Maybe you have read about buy and sell walls already, and the talk is everywhere if you lurk into the Crypto world. On Bittrex you can see them for each trading pair if you click on “ORDER BOOK” right beside the timeline tab. That being said Binance seems to have the best order book visualization, so you might want to observe there to learn. These buy and sell walls are representing the trader’s most current trader sentiments by visualizing all placed buy and sell orders in the order book. The walls are your outlook into the future, but you have to take this with a big grain of salt. Buy and Sell walls are useful for short-term trading and to estimate if a coin gets the point or to determine a better entry point. All in all, if you are going to hodl, these walls are almost useless, they can be used to tweak your profits a bit concerning a better entry price. But let’s do some groundwork and start from the beginning by diving into this exciting topic.

Table of Contents (click to expand)

The Order Book

What exactly is an order book? It’s a list of all active buy/sell orders that have been placed for a particular coin on an exchange like Bittrex. Order books are an excellent source to determine trader sentiment for a certain coin. It lets traders view a list of buy & sell orders and also gives them a sense of market depth. BIDS are offerings to buy your coin for a certain price and ask are requested to buy a coin at a particular price. This is a way to see some of the highest/lowest bids to buy & sell orders. On most exchanges, you have the ability to make direct purchases from an order book as well. We explained this in our Bittrex Guide. Basically, you have to know the green walls are buying walls, the red walls are selling walls. Green walls support your coin, red walls are the resistance it is facing. Keep in mind that order book trading is really mostly for short-term trades and for some quick 5% profit here and there. If you want to use it, you should combine the information about the order book in conjunction with technical analysis. The combination is great for short-term pop and drops, which can also serve to give you a feel for the overall sentiment of the day.

What is a Buy Wall?

A buy wall happens when the amount/size of buy orders for a particular coin are much higher than the number of sell orders. The wider/taller a buy wall is, the better it is. It’s a good sign when traders see a buy a wall since it shows reasonable belief about the current state of that coin. In order words, traders want to purchase more than they want to sell. In that case, traders buy more than they sell and it’s a race to purchase all cheap orders. When the cheap orders are bought, the buy orders fill in quickly behind the increasing price point.

It’s crucial to short-term/day trade a cryptocurrency that has a positive sentiment already existing. If you take that approach, you’re well on your way to getting better results. On the other hand, if you don’t you could have problems in getting good daily results. That’s the name of the game! So it’s critical to trade a coin that has a positive sentiment and healthy activity.

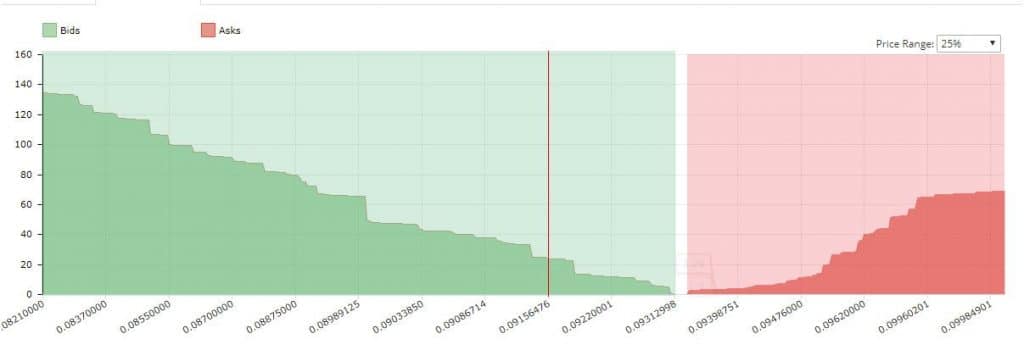

Here is an excellent example of a buy wall, a good one to see the buy orders exceed the sell orders significantly. I marked the middle of the graph with a red line. We like to look at the buy wall going up gradually here, which is a good sign for slow and steady growth. The green candles should not explode but slowly grow more and more.

