Crypto payment gateways are the next big step for cryptocurrencies. At least regarding mass adoption is the broad acceptance within e-commerce. Is it already worth the hassle?

Won’t it be too volatile? And how the hell can I accept Bitcoin as a payment method? As our team has profound knowledge in the e-commerce sector, we want to give you a headstart.

Here we examine some general thoughts, crypto payment gateways. With the advantages of accepting cryptocurrencies. This post might not be for all of our readers, but for those in business, it is hopefully helpful.

The future of business is coming around fast. Happily, day by day more companies are now accepting cryptocurrency as a form of payment. Outages like the recent one with VISA cards show us how vulnerable electronic payments are with credit cards. As well how fast you can become unable to pay with regular payment methods.

Thus even celebrities are starting to utilize cryptocurrency to help promote their brands. Yet for online shops this is not so. As it is yet most small brick & mortar kind of businesses.

Hence these smaller shops are doing something visionary. It is worth honoring that. As they show trust into the future of crypto. To build a foudation for all of us. We can support them by buying from these crypto payment gateways in the future.

First thing for store owners to know is that you apparently can still use fiat money for your business. But you’re limiting yourself if you don’t allow your clients to pay you in crypto. Either Bitcoin, Ethereum, Litecoin, or any form of crypto.

So that’s why this guide was made. We want to help you accept cryptocurrencies so that you can improve your company grow in the long run.

Table of Contents (click to expand)

- Why Businesses are Moving to Cryptocurrency

- Crypto payment gateways & understanding cryptocurrency

- The Wonders of Cryptocurrency

- Tons of Exciting First Mover Options

- How to Accept Bitcoin with a Crypto Payment Gateway

- Crypto Payment Gateways

- UTRUST – a Crypto Payment Gateway with Spot Conversion and Buyer Protection

- Coinpayments – Widely Used Crypto Payment Gateways

- Coingate – Exchange and Crypto Payment Gateways

- Crypto Payment Gateways: Coinbase

- BitPay

- Crypto Payment Gateways in conclusion…

Why Businesses are Moving to Cryptocurrency

Every businessman, especially the successful ones know that there are limited ways to pay for their services and goods. The most common options in e-commerce are credit cards, PayPal and wire transfer. But, credit cards took at least ten years before it was accepted as a conventional form of payment. That’s a very long time.

The crypto market has matured for ordinary people and investors. Australia, Japan, and South Korea have made the most progress throughout the industry.

These countries view Bitcoin as an acceptable form of payment. Hence they are positive about it. So that their civilians and businesses can buy and sell products and services.

Here are two of the main issues. Each happen when a new payment network tries to start obtaining market share:

- Businesses don’t want to use a payment method that’s rarely used.

- Customers want to use the payment method but can’t due to a lack of infrastructure.

Despite this we now we are living in an era of faster, safer, and cheaper. All for transactions that aren’t controlled by the government or other institutions. About 50 years ago, no one accepted Mastercard or Visa. Bitcoin, Litecoin, Ethereum, and other cryptocurrencies will have that same outcome.

As society progresses, there will be a time where business owners will have to embrace this financial revolution. Interesting website: Coinmap shows where Crypto is accepted as a mode of payment. Secondly it shows on the different point of sales in the world.

Crypto payment gateways & understanding cryptocurrency

Most brick and mortar businesses tend to shy away from cryptocurrency. This is usually due to a lack of understanding. That’s why you need to understand the value of cryptocurrency so that you can utilize it.

If you’re going to accept cryptocurrency for your business. Additionally don’t you have to understand that its value will change every day? This means that if you do take crypt as a payment. The payments you receive today can be worth nothing tomorrow. However, it can also be worth x10 as well. This volatility is not what we want if we run a business in the first place.

However, consistency in the acceptance will iron out the fluctuations over time. Also, you can convert your accepted crypto into fiat money. Doing so by the end of each day if you want to minimize the risk. UTRUST was the only provider in our test. They offered spot conversion, so you would not suffer any loss from volatility of price. With this the payment of an online purchase would be converted on spot to your fiat currency.

Most of our readers know it already, but for Googlers that found this post to get the necessary information. We will outline some fundamentals first about cryptocurrencies. Every transaction is stored via blockchain, which is a method of recording them with cryptography. Also, they aren’t recorded on one server, but through a network of multiple computers.

That’s why it is very secure – it is like a network database, which matches each entry through a worldwide, decentralized network of computers, to say the least in a very condensed way. Crypto payment gateways offer us security for the future.

But, just because the transactions are secure, doesn’t mean that your crypto can’t be stolen. Recently, cyber thieves have made millions of dollars of stolen cryptocurrency. Since cryptocurrency isn’t backed by the government or any bank institutions, theft losses aren’t covered. Hence the encryption makes it harder to track the person who stole your cryptocurrency.

That’s why you need to keep your cryptocurrency secure. And (not only) when using it for your business. If possible, use hardware wallets. These are often referred to as COLD WALLETS. Such as TREZOR or LEDGER to ensure that your payments are safe. Only going towards your business. If you plan to keep them for the long-term.

