Bittrex US has filed for bankruptcy because of a fine of 50 million and a lawsuit from the SEC.

If you want to buy any cryptocurrency besides Bitcoin, Ethereum, and Litecoin, you will have an account on Bittrex soon. Bittrex was no doubt THE major player when it comes to trading altcoins, although the site has some major issues like its design on mobile devices. Bittrex has the biggest volume, so your chances are good to get your orders filled.

Oh, question marks? I see – we will take a more detailed look at the exchange and show you how to use it the right way. If you landed on this post, because you wonder what all this stuff on Bittrex means, you are probably new to trading on exchanges. This Bittrex guide shall shed a light on how everything works, so you find your way into the exchange and use it profitably. Note: You will see a slight difference between our Bittrex charts and yours when you open them.

This is because we use a Chrome extension that: a) displays the much better Tradingview charts over the Bittrex charts and b) shows you the USD value in additional columns on some spots. This helps to keep on track of your spending and earnings, especially if you are new to the Crypto world. It is not convenient for most to calculate everything in Bitcoin.

Table of Contents (click to expand)

- Bittrex Overview and Frontpage

- How to buy and sell a particular amount of a coin on Bittrex?

- Why do some orders not fill immediately on Bittrex?

- What does the ‘Partially Filled’ popup on Bittrex mean?

- How do I set up a take-profit or a stop-loss order on Bittrex?

- Can I set up a stop-loss AND a take-profit on the same trade with Bittrex?

- How to sell and buy with the order book on Bittrex?

- The buy and sell walls in the ‘Order Book’ tab on Bittrex

- What does the trading volume column on Bittrex mean?

- How can I get better charts and indicators on Bittrex?

- Are the wallets on Bittrex safe for long-term hodling?

- Is there an app for Bittrex?

Bittrex Overview and Frontpage

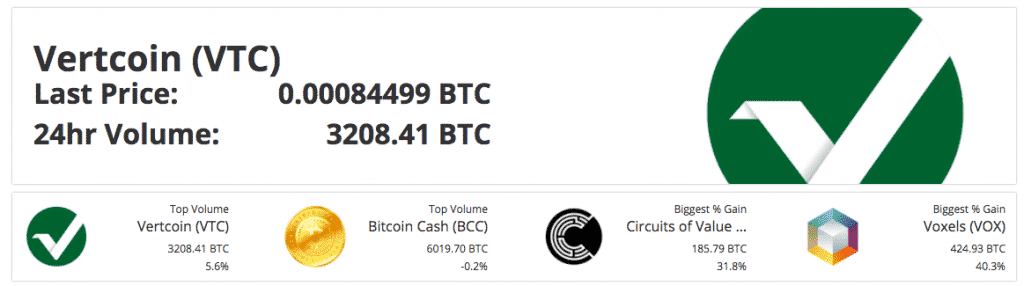

Once you logged into Bittrex you will see an area on the top that shows you the biggest gains and the coins that trade with the most volume. It is like a “trending now” section. I tend to see the big gainers as trains I missed, if you buy into those, you likely buy into a peak of them which will bring you to an often made newbie mistake called “Buy high, sell low” – obviously you should do it vice versa. The top volume is more interesting, it shows the top coins that have the most volume of BTC trading within. You want to have a good volume for your trades, as these pairs are active and actually traded, which means you likely will get your orders filled near to a realistic price.

Below you will see the current three boxes: the Bitcoin markets, the Ethereum markets and the USDT (Tether) markets. These are the three base currencies that Bittrex offers to trade against. So if you want to trade Vertcoin against Bitcoin, you choose it from the first box. If you want to trade Omg against Ether, you choose it from the second box, and so on. As you know, all prices are relative in value, depending on the counterpart you trade against. OMG/BTC is a different chart as OMG/ETH and you might have a completely different opinion about the price projection (however, they often correlate in some ways, which is an interesting topic for a future post notes that down).

