Altcoins comprise over 34% of the crypto market, with 5000+ available. Altcoins compete for market dominance and create fierce competition in the market. Some of them, like Ether, Litecoin, and Ripple, have increased in popularity and value over the years.

Various factors, such as price trends and fundamental analysis, affect the value of a coin. Despite potential inconsistencies with other factors, Bitcoin always consistently impacts a coin’s value through its current price movement.

We saw this happen with Ether. (altcoin) This year, 2020, Ether enjoyed a bullish run. It started the year at $130, hitting $279 by mid-February. The coin enjoyed more recognition and adoption. The news of upcoming improvements to the Ethereum network further solidified the increased value of ETH.

However, the Covid-19 pandemic affected the global economy and caused a price drop in Bitcoin. Ether’s price dropped to $135 as of mid-March. Ether’s decreased value cannot solely be attributed to the drop in Bitcoin’s price. However, it did play a significant role in the decline of all altcoins.

Also, there are times when a rise in the price of Bitcoin causes a decrease in the price of altcoins. Therefore, to speculate on a new altcoin cycle, an investor must first understand the price movement of Bitcoin. Before we predict the new altcoin cycle in this article, we will examine the possible relationships between altcoins and Bitcoin.

Price Relationship between any Altcoin or Bitcoin

—Bitcoin low, Altcoins low

Bitcoin is widely recognized, stable, and can be exchanged with fiat currencies. During bearish markets, investors tend to trade altcoins for Bitcoin.

This is because Bitcoin quickly regains value after a bearish run. Investors prefer to hold Bitcoin or exchange it for USD instead of holding altcoins. For instance, there was a massive sell-off of Bitcoin in March due to the coronavirus pandemic, plummeting its value by 48 percent within 24 hours. With the economic depression and uncertainty accompanying the pandemic, many investors thought it wise to liquidate their crypto assets.

—Bitcoin high, Altcoins low

It is logical to think that since Bitcoin is the poster child of the cryptocurrency world, altcoins should ride on its wings. But this is not exactly the case. Bitcoin has amassed so much visibility and value that many investors do not trade altcoins as a store of value but as a way of increasing their Bitcoin. So if Bitcoin experiences a bull run, money would flow from alts to Bitcoin. One reason for this is the fear of missing out experienced by investors. Thus, a rise in Bitcoin price births a further increase in value due to high demand in digital assets.

At present, Bitcoin has bounced back from its March lows. This BTC rally has been attributed to key factors like institutional buying, supportive monetary policies, and the halving.

The halving and what it means for altcoins

The crypto world always anticipates Bitcoin halving — the control measure that keeps inflation in check. Occurring every four years since November 28, 2012, this year’s halving took place on May 12. This means that since May 12, miners’ rewards has reduced by half — from 12.5 BTC over the past four years to 6.25 for the next four years.

Historical trends have shown that a rise in Bitcoin value always precedes a halving. Investors speculate that halving will cause a meteoric rise in Bitcoin. Thus, investors accumulate as much Bitcoin as they can before the event. And the 2020 halving was no different.

Past trends also show that there is usually a significant drop in Bitcoin value after halving as miners and investors liquidate their digital assets. But that may not be the case this year. The coronavirus pandemic has made many question the efficiency of fiat currencies. Social distancing laws and the closure of businesses have opened the eyes of many to the benefits of crypto.

Sideways market

It is likely that Bitcoin will not experience a price drop but rather trade sideways with no clear trends for a period of time. This is because any liquidation of Bitcoin into USD will be offset by new investors entering the cryptocurrency market and existing investors holding onto Bitcoin as a store of value. As a result, now may be a favorable time to invest in alternative cryptocurrencies.

When Bitcoin trades sideways with relatively stagnant value, investors begin to invest in underperforming altcoins, causing the price of altcoins to rise quickly. Since the beginning of this year, there have been bullish speculations for the altcoin market. The market has experienced a long bearish trend since 2017, with some altcoins (e.g., DASH) dropping to its January 2016 value. Thus, there is expected to be a rebound and the beginning of a bullish trend for altcoins since the crypto market moves in cycles of lows and highs.