The Wonders of Cryptocurrency

When you accept cryptocurrency keep in mind. Again include another way to receive profit from your customers. Here are four reasons why you should accept cryptocurrency for your business.

People are searching for options to shop with Cryptos

Believe it or not, many people are deficient in fiat, but rich in cryptos – and they are actively seeking the web for options where they can spend parts of their funds directly in online stores.

This might happen for several reasons, but since the cryptocurrency frenzy in 2017, many people own big chunks of crypto and are willing to spend it online. The conversion back to fiat is connected to transaction and withdrawal fees, which they want to avoid. Again crypto payment gateways to the rescue!

If they have crypto, but no fiat funds, they will start to search for things like “buy iPhone 10 with bitcoin” – these keywords are low-hanging fruits for search engines and you can claim good rankings for your niche if you are an early adopter.

Firstly: High Transaction Speed

Unlike fiat currency, cryptocurrency transactions happen almost instantly. For instance, Bitcoin miners take at least 10 minutes to facilitate and complete a transaction. Other cryptos such as Ethereum and Litecoin can verify transactions in about 20 seconds. This means that you’ll receive payments in 10 minutes or less. Many crypto payment gateways (which we will talk about later in this post) can credit the spent funds immediately.

Now let’s think about fiat transactions.

When accepting USD, AUD, GBP, etc., it takes at least 3 days to reach your bank account. While fiat money has undoubtedly its importance in today’s world, you could accept cryptocurrency and receive money even faster due to blockchain’s fast transaction system.

However, your merchant account will take 2-3 days to reach your bank. This is because the account converts your cryptocurrency into cash automatically. You’ll still be able to receive the crypto quickly, but it will take longer to convert it to cash.

Secondly: Increased Payment Options

As we stated earlier, accepting cryptocurrency gives your customers more payment options. For instance, in a 2016 payment processing survey, the results concluded that customers use about 5 payment options. Thus, by accepting cryptocurrency, you allow your small business to reach a larger and very specialized customer base. Many people spend cryptos with more ease than fiat money.

Crypto payment gateways In a nutshell, e-commercers across the board made the experience that if you offer the right mode of payments, the conversion rate will increase, as it is more likely that the prospects can pay the way it fits him/her. Depending on your niche, there might be tons of customers searching for an option to buy a computer game, a bicycle or whatever in cryptos – and there are convenient integration plugins by crypto payment providers available, so why don’t give it a shot?

Thirdly: New Clients & Currency Conversions

Cryptocurrency has the same technological advancements as the Internet. And for a good reason, with cryptocurrency, third world countries such as India are able to use crypto to help their economy. Because of this, we can see that cryptocurrency has been used in almost every country in the world.

When you accept cryptocurrency, you open your business to international clients. You don’t have to worry about non-stop value recalculation or conversion rates. Thus, making it easier for you to receive payment without the financial hassle of fiat money. I work with an online store that ships worldwide. You won’t believe the trouble of currency conversions we face every day, especially when it comes to refunds. Try to do research: if you sit and sell in the US and you have clients from China for example and you refund them $300, guess what they will receive in the end in RMB on their card? It is a robbery.

The clients have to pay a conversion fee very often, which makes it hard to convert them – you/your clients are free of this stuff with cryptocurrency payments! And as we talk about China: if you deal in larger amounts, it becomes a headache with them, as the Chinese government tracks the money outflow of their country and limits their citizens how they can send abroad. One of these limits, for example, is 10k/week if you are not an institution. The e-commerce we work with has many high profile clients, who order for 20-30k a week – they are genuinely in the red with the company, not because they can’t pay, but because the government doesn’t let them pay the whole in a bunch. Crypto payment gateways can be a wonderful workaround for that.

Fouthly: Complete Transactions

With fiat currency, customers can negate sales and create a chargeback. This can hurt your business severely. You’ll find it harder to keep your profits due to these disputes with your customers. Chargebacks – what a headache. USPS messed up a delivery? Customer chargebacks his payment and you sit there with the trouble. We all know that.

That’s where cryptocurrency steps in.

Every cryptocurrency transaction is final. When your customer buys your product or service, they are unable to turn back on their decision. Cryptocurrency payments reduce the chance of customer fraud (when a customer disputes a transaction just to receive their money back or use fake credit cards to buy your product).

Lastly: Tiny Processing Fees

Most businesses who accept credit cards complain about having to pay for processing fees. No matter what credit card processor you use. Because they’re going to change you to obtain profits and operate their system.

On average, these fees can go from 2-4% per transaction. Take a look at PayPal which take 2.9% – 4.4% plus fixed fees on each purchase. This is criminal! But also credit cards like Visa usually take a processing fee of 2-3% or more! Hence this can sum up to big numbers! If you compare to the low fees of ~1% crypto payment processors provide.

Do you see the issue with these high fees on traditional payment providers?

