DYOR is our motto here at SmartOptions = “Do Your Own Research“. In these times. We don’t trade much besides doing DCA down to the bottom for some major coins. But what we love to do instead is to make our Crypto funds work for us. Meanwhile by investing some of our equity in the right ICOs. You might have seen our recent ICO SCOOPs, where we put much work into it.

We try to bring you more of these reviews in these circumstances and carefully select/research the projects. But you should not rely on us alone. We want to educate you and enable you to become a DYOR ROCKSTAR! Just tangle along these metrics and should find those gems yourself: DYOR

In this ocean of ICOs out there, we have to conclude that most are pretty bad. Whether their ideas are needless, their products are shitty or they try to fake out investors. When looking into their “project” all you find is crapola.

Don’t let this be you.

More and more scam ICOs are entering daily, they try to tease us with nice payments – though we have to say politely “Thank you, Sir!” (British for “Go, **** yourself”). A phrase often found after DYOR.

If you are looking for the right ICO to invest in, you will come across the bad and the worse of them. And that’s why we’ve created this survival guide to help you to become a DYOR ROCKSTAR, spotting the best ICOs that are available.

Table of Contents (click to expand)

- Shine on, you little diamond – DYOR The Website Design

- Find Scams before they find you!

- It’s a DYOR TRAP!!!

- We got 99 Problems, but the chain ain’t one!

- “Yes, Ashton Kutcher is part of our team!” – The ICO Team Evaluation

- Hit the Road, Map (♫ No More, No More, No More, No More♫)

- Numb Numbers – The Token Metrics

- The Gossip Girl Army – Hype, FOMO or FUD?

- 3 Levels of Project Quality

- The DYOR Rockstar ICO Checklist

- Conclusion

Shine on, you little diamond – DYOR The Website Design

The first thing you will come across is the website. And while it is essential to say you should not become convinced by an eye candy design, it can be the first indicator. Sometimes, scam ICOs have a terrible website that’s easy to spot. Most of these scam sites tend to make the page more than it appears. This means that you’ll have to check the design of each ICO website to gauge if they’re legitimate or not.

Many scammers try to fast exit scams on novice investors and throw a website on the screen, to have the platform to rip you off. Scammers often come with a low starting budget and have to do the sites themselves. Trying actually to establish a brand, you should come up with enough capital to bring up something professional at least. When in DYOR mode you will notice this often.

Find Scams before they find you!

Most scam websites deliver promises that are virtually impossible to meet. For instance, there are some ICOs that will promise to give users 100% back on their return if they invest in their coin.

While this may sound like a good idea, these are been turntryingusually tryrying to coerce crypto enthusiasts to look into their platform while offering no long-term beneturn. DYOR angry mode on!

No one can say how successful the ICO will end; some have better odds than others. That’s the deal. If they stop at the beginning of a long-term bear market, they can’t do much.

This is also a reason, why we think that now is a great time to invest in ICOs. The bears are with us already, your funds are losing in value. Give your ETH a job while the environment is negative.

It’s a DYOR TRAP!!!

Don’t fall for the XXX% gains trap. These websites are made to trick users into thinking that their coin is more valuable than it really might be. When looking at the underlying design ask yourself the following questions:

- Is the page easy to read?

- Does the page allow users to interact with it? Like where is the contact link placed, etc.?

- Did the webpage designers make the page digestible for the audience?

- How is the language, are there any errors? Does it look like written in a hurry?

Also, you should become a sneaky detective in DYOR. Run a whois check on their domain. When has it been purchased by whom? Where is the address of the company, how does the property look? (Google Maps/Streetview helps here)? Can the company be found at this address or is it just an offshore company?

Keep these thoughts in mind for a first step when you’re looking for a reputable ICO.

We got 99 Problems, but the chain ain’t one!