On the front page, once logged in, you will see the Top20 coins from the BTC, ETH and USDT markets, with the biggest trading volume. People will trade the coins against BTC more often, therefore you will see here the biggest numbers in terms of volume. This overview of the Top20 gives us a great chunk of important info at a glance. The most important columns are: Volume, Change, 24hr High, 24hr Low and the Spread. If we can see a big range between the high and the low, we want to take a look at the spread. A tight spread (<2%) will show us that people are still trying to get in, and it could take some time until your order becomes filled. So if you see this small spread on coins that are up with >100% gains and are near their 24hr high and have a tight spread below 2%, it is a clear alert not to buy it right now. It is a reliable indicator that this particular coin will get dumped the next time and you might want to wait for a better entry point. If we did our research and want to get into some coins of our shopping list, it makes sense to check which of them is down at least two figures percentages-wise AND is near to its 24 hr low (or 1 week/month low – this depends on how long you plan to hold it) AND has a large number on the spread column. This makes sense as it wouldn’t be rewarding for the coin holders to dump it since they didn’t profit anything yet.

Bitcoin markets on Bittrex

How to buy and sell a particular amount of a coin on Bittrex?

If you are trading BTC markets, you will need to have BTC in your wallet. That done, you want to search your coin over the Bitcoin markets or you pick it from the front page if it is at the top20.

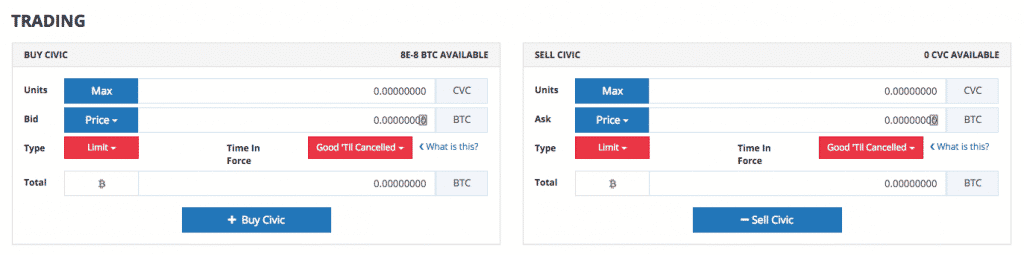

Buying and selling work in the same way. You will find two sections below the chart to place trades: The “Trading” section and the “Order Book” section. Right beside the chart you can see the most current bid and ask price. These are the current highest bids (offers) and lowest askings for the coin. Every time a trader wants to buy a particular amount of units, he sets a bid at which price per unit he is willing to purchase from you. Vice versa if someone wants to sell. They are placing an ask order and asking for a particular price per unit to sell their coins to you. The gap between the current highest and lowest of these two prices is known as the spread.

Right below you will find the trading section. Here are some options, which you want to look for. For buying and selling, the procedure is the same. If you want to go all in / all out, you hit the Max button. The next thing below is to choose your bid / ask price. If you click the PRICE button beneath “Bid”, you can choose “Latest”, “Bid” or “Ask”. “Latest” means the most current real price you can see on the chart. “Bid” means the highest price you can choose that another trader has defined to purchase a unit and vice versa. “Ask” means you select the value of the lowest price asked for a unit.

Why do some orders not fill immediately on Bittrex?

First, you must know that Bittrex is an exchange and you will need a counterpart for every order. It means that Bittrex itself won’t buy or sell anything. It just charges a commission per trade. If you want to sell 20 units of a coin, there must be a buyer for these 20 units. If you want to buy 20 units of a coin, there must be a seller for those. So the reason why orders don’t fill immediately is usually: a) the volume is low and there is currently no one buying/selling, so you have to wait for your counterpart or b) the price has changed and your order is unattractive to the buyer/sellers at the current moment.

What does the ‘Partially Filled’ popup on Bittrex mean?

Partially filled means that only a part of your order became filled. For example, if you want to sell 3 Litecoins, but only 1.5 LTC have been purchased by another trader so far, it is “partially filled” until the 1.5 LTC left are bought as well. Orders are often filled in small stacks, so don’t worry about it too much. You can cancel the remaining amount of your open order any time you wish and sell/buy it later. If you cancel an active partially filled order, it has no effect on your already purchased amount, as all trades – also the partial ones, are final on Bittrex.