Cryptocurrency doesn’t have this kind of huge processing fees because there’s no middleman, just miners. Crypto payment gateways use decentralized ledgers to assist with each transaction. As a result, you don’t have to pay this big chunks for each purchase. So you save more money in the long run.

But, each merchant wallet charges a monthly fee for using their services. Which is usually about $30 a month. You can pay a 1% fee to get priority payment posting and processing. Since cryptocurrencies have fast transaction speeds and this fee is viewed as a luxury and not a need. So you can continue to have your merchant account take payments and pay very small fees in the process.

And, when you convert your cryptocurrency into a base currency, the exchange will show a buy/spread. Alternatively this means that they will buy your cryptocurrency. Just at the selling price and sell it to a user at the buying price. The difference between the buy/sell price is how the exchange earns its profit. If your cash flows allow it you can always try to make use of the crypto volatility to balance out the fees of your crypto payment processor. However, you should have some knowledge with cryptocurrencies to do so.

Be careful with the fees though! You have to think in multiple layers here: These are the areas where costs can apply:

a) Firstly – Transaction fees

b) Secondly – Conversion fees

c) Thirdly – Bad market rates for conversions

d) Lastly – Negative price development of the underlying cryptocurrency if you don’t convert it on spot.

There are many pitfalls. Most of the providers make use of it to generate some extra dollars with you. The most honest provider we found is Utrust, as you can see from the table below:

Tons of Exciting First Mover Options

As we know there are many people out there, that want to spend money in crypto and the wallets sit often more loose than a credit card, we not looking out for unclaimed niches? Re-inventing eBay with enabled Crypto Payments? Why not?

There might be tons of opportunities right in front of you and with a tiny bit of research, you can select an already prove-to-work niche and start the same business model with cryptocurrencies. Get your feet wet – now is the time to overtake your niche in conjunction with crypto payments! We have the scripts to make it technically. And we have the Crypto payment gateways, you just have to realize it.

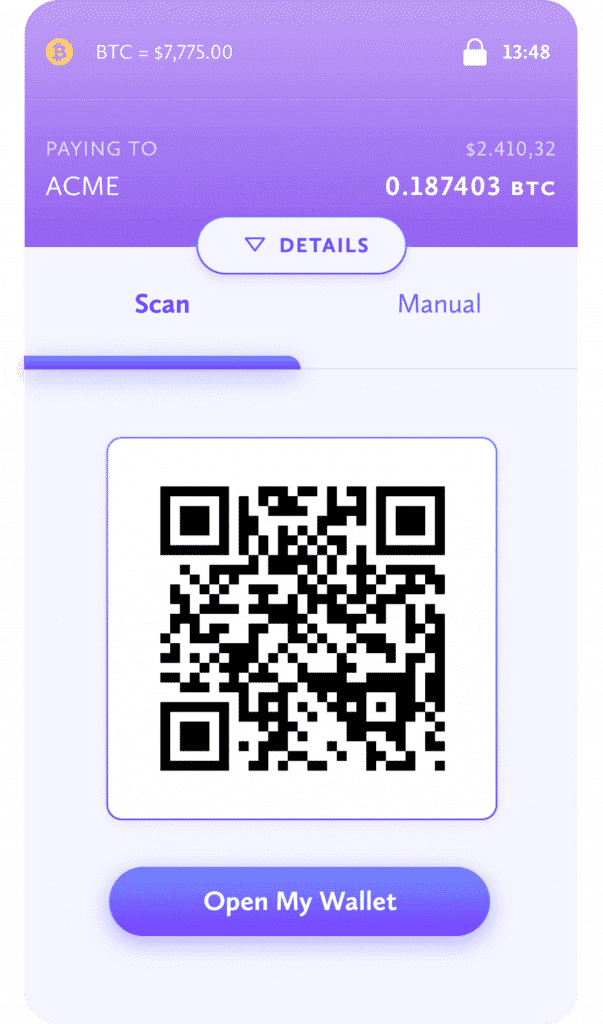

How to Accept Bitcoin with a Crypto Payment Gateway

First, you have to create a virtual wallet to start accepting crypto for your business. Each virtual wallet has security features such as identification methods and backup systems. Some wallets are free for users and some that are paid that offer an extra layer of security.

Next, you have to advertise to your customers that you accept cryptocurrency. For example, you can show a small sign that says that your business accepts bitcoin. There are multiple ways that you can advertise this, such as the internet. Especially search engine optimization offers countless opportunities in this field and should be easily reachable without a big budget.

Coinbase and Bitpay are two forms of payment processors that you can use to finish your cryptocurrency transactions. Utrust is the only crypto payment gateway, which converts on spot, so you don’t face additional fees and volatility issues. Other payment providers like coinpayments might have fees applied to them, so make sure to check for them before letting your business accept them. Later we will show you a selection of crypto payment providers, and give you a head start with it.

Check for its Legality

Before the dollar was invented, U.S. currency used the “gold standard” until 1971. After that, it was named fiat because it was a currency that has government declared value. But, cryptocurrency isn’t under government regulation. It exists through digital transactions.