Your ICO needs to be able to spot a problem within the industry and come up with an effective solution. There are two ways here to spot a bad ICO:

- The problem is not a real one. They pull a non-existent problem artificially out of their poo-poo to provide a not needed solution. This has not to be a scam indicator, but sometimes the basic thoughts behind a project are wrong. They got lost in an idea that makes no sense or started to work on it when it made sense, but things have changed meanwhile and they don’t want to leave it.

- The solution is not a real one. clear present hypothetical solutions without having a real clue on how to provide them. These ICOs often sound like future music in the best case, like a Perry Rhodan Sci-Fi mag in the worst. Hey, 2020 is around, where are my flying cars, and can we run those on the blockchain? DYOR horse poop!

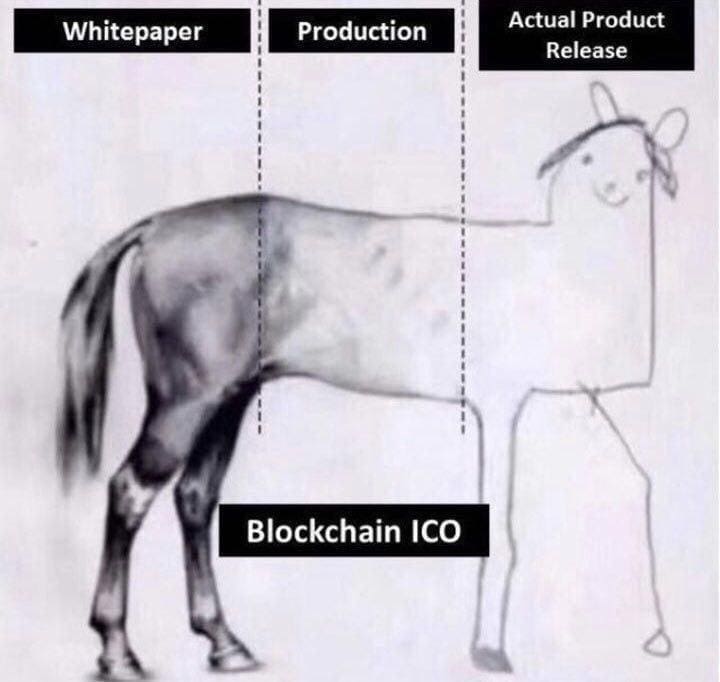

DYOR – Stages of ICOs Development

The solution can be existing already or can be just an idea, mainly hot air. The best ICOs can provide an MVP. At least a rough prototype of their product before or while the ICO. This is an essential factor because seeing means believing in DYOR. This will a) attract many investors and b) makes sure that there has already been money invested into development. You can get an outlook on how neat the coders work, how the look and feel will be and if they work on a good product.

Careful: Not every MVP is excellent – you can also find ICOs with crap MVPs and don’t expect them to get better. Good code is built from scratch, with a stable baseline. Sure, an MVP may have bugs and misfunctions – but if everything crashes and looks like ****, one can doubt why they even released it. If not linked on their website, ask if they plan to host the code on Github, if yes review it. If you can’t code, ask someone for the quality and code structure or at least check how often they worked on it and how active their Github is.

The Professional Whitepaper From The Desk Of Dr.Ngogo Bazolius

“Hello! My name is Dr. Ngogo Bazolius and I present my professional whitepaper here!!!11!”

OK. What’s your ETH address again? I am sold. Better not, as the Whitepaper is the most important part of any ICO – the heart piece. This is their chance to show that they’re a valuable project and detail their plans to their audience. Any ICO that fails to do this is destined to fail as you need a clear goal and a well-defined direction for the project.

That’s why you have to view the ICOs and check the quality of their Whitepapers. DYOR is not always fast or easy so you have to pay attention. Any grammatical errors or missing information (financial information, roadmaps, etc.) are a sign that they don’t take their project seriously.

Look at their Whitepaper, does it have a professional appearance? If it’s an ICO that works within the financial industry, does it present itself that way? Or does it appear like DogeCoin where the site can afford to have a silly appearance in exchange for its overall functionality?