With a gradual rise in the value of Bitcoin, many altcoins will follow suit. Crypto analyst, Nicholas Merten, predicts that Ether and Litecoin are among the altcoins that would perform excellently before the end of 2020. For Ether, launching phase 0 of Ethereum 2.0 would play a significant role in its upward trend.

How to benefit from the new altcoin cycle

A trader who will benefit from the new altcoin cycle understands the cycle. Usually, a bull run in the altcoins market is relatively short-lived compared to a bear run. As explained earlier, altcoins can only be exchanged with Bitcoin; this means that as investors who start trading look into buying and selling altcoins, they must first purchase Bitcoin. This boosts the demand for the latter and leads to a corresponding increase in its value.

Much of this can be seen on many industry-leading cryptocurrency exchanges with their huge trading volume in the digital currency space. Showing much of the high volatility as traders both find themselves losing money and then making money in the crypto exchange they find themselves on.

A trader or Investor

As a trader or investor, do not think that the market would align with your speculations. The market is unpredictable. Therefore, the best strategy is to buy closer to the bottom and sell closer to the top. Each area often shows large deposits and withdrawals as traders fall into FOMO or FUD patterns in the long term.

Understand the psychology of the market. Know what triggers the increased value of a coin. Sometimes, crypto traders and investors seem bored of Bitcoin’s perpetual market dominance. For this reason, many may rush into investing in a new coin, touting it as the currency that will upend Bitcoin’s dominance.

Brendan Bernstein went down memory lane to March 2017 when Ethereum launched on Coinbase. Ethereum had a massive run as investors flooded its space, with some even quitting their jobs to join the party. Bitcoin’s dominance plummeted from 86 percent to 40 percent. But it wasn’t long before the party stopped. Bitcoin regained its dominance as institutional capital returned to it slowly.

Do not allow the fear of missing out make (FOMO) you buy a coin at the top. The best time to accumulate altcoins — and Bitcoin, too — is at the beginning or middle of the altcoin cycle. While you do this, you should apportion your capital wisely.

Warning on Holding

Furthermore, be alert, especially if you hold large positions on alts. Bernstein says that as the cycle peaks and begins to reverse, illiquid tokens with smaller market caps will fall as quickly as they rose, making it impossible to sell these tokens close to the quoted price. Remember that in the crypto space, your loss is another’s gain. Always seek to shore up your digital wallet and profits and losses.

Keep in mind altcoin holdings always can fluctuate quickly, so always be ready with a plan as this is not the stock market or trading the dow jones industrial average you know, so know the wild opportunities up and down that you can have with trading your favorite altcoin.

DEFI new Altcoin sector for the crypto market

When is the next Altcoin cycle to be expected? Well many think we are starting into one now since the bitcoin halving occured. So everything has gone hot for us, as well there is a bit of flux too due to covid-19 and the effects of the virus.

It has thrown all of us into a bit of chaos and we are not sure what will happen with this instability. This chaos can help and hurt us at the same time as we are in a fight for capital vs say the stock markets of the world. Capital is always flowing from one market to another, but we do have a kill app as to put it with the crypto space, this is called DEFI.