This doesn’t mean that it’s illegal. It just means that any government branch does not back cryptocurrency. There could be a reason why most countries don’t accept it. But that doesn’t stop you from using cryptocurrency for your business. However, you should talk about it with your accountant to check the rules for accepting cryptocurrencies.

Taxes

Every reputable business pays taxes. The IRS doesn’t view cryptocurrency as money. But, if you’re making a merchant account, in most countries are you’re going to have to pay taxes like you would with traditional funds.

Speak to your tax preparer or accountant to ensure that you’re following tax regulations. This will save you and your business a lot of trouble later on!

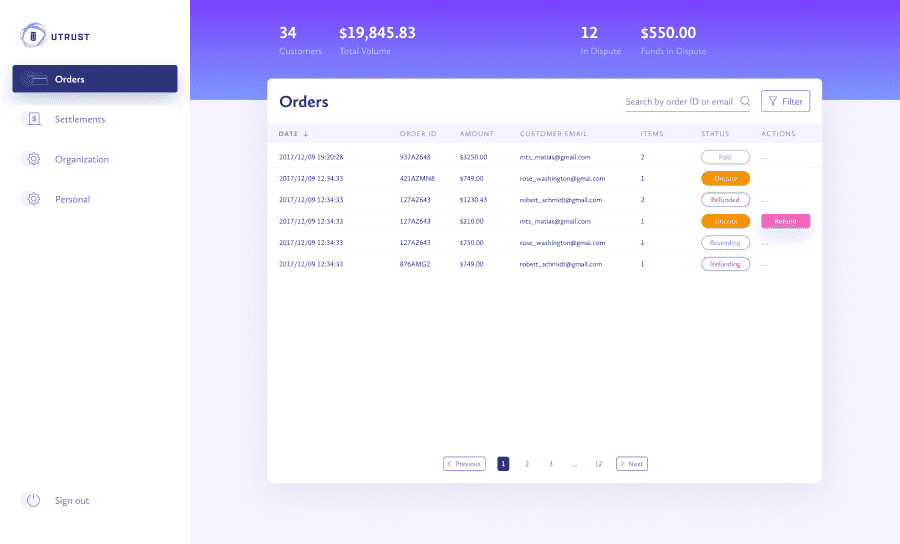

Crypto Payment Gateways

At first, the world simply accepted fiat money as a form of payment. And while this was a great thing, there are a few issues with it. Fiat money is untraceable, meaning that once you lose it, it’s almost impossible to trace it back to you. You can accept fiat money for your business, but without cryptocurrency, you’re leaving yourself at a considerable disadvantage. No wonder many merchants are searching for a bitcoin payment gateway.

While there are many crypto payment providers in the game, we have chosen to review the five biggest/important/best ones of them, as we suspect them to be the most secure and enough liquidity to handle larger clients as well.

Overview of Crypto Payment Gateway Providers in this post:

- UTRUST

- Coinpayments

- Coingate

- Coinbase

- BitPay

WebsiteCompany from SwitzerlandAvailable shopping cart plugins: – plugins for major shopping carts under development – Fees: 1% fee on every transaction (paid by the buyer) Coins/Tokens accepted: All major coins, more to come on monthly base Withdrawals in Fiat: Yes, with spot conversion to fiat ID Verification process: Not needed for the first transactions with total revenue of 3000 CHF (or equivalent amount in Euro/USD etc.) Back office, Features, Settings: Feature-rich, with many smart solutions and automation options API/IPN: Yes –>

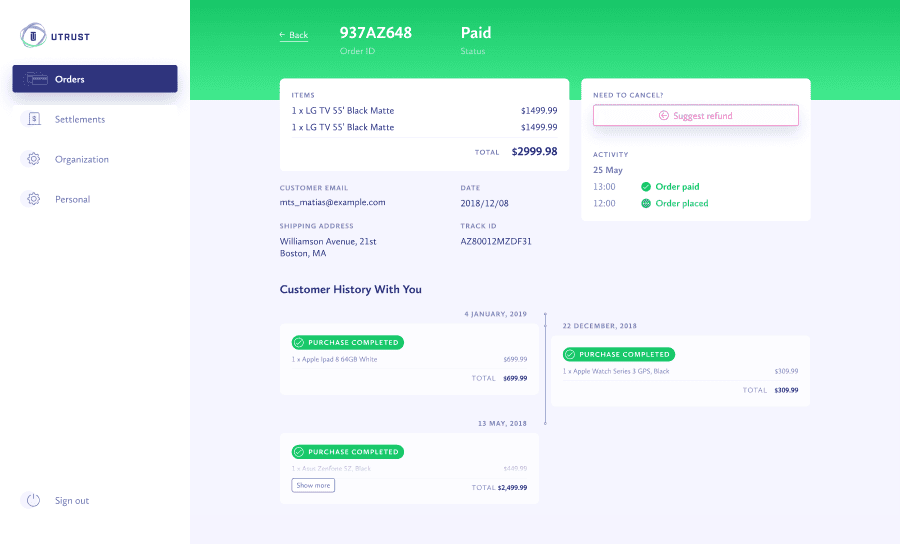

UTRUST – a Crypto Payment Gateway with Spot Conversion and Buyer Protection

Aiming to provide a PayPal-like option which merges the advantages of cryptocurrencies with those of fiat money, UTRUST offers a set of solutions to a number of burning problems.