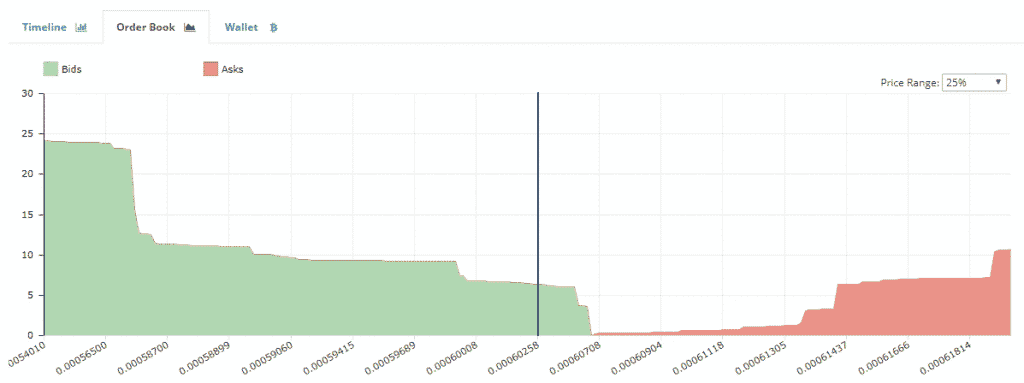

Below is a not so cute buy wall. We can see the buy orders are still exceeding the sell orders, so the price is likely to increase, though you have to keep in mind that the big spike in the left area might be fake.

What is a Sell Wall?

I am sure you are smart enough to guess this, but just to be sure: A sell wall is the same as a buy wall except the sentiment goes in the opposite direction. A sell-wall shows some tough times for a cryptocurrency. In this case, the sell walls build traders pile in to sell. A big sell-off is underway, and traders usually fill the highest buy order that is viewed on the market.

After the highest buy order gets filled the order that’s next-lowest in the book becomes filled. This process continues until the market levels out. If you see a big sell wall upcoming there’s a good chance it’s a bad time to buy that coin and a good time to get out.

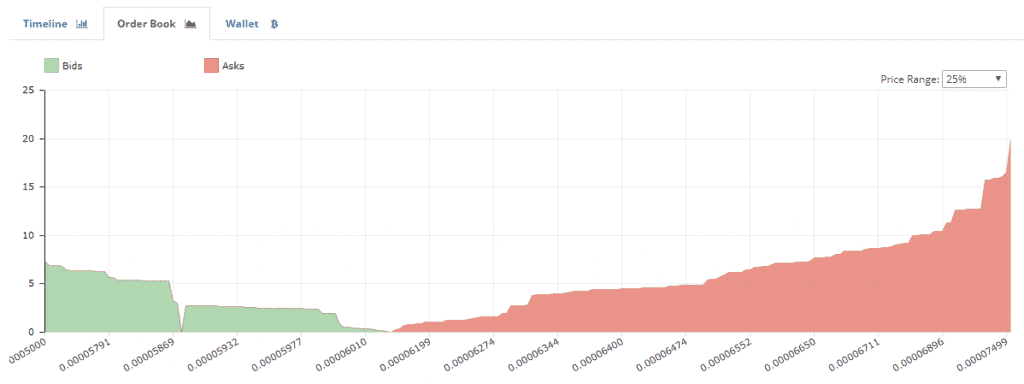

Here is an example of a sell wall. The sell orders exceed the buyer’s demand:

The background behind Buy/Sell Walls

You might be wondering if you should even worry about buy/sell walls. In almost every market buying/selling walls are becoming more popular across different exchanges. There are significant buy/sell orders for all popular coins. In general, you should have a look at the right column on Bittrex to see if the coin has a minimum trading volume of 500 Bitcoins to ensure enough liquidity and movement. Several people purchased the currencies at a rock-bottom price and hoped to cash out as soon as they can.

Also, whales (big players) effectively control the prices of crypto-currency when they’re able to do that. They don’t benefit when they let any currencies break above a particular level until they’re profiting. In many cases, a sell wall is a fake oppression tool that’s used to keep prices far below the max. threshold. This allows whales to purchase tons of cheap coins. We will go over that later on “How to spot a fake wall.” When people have enough money to manipulate a particular market, it’s likely someone will try to achieve that goal.

While many people believe what they see, the fact is that buy & sell walls aren’t native to any particular trader. When more significant buy & sell orders show up, it’s to be expected that others will put their own orders at that price point. Besides, currency exchanges rarely create buy & sell walls on their own unless it must follow a current agreement. In the majority cases, those agreements are about an ICO in which developers agree to purchase X number of coins at a particular price, but that is a pretty rare exception.

A big question that will always exist is if there’s any particular “strategy” linked to keeping prices low beside from the point of view that involves projections. It doesn’t seem there’s a justification for big buy & sell orders to show up less a person is trying to control the market. There are several favorite trading strategies, but buy & sell walls aren’t part of them.