Does the site have a well-groomed appearance? Or does it feel like the website design is rushed and like it has been completed in just an hour? Does the site intrigue you enough to view their page or does it make you want to click the next tab? DYOR: Keep these factors in mind when you’re looking for the next ICO.

I don’t weigh the design of the newspaper too much, it is secondary – the content is the most important though. There we can go two routes again:

- A fluffy whitepaper that does to sound professional but contains no real information. Fluffed-up content to make people that have no clue say “oh that sounds deep, I’ll buy it”. There are many whitepapers out there, that are like that. They consist of many buzzwords, sexy words in lingerie – but the problem is they don’t say anything. If we consider the whitepaper as the base of a project it should be rock-solid.

- A too technical whitepaper, that does sound like written by a particle physicist. This might be the better bet of the two options, but a whitepaper nobody understands is simply not worth it and brings danger to the crowdfunding process. Many CTOs get lost in their nerdy world and totally forget about the marketing aspect – which is very important for the success and later outcome of an ICO. You always want to walk in the middle way between understandable/almost entertaining content and profound expertise within. ICOs with too technical whitepapers might have a great project behind them but could fail simply because no one gets their vision.

Whitepapers of scammers contain often plagiarized parts. A tool we use for our ICO SCOOPs is the premium service of Copyleaks.com.

Classically, the whitepaper should outline the vision of the ICO in a more detailed way than the website, give us insights in regards to the team and very important: show the token allocation and provide profound insights in the token metrics. Does it contain any comments on the legal situation with their product? Some products might be in conflict with laws or regulations. Also, check the sentiment in the niche of the ICO. DYOR: Are regulations or new laws around the corner? Is something hindsight, which could affect the success of the project?

Another point to consider and to do research about is, how unique the idea presented in the whitepaper is – did you come across anything similar yet? If yes, not a problem, but what is different to this ICO? What is their USP in comparison? Do they add an angle any other project is missing?

An essential section of the whitepaper is how they split the raised funds of the ICO over the several fields of action. How much will be used for the development? How they stem the legal part and significant for many projects is how many % they want to apply for the marketing of their product. Can a business be built substantially and long-term with an allocation like the one shown?

If you think business-wise you might want to consider that there are always two types of spendings a company has to issue: Spendings in the profit center and spendings in the cost center. This means some costs are to maintain the project, to have it run and keep it stable (like the costs for legal or administration stuff) and some spendings are there to generate growth and increase the revenue, like for marketing. The profit center should have allocated more funds than the cost center.

“Yes, Ashton Kutcher is part of our team!” – The ICO Team Evaluation

DYOR: We had some fun recently with ICOs that used pictures of celebrities as team members – so these scams are easy to spot. No real people, no real ICO – easy as that. If the ICO uses celebrity pics as team members, then we even have some extremely dumb scammers. For each of our ICO SCOOPs, we do some painful work for you: we download all the team member pictures and use TinEye, a reverse image search, to find out if the pictures are from somewhere else, taken out of context. Only if all team members pass, we go on with our work. Another indicator of an “unreal” team is if they all look like from iStock, TinEye should find it for you, though.

Besides the images as a first step, you need to check their team to see if they’re legit. The most valuable ICOs have a group of dedicated members that are ready to work on their projects to completion. Personally, I worked with one ICO in the past – and hell, this is stretching. For the ICO phase, most teams become steady overnighters and work their asses off to get the job done.

When looking at your ICOs, look for teams that have a valid LinkedIn address and social media contacts – we check the creation date of these profiles with the Google Cache feature or the Wayback machine. If all team members created their accounts just short in front of the ICO, it might not be substantial proof of a scam, but it is a negative sign.

The ICO needs to have a clear goal and a team that’s willing to help it get there. You want to make sure that the team you’re looking for is there to stay and ready to make the ICO gain in value.

And the team must have a vision. They can’t walk away when problems arise on their platform. They should have someone in their PR that knows what their team is doing and effectively help the team receive a good amount of publicity.