Launched during the ICO craze of 2017, UTRUST turned out to be an initiative which has provided blockchain technology with a clear and feasible use case.

Looking to become to crypto payments what PayPal is to fiat-based e-commerce, UTRUST addresses a number of problems which are major hurdles in the path of crypto mass adoption.

The solutions offered by the UTRUST platform to these problems are very straightforward and common sense, yet they are all potentially game changing in regards to institutional and retail crypto adoption. Shooting forward to the bottom line: Utrust offers the most complete crypto payment solution, tackling the problems where all the other providers still suffer from.

What is UTRUST and what problems does it solve?

UTRUST is a payments ecosystem aimed at online merchants and buyers. It converts an impressive number of cryptocurencies to fiat instantly, besting some of the top names in the industry in this regard.

While coinbase offers comparable conversion services in 37 countries, UTRUST aims to make its platform available globally.

Online payments have always been the Achilles’ heel of e-commerce and let us face the music: they’re not exactly headed in the right direction, with payment processors growing greedier all the time.

Being overcharged for a service that should cost next to nothing in the age of cryptocurrencies, is no longer acceptable, however.

That said, as they currently are, cryptos do not exactly make ideal payment vehicles, when directly integrated by merchants.

They present a number of problems that render them quite useless for everyday payments.

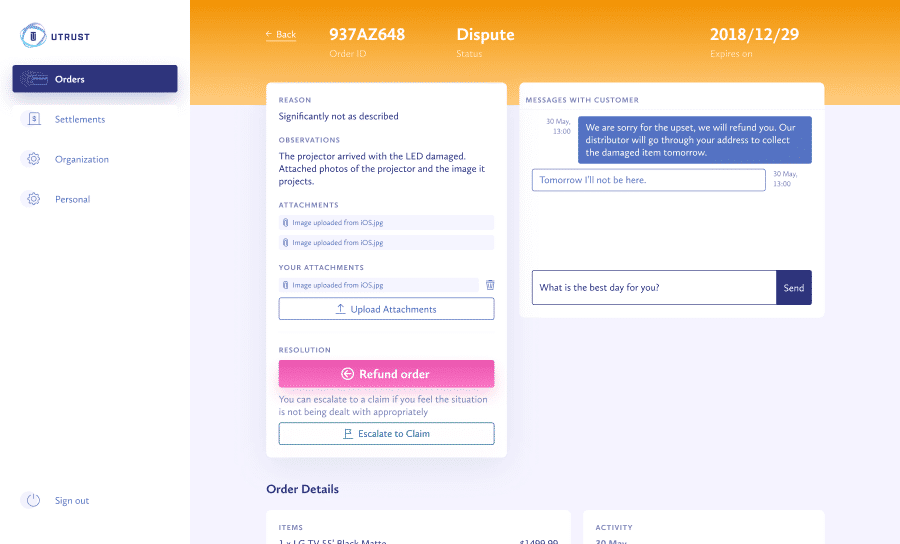

The most obvious of these problems is buyer protection.

Payment solution providers such as PayPal may overcharge, but they have buyer protection covered. If someone pays for a product and then does not receive it, PayPay will make sure his funds are returned to him. Dispute settlement is included in the package.

Digital currencies such as Bitcoin and Ethereum cannot provide such protection/guarantees on their own. When someone sends a BTC payment, the money is gone for good. No one can recover it.

If all transactions were done in good faith, this would not be a problem. But people are always quick to latch on to such vulnerabilities and exploit them. That rules out cryptos as feasible payment methods.

Even Satoshi Nakamoto, the creator of Bitcoin, was aware of this problem and recommended the use of escrow accounts to deal with the issue. That is exactly the solution UTRUST adopted.

While crypto purists will be quick to point to smart contract-powered escrow accounts, UTRUST’s more traditional solution works well too.

Whenever a payment is made through UTRUST, the money lands in an escrow account, where it remains until the payment is cleared. That may take up to several days, though sellers with a good reputation will have the payments unlocked almost immediately.

It is in the interest of the seller to build as good a performance rating as possible. Whenever a mishap occurs due to the seller entity, it gets stuck with a downgrade.

In addition to this system, UTRUST also offers a way for buyers and sellers to settle their disputes amicably. Ultimately, UTRUST can step in as arbitrator.

Another problem UTRUST eliminates from the crypto equation is the issue of volatility.

Based on a technology which is yet to reach maturity, cryptocurrencies are notoriously volatile. Price drops and explosions of 10-20% are relatively common. For merchants, such swings mean the possible disappearance of profits and they are not exactly a boon for buyers either.

To eliminate this problem from the picture, UTRUST instantly converts crypto payments to fiat, locking in the momentary value.