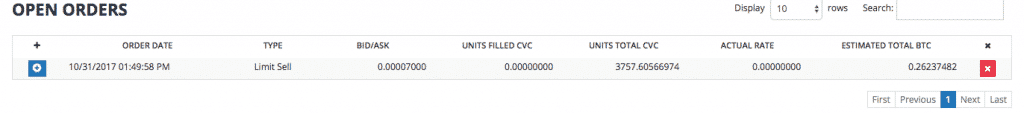

How do I set up a take-profit or a stop-loss order on Bittrex?

For order types, you can select between two options: limit order and conditional order. The limit order places your order immediately in the order book as defined by you above. With a conditional order, you can set up market conditions that have to be met before the order becomes automatically executed. This way, you can set up pending orders, take-profit or stop-loss orders. The conditions available are “Buy/Sell when greater or equal to and Buy/Sell when less or equal to”. So If I am assuming a price of 0.0007 sats and want to sell there, I set up a conditional order to take-profit automatically, once the price of 0.0007 sats has been reached (see example below). Vice versa, you could also place a stop-loss order by using the condition “Sell when less or equal to”.

Examples:

I want to setup a pending order for when the price hits 0.0003 sats.

I would use the buy box, choose “Conditional” -> Condition -> Less than or equal to 0.0003

I want to setup an automatic take-profit order if the price hits 0.0007 sats.

I would use the sell box, choose “Conditional” -> Condition -> Greater than or equal to 0.0007

I want to setup a stop-loss order, if the price falls below 0.0003 sats

I would use the sell box, choose “Conditional” -> Condition” -> Less than or equal to 0.0003

For the button beside, named “Time in Force”, we have two options: “Good ’til canceled” – which means that if you place your order, it will stay active until a buyer/seller that matches your conditions is found. If you choose “Immediate or Cancel” (on other exchanges often called “Kill or Fill”), your order will be terminated completely only if there is no buyer/seller to be found right after you place the order.

Important to know: For all orders that are not directly filled (because of a missing counterpart or being a pending order) your funds are locked and not tradeable anymore unless you cancel the pending order.

UPDATE: We found this helpful image on how to setup stop-loss on Bittrex to share it with you:

Can I set up a stop-loss AND a take-profit on the same trade with Bittrex?

No, this is a hefty limitation by Bittrex’s engine. As your funds are locked for a defined action you are not able to place another pending order with it. That means that you have to choose between a stop loss order or a take profit order on running trades.

How to sell and buy with the order book on Bittrex?

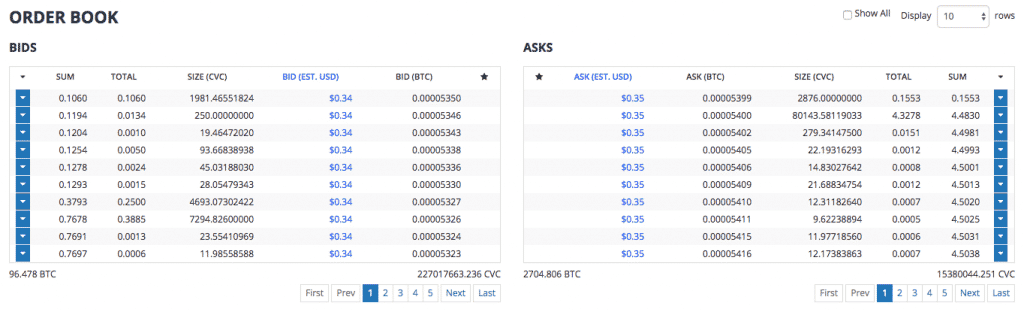

The order book is a powerful tool and gives great trading insights. It shows live the incoming bids and asks. The best offer is always on top. Let’s take a look at the screenshot to get familiar: On the left hand we have the bids that you can choose from if you want to buy the coin. If we take a look at the first bid, we can see someone wants to buy around 1981 CVCs at a rate of 0.0005350 sats, with a total price of 0.1060 sats. If you want to sell some of your CVC at this price, you can click on the blue arrow on the left side to start the process – the same for buying in the left box. Just click the blue arrow and you simply have to confirm this order to be executed. Nice to know: If meanwhile a better price is listed, Bittrex will apply it for your automatically.

Also, you can buy up to 2876 CVCs from someone from the ASKs book. We can see he wants 0.00005399 sats per unit and a total of 0.1553 sats. If you hit the blue arrow and click on confirm, the amount is sold to this trader.