I’ve seen a lot of exciting coins that had strong teams behind them, but they don’t expose themselves fully because they don’t have the experience. This results in the ICO not fully growing, and all of their hard work is wasted. That’s why you need to look into their teams and ensure they’re legitimate so that you can utilize them to your advantage.

Many people ask themselves what kind of role Advisors play. Well, I know many take this highly rated into account, my personal opinion is: For the project itself they don’t mean anything. They are bought personas in so many cases, faces to pimp up the team. On the other hand, they can help to improve the social hype. “Did you see? ABC ICO has XYZ as Advisor who was also Advisor at EFG ICO, and this made me 300%!” There is no logic in it, but still, it is how the majority works. I take the advisory board as a form of extended marketing.

Another important thing is to check the particular team members against their responsibilities on the board. Is the ICO going to be something around smart contracts on Ethereum? Where is their solidity developer in the team? How is on board for the marketing and where did he/she work in the past – was she able to create some serious hype there? Has the CEO experience in the field we are in with this ICO, is he a serial entrepreneur or is it his first venture?

You see, I want to give you an idea of how to view and interpret the presented data because you should not fall for the hype alone. DYOR means that YOU do your research and not some stranger in a telegram channel or a Facebook group, who is telling you that team is the icing on the cupcake.

Hit the Road, Map (♫ No More, No More, No More, No More♫)

DYOR: The roadmap is a vital piece of each ICO. Experienced businesspeople and investors can abstract how realistic these milestones are set. A disruptive mega project, which shall change the world is not going to build by year’s end. Bonus points can be gathered if they already started out and created a product you can see – in this case, you can consider the past of the roadmap and compare how they hit their goals along that journey. Think of comparing release dates on Github with their roadmap, think of checking their old announcements in their social channels with the roadmap.

Vital for you to decide, before investing in an ICO: Do you want to invest long-term (multiple months to years) into this project or are you looking for a quick flip? Depending on your answer, you should consider how long the roadmap is planned and when they plan to hit the exchanges. Some projects have an overseeable roadmap, which might come in handy if you are want to flip fast – check when they expect to get on an exchange.

Other projects are going to be built into something bigger like for example a whole Ecosystem like HALO – this is more of a long-term investment. Are any partnerships planned, when, and with whom? These are also questions for their Telegram channel you should join to ask, ask, ask.

DYOR for ICOs is about connecting the dots, so you should compare the experience of the team with the timeframes chosen on the roadmap. Some can deliver faster if they are working in this industry for many years already. You have to imagine that networking is also an essential factor, and it needs time to build your niche-specific network.

Crypto prices are often driven by some hyped fundamentals, despite the fact I usually don’t find that hype justified with the price increase generated, it is essential to check the roadmap for such price drivers: Mainnet launches, prototype releases, airdrops, team acquisitions, exchange launches, token burns, these are some points you should look for.

Numb Numbers – The Token Metrics

For basic knowledge of token metrics, you can take a look at our post “The Numbers Game” – this contains already much valuable information for you on how to calculate a future value of a coin and how you estimate its success, and what a future roof for the coin’s price might be. Basically, you look for the total token supply they will create and how it will be allocated. If they just drop a truckload of tokens on your for 0.1 ETH it might be not a good decision.

Token supplies > 1 bln are usually too big for my taste, but you can’t conclude from that alone. The whitepaper should show off a token allocation pie chart and from there, you have to read. how many of these tokens are planned to get into active circulation?

DYOR: It is absolutely crucial that these tokens have a real use case on the platform they are going to build. ICOs with useless tokens are just stupid as, well, they are just meaningless and this is what they are selling in the end. Supply and Demand – always think of this very basic principle of the markets. If the available supply is too high, the single token might never achieve a proper price.

The demand for the token must be given, do you see the target group buying these tokens to make use of the platform? One of our recent ICO scoops, is a good example: Gamb.io has a vast supply of tokens, but I did not ditch it – why? Because only 35% of them are planned to hit the circulating supply, there is a demand for the product by merchants worldwide, and they mastered how to use the tokens within their platform – they are needed to create and design the future of the platform and make use of it.