Meanwhile, sell walls are frequently viewed as a sign of significant liquidity. That’s a plus since it shows there are lots of available coins to buy. Meanwhile, without a high enough buy demand there’s little reason to create active sell orders. That’s because in such situations whales would want to dump their coins on the market as well as fill current buy orders. Several buy walls frequently attract big holders searching for liquidity to dump their coins.

Something worth stating about big buy & sell orders is many times the orders only show up for a short time then are totally removed. It’s also possible the orders are moved up/down based on the way the market responds to observing the walls. This kind of action is more apparent since the Mt. Gox manipulation of order books many years ago. It’s clear market makers are still using big walls. However, in many cases the effects are small. Yet there are times when the very big whales, such as Roger Ver and Jihan Wu will try create big disruptive moves in the crypto pond. This is in order to gain a strategic advantage for them, thus directing prices as the fish they attack will chaotically frenzy about. This will create the liquidity the want and trap the small guys in to make the wrong moves at the wrong times.

What about those Fake Walls?

If you are day trading cryptos with short-term positions, it’s important to play smart. There are certain whales that can manipulate markets. These are traders with big amounts of capital that can put a buy/sell order at a particular position that’s big enough that it probably won’t be filled. Whales can set the floor/ceiling for future price movement.

What are fake walls? They can be observed by appearing tall/vertical. They usually don’t have a price runway and are typically put as either the lowest sell order/highest buy order on a crypto exchange, such as Bittrex. These are “fake walls” since the trader that placed the order can remove it anytime. He tries to convince other traders to result in a particular price movement. To put it another way, the sentiment itself is fake, and there’s no big market support.

In the case of fake buy, wall whales put big/un-fillable orders that are as highly charged sentiment for a cryptocurrency. The walls provide new traders some confidence that the particular position will hold and also lead them to think that the current price points are now the new floor. The result is buy orders will start showing up on the wall.

It might seem that they can only go up. In fact, whales can remove the wall anytime they want. In that case, the order of the whale makes up most of the orders the price can shift far in the other direction. The traders that try to get into the pump as well, may lose capital (satoshis, the smallest BTC unit) as the whales get out, while you get in. Always remember trading is a zero-sum game and there is still one paying the profits of someone else.

This is also true in the case of fake sell walls. Here’s why Whales can place big and un-fillable sell orders to hold down the price and buy the coin on the cheap. After they get enough coins they can then quickly pull their order off, which results in the price to spike in the case, the sentiment was mostly positive, independent of their order of course. That’s how the whale can win by tricking the traders into selling their coins cheaply.

Keep in mind that whales are using buy/sell orders to find pumpable coins to perform pump and dump actions. Pump and dump can be profitable to those who know that there is a pump going on early, for everyone else it is very dangerous eye candy. Whales are searching for low volume shitcoins with a minimal amount of sell orders. Pumpable coins don’t need much buy support to increase. So they are searching for low-volume coins that have just very little resistance concerning active sell orders on the order book. Again, it is hazardous to participate in such games and likely you will be paying the whales with your coins at the end of the day.

How does an artificial fake sell wall look like?

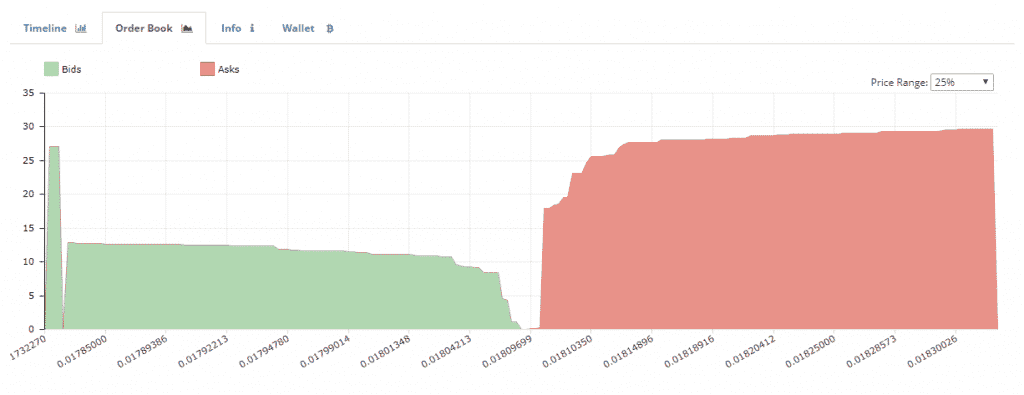

The example below is from LTC this morning, a very bullish coin with huge demand. Whales are interested to get it at the best price so they use their huge chunks of BTC to scare traders. They are putting up fake sell walls to the push price down and to purchase the coins cheaper. They simply remove their sell orders once the price has been pushed down and purchase. Crypto markets are young markets and this kind of manipulation can be easily achieved if you have enough funds. You can use these fake walls to follow the money of the whales and buy the dip. If you have this coin already don’t panic sell, just buy more on the dip to accumulate. Note these walls are not made by professional whales, as they are easy to spot. Well versed whales will do a much better job of covering their tracks in order to get your coins on the cheap!