Let’s go through the columns of the order books:

SUM: The SUM shows how much BTC would be required to move the price up or down to that range

TOTAL: The TOTAL column gives us information about the total amount of BTC that can be found within the order book at a particular bid price (which can be found in the last column under BID (BTC)

SIZE: The SIZE column shows how many units of this coin will be bought at that price

BID (BTC): The last column shows us the actual bid price in BTC per one unit of this coin

Beyond the corners of each box at the bottom, you will see the total volume, like how much BTC/coin units overall are in the order box to purchase/sell this coin (these are open and not yet filled orders). If you scroll through the pagination of the order books you can find out how much buy or sell resistance there actually is.

The order books are a more direct way to purchase or sell and the orders will get filled directly.

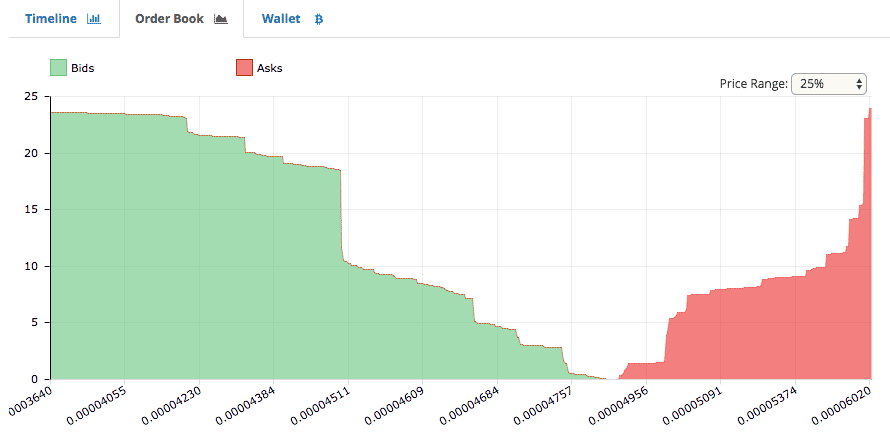

The buy and sell walls in the ‘Order Book’ tab on Bittrex

If you click on the order book tab on any coin, you will see something like this:

The concept is actually not hard to get: these walls are actually a visualization of the order books. The green side is the bids (buy) orders in the order book, and the red one is the Ask (sell) orders. On the x-axis you can see the price in sats, the order has been placed. The y-axis shows the amount of BTC for this order. From this example image, you can see for example a bid @0.0003640 with a total amount of around 24BTC as the highest order in the book. Each wall represents a from-to range in terms of order price and size. A more elaborate article about how to read buy and sell walls can be found here.

What does the trading volume column on Bittrex mean?

The trading volume shows the total amount traded within a particular pair in the last 24 hours. If the volume shows 566.5483 BTC, it means that this coin has been traded for this amount in buy and sell orders within the last 24 hours. A low volume means less interest by the traders in general and makes it sometimes hard to get your orders filled in time or at your wished price. It is like there is no big movement to expect the next time if the volume is low. Also, it makes technical analysis more difficult, as there is not enough data and movements to let patterns appear, that you can exploit.

How can I get better charts and indicators on Bittrex?

Use the Better Bittrex Chrome extension to have all the luxury of Tradingview right within Bittrex.

Are the wallets on Bittrex safe for long-term hodling?

You want to keep a small amount of your funds within the exchange wallets to be able to participate in trades, but – as the past has shown – exchanges get hacked or other stupid things might happen in this unregulated area (read up Mt Gox). So the best and safest way is to have your funds in at least a hot wallet. The best practice though is to transfer your holding funds into a cold wallet like the Ledger Nano.

Is there an app for Bittrex?

Not an official one, but many people use TabTrader, which allows connecting your exchange accounts via API. Bittrex offers an API key, so it is possible to connect your Bittrex account to TabTrader. The app is rock-solid and loved by many traders. Alternatively, you can also use the app by Coinigy in the same way.

Bittrex is also listed in the High Volume Exchanges article.

We also prepared a Bittrex user guide.

[…] write from time to time exchange reviews or guides. As an example: “THE ULTIMATE BITTREX GUIDE” At SmartOptions we keep you […]

We will update new guides soon. thanks for sharing.