So you can’t just ditch a project because of its huge supply, it might be a failure. To stay with the example, a considerable part of these tokens remain in the treasury pool, as one use case of them is to pay for example partnerships or affiliates.

Take a look at how many tokens the team reserves for themselves. 10% is a substantial number. You should always think about power in this case and also the option of insider trades. Imagine the following scenario: An ICO started well, good idea, a great product in the making – they reserved 40% of the tokens for the team. The ICO is over, and the token hits the exchanges. Unexpectedly, a new law product comes out which is far better, provides more value, has enormous hype, and on top, your ICO product does not meet up with some new laws.

I ask you, who will know about this first? Exactly the company. If they abstract a huge decrease in value, or to put it extremely now plan to exit as they don’t see any value in their project anymore, what will they do? Right, they will dump all the 40% on you and “Sell, Sell, Sell!”. Always check how many tokens remain in their control, check how the power is distributed.

Another thing that has not much talk is the difference between tokens and coins. Tokens are most often build on the Ethereum platform and shall have a use case that is smart contracts based. Coins are built on their own blockchain – I prefer the last one, even though these are most often long-term projects.

The Gossip Girl Army – Hype, FOMO or FUD?

Are you dating the talk of the town or the cross-eyed bookworm classmate? I don’t like to say that in public, but Crypto is often dead stupid. Young money floods in, not knowing what to do, but following the herd of sheep. But why? It is simple – everyone has heard of the crazy returns, doesn’t want to miss out and jumps on the bandwagon. Don’t be this guy; you are investing hard-earned money, so put in some energy to get excellent results, or else better invest in the Powerball.

The Lottery Is A Tax On Idiots

– Kurt Tucholsky

So this is a two-sided sword. You want to get in ICOs with hype; it is good to get on board when there is traction, it is good to have a team that knows how to market stuff and invests in it. But don’t fall for it blindly. Let’s take an example here: ETN, Electroneum, was one of the most hyped and marketed ICOs in ’17. Everyone was talking about it, hating it, defending it – but at least everyone had an opinion about it.

Why I personally thought, this is just crap, I went in with one eth, but not for long-term. I knew that kind of hype would push the price at first, so it was kind of a flip ICO for me. My ICO price was around 0.01 USD plus some bonus coins. I sold it as soon as possible- for 0.11 USD. Sure now you can say, I should have held it and sell at 0.2 USD, but I did not want to become a bag holder for this shitcoin. It was enough profit for me. See where the price is now, near the ICO price again.

The hype you see is a sentimenLook at their telegram group and how active they are – but an important one. Have a look at their telegram group and how active they are – also how the team there is responding and how professional they manage the community. Check how the talk on Twitter, Facebook, and Reddit is. Do a Google search for the name of the ICO and check how many results return; the momentum more, the better. Hype can create momentum, and I like to take hyped ICOs for a flip if you decide to hold instead, be sure that the project has a positive outlook in the long run.

Keep an eye if FOMO develops, Gas wars might occur, and it can be hard to get in. If you are convinced to get in and it gets lots of upfront hype, you can try to get in with an ICO Pool while the seed sale. Fair ICOs cap the maximum amount of contributable ETH.

The same goes for FUD – keep your eyes and ears open if negative headlines appear. Even honest and good ICOs can get caught in a negative downward spiral.

3 Levels of Project Quality

When searching for an ICO, you have to gauge the quality of the project. To make things easier, we have separated the levels of project quality into three tiers:

- Low Tier: This tier doesn’t have a product or an MVP to act as physical evidence for their claims. ICOs in this tier only have a promise and a pitch. Most of these projects might have a GitHub link to show their code, but they don’t have physical evidence as to how their application will be suited to the public. These are high-risk ICOs that you might want to avoid.

