fractal’ed into higher timeframes.

One rule I keep seeing on and on in market structures is that every move in the lower timeframes eventually ‘spills out’ into higher timeframes and basically the same structures repeat themselves time and time again.

Using the Weekly Open as a PIVOT around which price turns around I can go ahead and try to predict what kind of movement might happen and how I can turn that price action into a tradeable plan.

Using the Crypto Weekly Open Strategy here I can strategize around EOS through one pivotal line for the ENTIRE week.

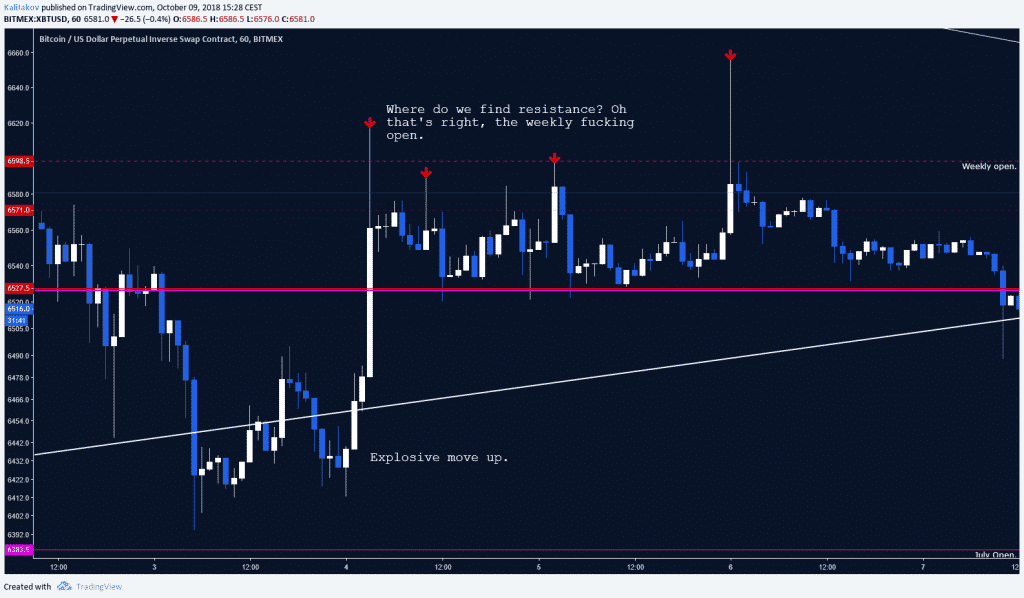

SECOND EXAMPLE ON BTC

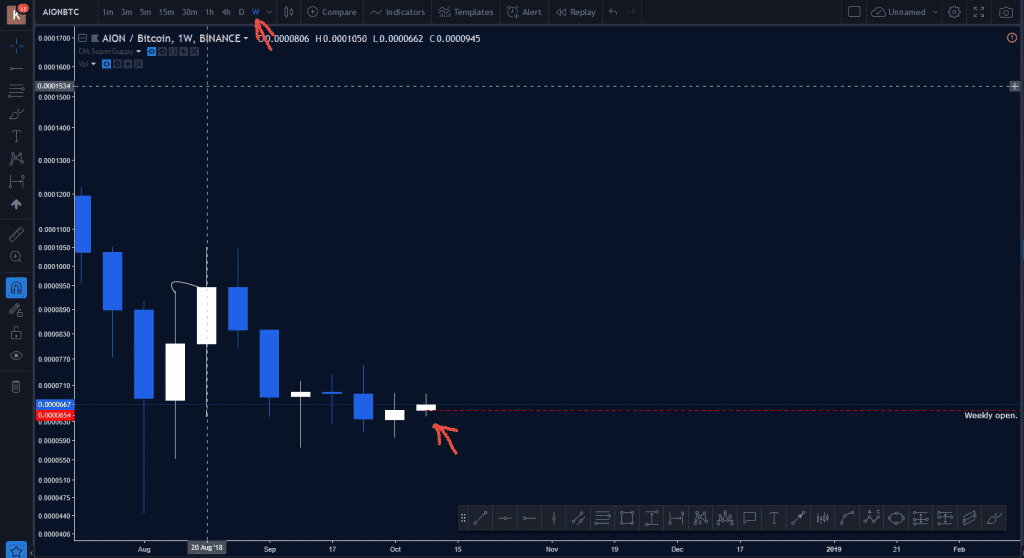

Observe the following chart:

This is why I was bearish the whole time on BTC during the first week of October.

Numerous touches + candle closes right under the Weekly Open, every push above it was an opportunity to short.

In the end, a range was formed using the weekly open + the 6527 crucial support we charted some months ago.

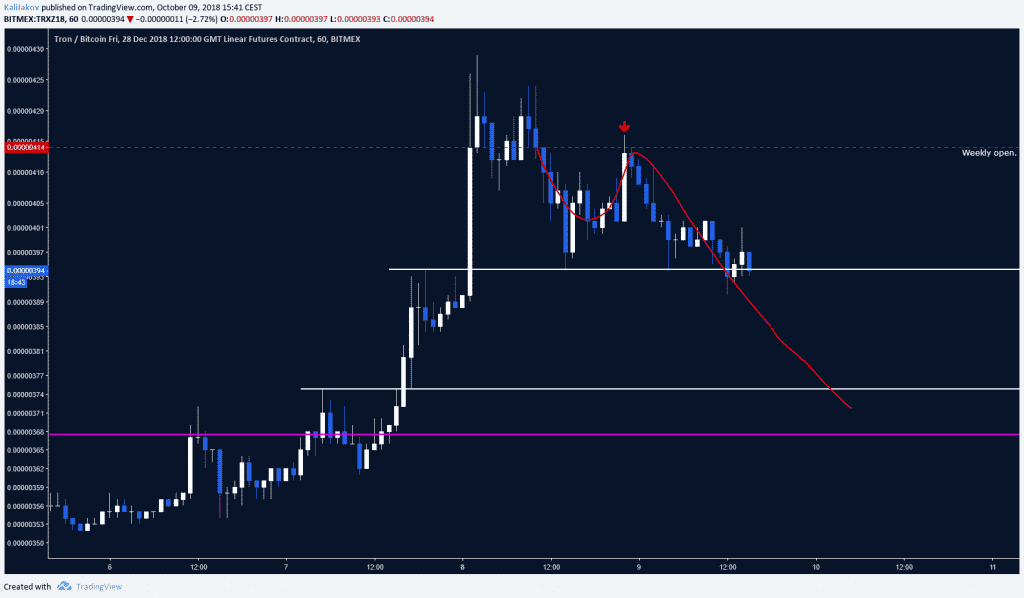

THIRD EXAMPLE ON TRX

Observe the following chart:

So everyone including your grandmother is bullish on TRX? Well here comes your boi TraderJakov with the weekly open strategy and completely blows your mind.

Instead of going long on this shitcoin which we all know has absolutely zero reasons to pump as it did, simply look at that perfect touch on the weekly open and short that sucker.

Thank me later.

That’s basically the gist of the entire strategy. To summarize.

Price action under the WO – Bearish

Price action above the WO – Bullish

That’s how simple it is.

Big thanks to TraderSZ for having a video on it which is where I learned the strategy from and adapted it cryptocurrencies -> https://tradersz.com/detail_page.php?id=38

Join GetGood for more stuff like this, we’re a Premium channel turned FREE focusing on educating people like you to GetGood at trading. We’ve got the healthiest and most loving community in the cryptosphere, come to check us out! Enjoy the Crypto Weekly Open Strategy.

For a list of all our channels and chats check out the Getgood Nexus