The time frame used by the platform in this regard is 2 minutes. When the buyer makes a purchase, he is presented with the price in the crypto of his choice, which is valid for 2 minutes. After that, the system updates it.

Other problems tackled by UTRUST are those linked to scalability, compliance and competing crypto blockchains.

As far as scalability goes, the platform accepts an impressive number of cryptocurrencies and it guarantees near-instant transactions for all of them, regardless of the transaction speeds made possible by the individual blockchains.

Compliance-wise, the platform has adopted the strictest regulatory frameworks of traditional, fiat-based payment processors. The in-house legal team of the operator has made sure that UTRUST would not encounter any regulatory surprises in the future either.

Dispute resolution is focused on putting the buyer into direct contact with the seller, in the hopes of an amicable solution. After 7 days, the buyer can escalate the dispute, bringing in a UTRUST mediator, who then collects evidence and makes a final decision.

How much does it cost to use UTRUST?

UTRUST charges the seller-side user a 1% fee on every transaction. This fee is however passed right along to the buyer, as the price delivered to the latter includes this fee, as well as all expenses incurred through the crypto-to-fiat conversion. To this end, the platform uses a number of 3rd part exchange service providers. Apparently, it employs special algorithms to make sure the best possible rates are used.

If the buyer takes a dispute all the way to a UTRUST mediator and then gains a refund, a further 2% is deducted from the refunded money.

Refunds are made only in UTK – the platform’s native cryptocurrency. UTK-based payments are cheaper than those made in other cryptos.

Features

Pro UTRUST

Contra UTRUST

Website

Company from Switzerland

Available shopping cart plugins:

- Drupal

- Magento

Fees: 0.5% fee on every transaction

Coins/Tokens accepted: around 200 cryptocurrencies (unique!)

Withdrawals in Fiat: Yes, with Coinbase/Coinmotion bridge

ID Verification process: none – however Fiat conversions will need one

Back office, Features, Settings: Feature-rich, with many smart solutions and automation options

API/IPN: Yes

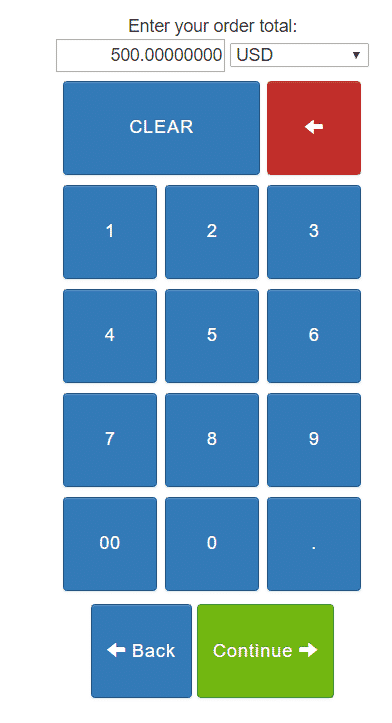

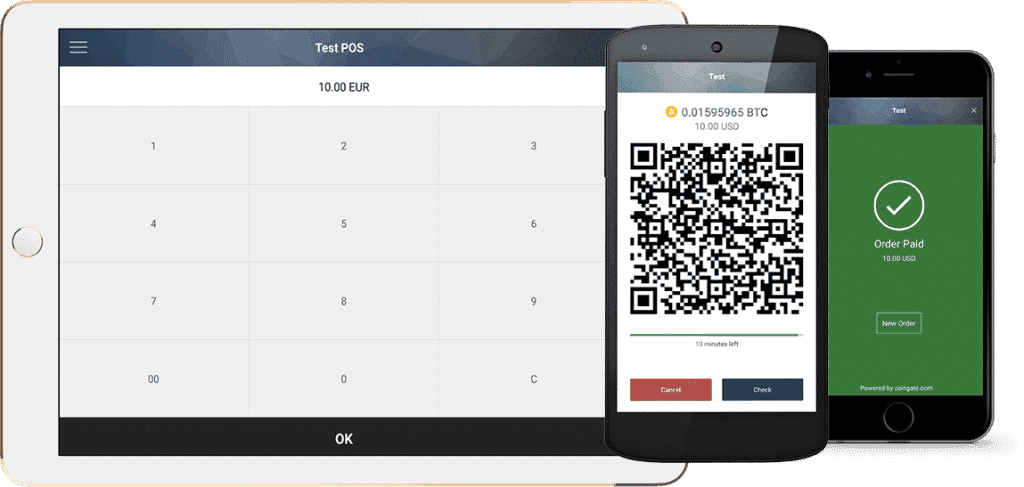

POS solutions: Yes, mPos available

Mailorder processing: Yes, QuickPos available

Coinpayments – Widely Used Crypto Payment Gateways

Coinpayments is a wallet service platform and merchant payment solution that facilitates the trading, buying, and selling of cryptocurrencies. Like other crypto trading platforms, investors and speculators can use this service which benefits from transacting and withdrawal and fees that are charged on deposits. We read a Coinpayments review or two and found no serious complaints about them

Coinpayments fees are 0.5% on every transaction and accept around 130 unique cryptocurrencies. Mind you, you will pay more than 0.5% as the conversion plus the volatility risk is on your side of things. The payment platform was developed in Canada and has over 718,000 vendors in over 182 countries internationally.