- Medium Tier: Think of Iconomi when you look at ICOs of this type. The ICO gained impressive results: over $10 Million was raised in total. However, the ICO didn’t give a technical description nor had a functioning product behind it. ICOs of this rank have a team behind them, and they’re not afraid to disclose their information. When looking at ICOs of this type, proceed with caution and only invest if they show any long-term progress.

- High Tier: ICOs of this type will have a functional product behind them. It’s rare that an ICO will have a product during its pitch phase, but the ones that do tend to gain the most results and investor interest. For example, Ethereum and Swish. Both ICOs had a working product behind them to back up their whitepaper and showed patterns of long-term growth.

Remember, the quality of the ICO will determine if it is good or not. If it’s a high risk, chances are it can either be a scam or it won’t provide any long-term benefits. But, if it does have an MVP, a prototype, a detailed whitepaper, and a visible team, then chances are you’ll have a higher return on investment when using it.

The DYOR Rockstar ICO Checklist

We’ve created a table to help you decipher if the ICO you’re looking into is worth your investment. When researching ICOs, use the Verdict section to make your personal conclusion.

| ICO Assessment | Verdict (Good or Poor) |

|---|---|

| Social Hype: How is the ICO recognized by the community? How active is their Telegram Channel and other social properties? How is the vibe within the groups? | |

| Updates: Are the developers providing regular updates about the ICO? Developers who can clearly communicate their progress with their ICOs tend to have room for long-term growth. | |

| Project Advisors: A project that has credible advisors will have more community support and long-term success. Even though they are most often useless for the project, they are there to create hype and credibility, which is crucial for a successful ICO. | |

| Project Advisors: A project that has credible advisors will have more community support and long-term success. Even they are most often useless for the project, they are there to create hype and credibility, which is crucial for a successful ICO. | |

| Legal Barriers: Is the ICO banned within your country? If the ICO is structured in a way where it might cause regulation or legal issues, then it will have a hard time growing or developing into a functional project. How is the political sentiment, are they in a high-risk area where regulations might kick in? | |

| Viable Target Market: The ICO should have a well-defined target market that should be large enough to have growth. | |

| Competitors: How is the coin faring up against its competitors? Even if it’s similar to its competition, does it have unique advantages that can result in more user adoption and traction? USPs! Create a competition matrix. | |

| Money Raised: You don’t want an ICO that’s unable to raise money during their Pre-ICO and ICO stages. You should find out how much money is spent and how it’s going to the completion of the project. | |

| Time Line: Is the roadmap or timeline clear and easy to follow? A clear timeline shows that the ICO is dedicated to completing their project. Is it doable for that team? | |

| Team Experience: As we’ve stated earlier, the team needs to have experience in their niche and in completing ICO projects. Make sure that they have an interest in blockchain development and previous history of successfully finishing ICOs. | |

| Centralized or Decentralized: Decentralized coins are designed to empower the masses and have a myriad of benefits. But, coins that have a centralized “governance”, do not really support the idea of Crypto – however, they can be still from substantial success (e.g. Ripple) | |

| Investor Interest: Is the project backed by high-profile leaders or investors? Having investors that are known within the crypto sphere will increase the ICO’s credibility. How did the seed sale go? | |

| Consensus Algorithm: Is the ICO set up to prevent hyperinflation? Does it have a “proof-of-stake” or “proof-of-work” algorithm? | |

| Token Utility: The token needs to be profitable, show value, and long-term user engagement. | |

| Whitepaper Quality: Does the whitepaper explain technical information clearly? If the whitepaper just has marketing hype without showing the mechanics of the coin then its best to steer clear of it. | |

| Purpose: Does the ICO have a clear objective? Is the product they provide revolutionary/first mover of its kind? |

Conclusion

Don’t just take ICOs for their face value. There are great ICOs, but it will take effort on your part to decipher the good from the bad. You need to research them and find out everything that’s internally going right and wrong with them. Having success by investing in ICOs is not as easy as it seems and you have to invest more than just some ETH. You have to invest your energy. DYOR, they say. Now, you know how to do that.

Pretty! This has been a really wonderful post. Many thanks for providing this info.