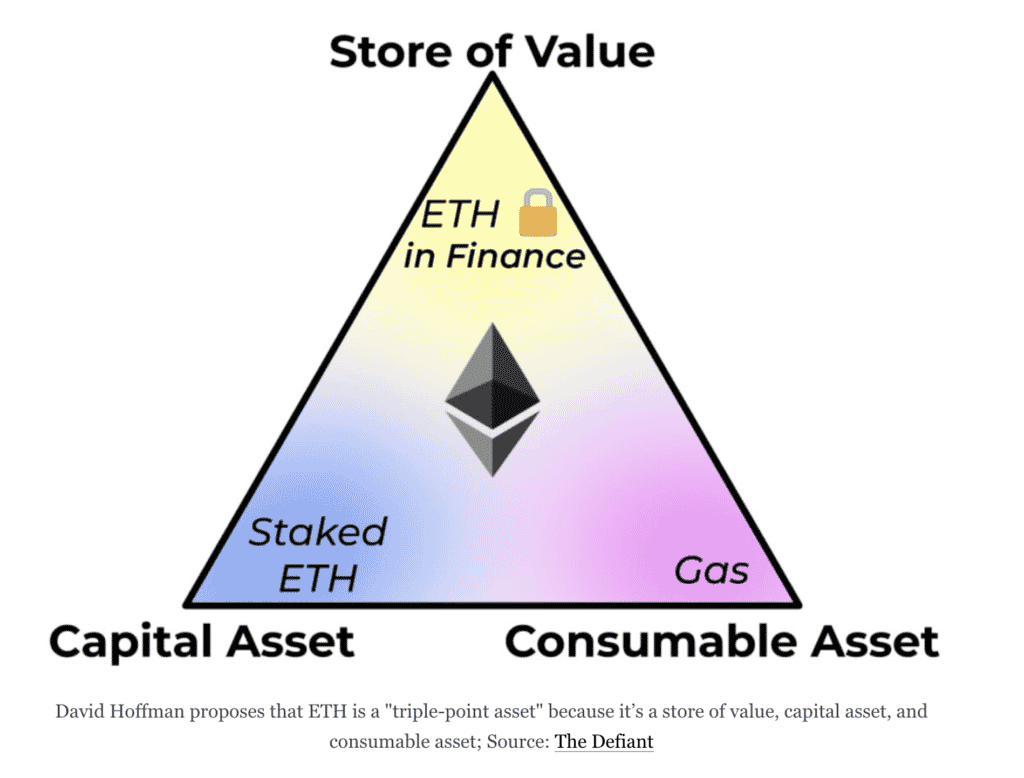

DEFI is considered more than a crypto market bubble but a whole new plethora of crypto moon coins that will advance and grow all the altcoin markets. DEFI is mainly based on the Ethereum blockchain and other smart contract chains, and since blockchains are very malleable, you can create them from even the Bitcoin chain.

The 10 DeFI Coins

Here is a list of the top 10 DEFI coins to add to the mix of Altcoin winners of the future. All are Ethereum-based chains, FYI.

- Maker – Lending with a $1.45 billion market cap

- AAve – Lending with a $1.33 billion market cap

- Curve Finance – DEXes with a $1.09 billion market cap

- Compound – Lending with a $808.6 million market cap

- Synthetix – Derivatives with a $756 million market cap

- Yearn Finance – Assets with a $751 million market cap

- WBTC – Assets with a $363.4 million market cap

- Balancer – Dexes with a $267 million market cap

- InstaDApp – Lending with a $175.9 million market cap

- Uniswap – DEXes with a $175.9 million market cap

You can see that we have a whole new crypto trading sector to pay attention to. DEFI has arrived and is spurring growth in the market.

Above is a great article on how and what ETH DEFI is, click on the image to check it out. One of my personal favorites is SYNTHETIX which I think will be in the top 3 in DEFI coins soon as it is fast on the rise and has a great future. I am a diehard crypto trader and Synthetix will allow us to trade many different asset classes from gold, silver, oil, stocks, bonds, and the like through the DEFI ecosystem. This is terribly exciting as possibilities for the crypto market to grow are HUGE!

We will have a few articles in the future on the site that will go more in-depth for a few exchanges and Synthetix which you should read, as it will be amazing the whole new breed of options us not only crypto traders but crypto investors will have available to us in the coming period.

The New Cycle, SmartOptions, and You

At Smart Options, we aim to provide educational content so you can make better decisions. We are dedicated to providing comprehensive ideas on the latest market trends and analyses. Our expert opinions cover all trading platforms and digital currencies, including Bitcoin Cash, Litecoin, Doge, and PepeCoin. Additionally, we offer trading signals to maximize your profits during this new cycle. You can also read about how to use the Stock-to-Flow model to gain a comprehensive understanding of the market.

Worry no more if you are wondering where to get Altcoin trade ideas. One of our partners who specializes in Altcoin picks is Universal Crypto Signals.

gold jewelry bracelets are a bit pricey but they last longer and are very durable too.