Features:

- Vault: Coinpayment allows users to lock their coins inside the system’s vault. The vault works by giving the user a set amount of time before they can spend their coins. The maximum wait period is 56 hours. Coinpayments vault acts as a security feature because the funds can’t be taken out immediately in the event of a hack.

- PayByName: This Feature is used to store important information about each user. It’s similar to fingerprint technology where it collects fingerprints to decipher the unique characteristics of each user. It creates a unique tag so that the user can receive payments from all crypto coins.

- Fiat Settlements: UK and US users are able to have fiat settlements sent to their bank accounts.

Pro Coinpayments

- Small transaction fees on first sight

- Supports multiple countries.

- Available in multiple languages.

- Many coins/tokens available as a payment method

- Feature-rich back-office

- PayByName Feature

Contra CoinPayments

- Transactions can be a bit slower than usual

- We found reports by users losing their Ripple assets with CoinPayments (not verified).

- No Spot Conversion

- Hidden fees

- Outdated design

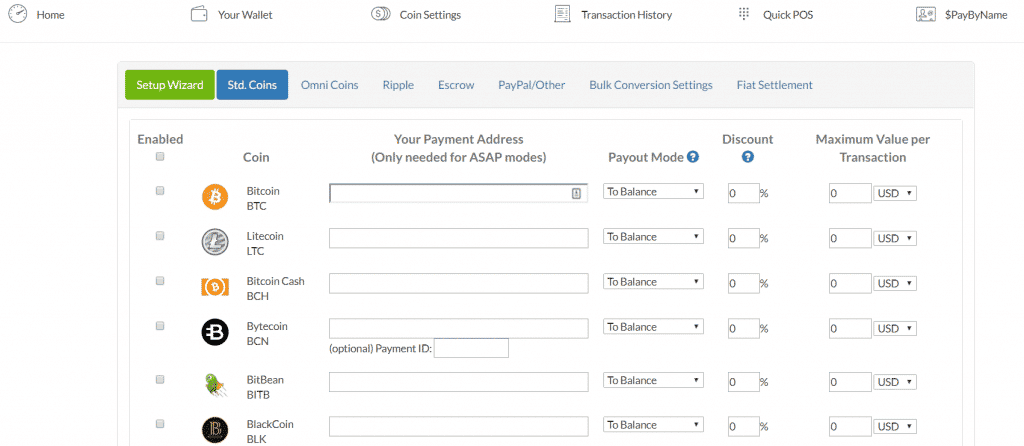

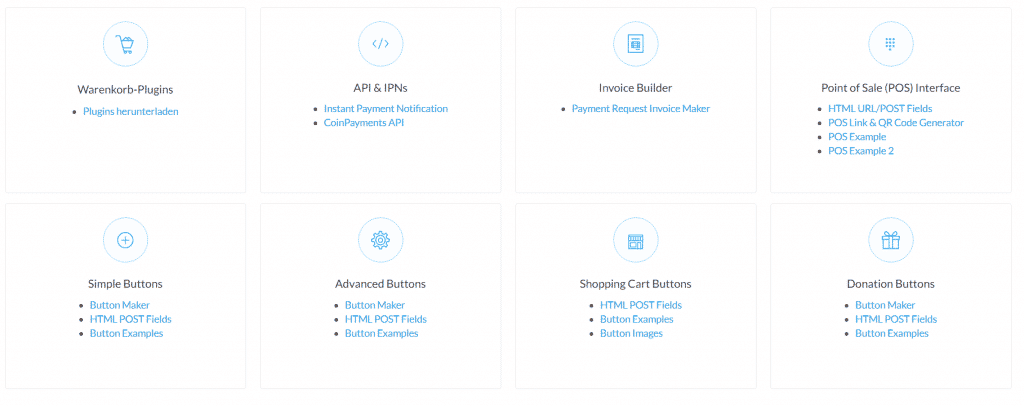

Coinpayments is a payment provider for those who want many features. The back office is full of options, however with many options comes also confusion for newbies, you have to find your way in. They have some quite unique features like $PayByName which let you create a handle for transactions. It is easy to find out how to use CoinPayments and how to withdraw from Coinpayments. Furthermore, they have their own ICO listing directory and a public, assorted directory of sellers that make use of Coinpayments. The support is very helpful and the system is secure and allows you to accept any payment through its unique address system. Here are some screenshots of their backend:

While it might have some issues due to the latest Ripple hack, the company released a statement saying that they have patched the issue. Thus, you should use Coinpayments if you want an active and reliable service that allows you to trade cryptos while also solving bugs and problems. It is one of the most used crypto payment providers and pretty convenient and easy to use and to integrate into most of the stores. The only question one has to ask is if you should really need to accept each and every shitcoin because most of them are available with them. Less is sometimes more.