So does this mean that traders should buy when there’s a fake sell wall going up since the price could spike when the wall is later pulled? A smart thought but the thought is flawed. In fact, the opposite is true. Traders ought to have a moderate amount of risk but it’s very dangerous to trade coins with an artificial price movement.

There’s a chance you could get lucky, but the odds are more likely to make super unlucky and lose coins doing so. The goals should aim for coins that have real trader sentiment if your goal is safe growth, slow and steady is the word to the wise.

Still, it’s still a good idea to buy a coin that sells well just as long as the order doesn’t comprise over 5-10% of the daily volume of the coin. That’s a good rule to follow regarding risk management.

Buyer Support

When you are day trading short term, it’s a good idea to search for coins that have big buy walls. Don’t just look for big buy walls but instead staggered support points within the wall. One technique to use regarding ideal buyer support is when a buy wall looks nearly like a staircase.

For example, should you invest in DASH? It’s a judgment call, but the sentiment seems right. Buy walls that are staggered show real points of support and also are safer. When many walls run up the slope, there are more price points that a dropping price could slow down. It’s impossible to be ultra attentive to portfolios, so these types of walls provide extra support in case the price is dropping.

Let’s do a real-world example: Let’s say you want to buy something around 1000 sats, but you see that there is a big buy wall at 900 sats. You resist the urge to buy the top on 1k but place a buy order at 910 instead. If the drop is incoming (and it often is), your order will be executed much cheaper, and you have additional support at 900 sats, which provides an extra layer of safety as in many cases this buyer support will hold, and the price shoots up. That being said, you have to consider the fake walls, so always analyze how native those buy walls are, otherwise, you might be trapped. Versa vice if you want to sell your coins: the price again is at 1k sats and you can see a big sell wall around 11k, you will do better to put your sell order between 1050-1090. This gives you the advantage to place your order early and increases the odds to get your order filled. The sell wall on the order book can be seen as resistance, as you have to imagine that more volume on the buy-side is needed to eat up the sell wall at 11k. It is always a game of cat and mouse.

It’s important to note that this isn’t 100% because when walls drop, they shift as well. These walls might be pulled and show up in various places when the price drops. The walls show positive trader sentiment and are mostly low risk.

Do Research

Order book trading can’t be used to entirely weigh sentiment. It can only provide a basic reliable sign of where the price could move. In several cases, no orders will be placed and the price could move a lot due to people buying current orders on the crypto-currency market. It’s important to use your best guess. The process of trading crypto coins isn’t just about reading order books. You must research coins and the various companies involved in the coins you’re investing in if you want to get the best results, as they are often news-driven. Check their Twitter, check Coinmarketcal to be sure that they have events upcoming for additional support. Which announcements/partnerships are on the way and how is the general outlook for the company and their coin. It does not have to be mandatory for the success of a short-term trade but is needed if something goes wrong and you end up as a bag holder. It is no fun to be the bag holder of a shitcoin with no future.

The majority of people join after the price has already skyrocketed. You could do even better if you enter before the spike happens with the help of the order books. Check out 3commas.io to execute your trades automatically with conditional logic.

Thanks for helping out, great info .

Greate pieces. Keep writing such kind of information on your site.

Im really impressed by it.

Hey there, You have performed an incredible job.

I will definitely digg it and in my opinion suggest to my friends.

I am confident they will be benefited from this site.

I simply wanted to write down a quick remark so as to appreciate you for all the amazing ways you are giving out on this website. My extensive internet search has at the end of the day been recognized with reliable information to write about with my family and friends. I ‘d state that that many of us visitors are extremely blessed to live in a magnificent place with very many wonderful professionals with insightful guidelines. I feel extremely happy to have come across your website page and look forward to tons of more fabulous moments reading here. Thank you once more for everything.

Great article! Thank you!

Dope article! Well done indeed!

Good info but you really should hire a proofreader. The grammatical errors made it hard to read.

That Steve’s style and most like it including me. He is not a native English speaker and talks in a mix that most like in the crypto community, so we won’t abuse him for his eccentricities or creative language abilities lol!