Website

Company from Vancouver, Canada

Available shopping cart plugins:

- Drupal

- Magento

- Opencart

- Oscommerce

- Prestashop

- Woocommerce

- WP eCommerce

- Übercart

- xCart

- ZenCart

Fees: 0.5% fee on every transaction

Coins/Tokens accepted: around 200 cryptocurrencies (unique!)

Withdrawals in Fiat: Yes, with Coinbase/Coinmotion bridge

ID Verification process: none – however Fiat conversions will need one

Back office, Features, Settings: Feature-rich, with many smart solutions and automation options

API/IPN: Yes

POS solutions: Yes, mPos is available

Mailorder processing: Yes, QuickPos is available

Coingate – Exchange and Crypto Payment Gateways

What makes Coingate interesting is that they provide two services, as they are exchange and a crypto payment gateway.

First, they give merchant services for small to large businesses that accept Bitcoin. And, they have a transfer service for people that want to buy, trade, and sell cryptocurrencies on its platform. It charges a 1% fee for each transaction when trading on Coingate.

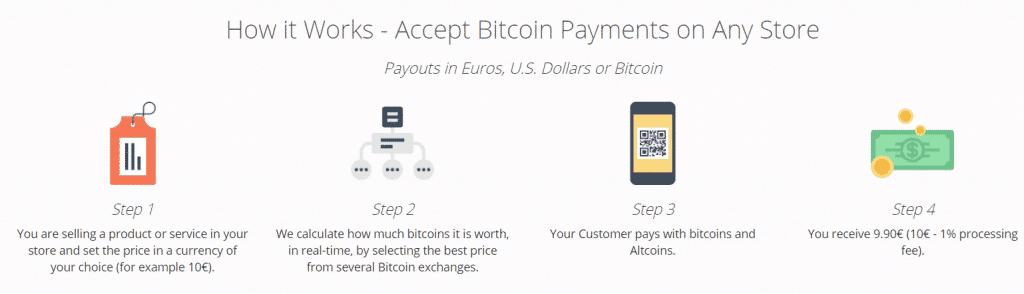

This comes in handy as it gives the service the needed liquidity on one hand and makes it easy to convert to fiat currencies on the other. Here is the process with Coingate as crypto payment provider:

Features:

- 24 Hour Withdrawal: CoinGate has a 24-hour withdrawal for crypto transactions. This is great for merchants who want to get their assets faster than other payment providers or need a quick withdrawal for liquidity reasons.

- Altcoin Functionality: Coingate is able to support over 50 altcoins within its network. For first time investors trying to find a good crypto payment provider, this platform will help you obtain the great cryptocurrency pairs that you need. They make us of direct integration of shapeshift to offer most of the altcoins.

- The best solution for multiple POS: From all checked crypto payment gateways, Coingate offered the best solutions when it comes to POS Apps so that you can accept cryptos in your store with a simple iPad.

- Security: With Coingate, you have high-level protection with a 2FA with Google Authenticator. This makes it easier for users to hold their assets without the fear of becoming hacked securely.

Pro Coingate

- Simple registration process

- Multiple shopping cart plugins

- Fast withdrawals

- Shapeshift integration, therefore many tokens/coins

- Great POS modules for local stores

Contra Coingate

- Not accepted in the US

- An onerous merchant verification system

- No Spot Conversion

- Hidden fees

Overall, we believe that CoinGate has the potential to be a great payment provider for crypto investors. It has a quick withdrawal rate, making it easier to get your assets after making your trade order. And you can use Google’s 2 Factor Authentication to ensure that your passwords are protected and only used by users. Thus, we suggest that you use CoinGate if you want a pure payment provider to get started with trading cryptocurrency, as it is an accessible entrance into the specific market of crypto payment providers. They also offer a streamlined process for Token Sale and ICO payment processing. The gathered funds can be withdrawn directly to a bank account. Their back-office is neat and tidy – you won’t run into problems finding a feature.

Website

Company from Vilnius, Lithuania

Available shopping cart plugins:

- Magento

- OpenCart

- osCommerce

- PrestaShop

- VirtueMart

- WordPress

- Zen Cart

Fees: 1% flat fee on every transaction

Coins/Tokens accepted: Bitcoin (incl. LN) and Litecoin. plus around 50 altcoins via shapeshift integration

Withdrawals in Fiat: Yes, in USD, EUR and BTC (with their exchange)

ID Verification process: Yes, extensive

Back office, Features, Settings: Incredibly feature-rich, full of smart solutions and automation options

API/IPN: Yes

POS solutions: Yes, POS Apps are available for Android and iOS

Crypto Payment Gateways: Coinbase

Coinbase is the world’s largest Bitcoin exchange. Besides from buying Bitcoin, Litecoin, Ethereum and BitcoinnCash with this platform, you can also use Coinbase to accept Bitcoin payments. As a result, businesses and individuals use Coinbase as a simple way to receive payments with cryptocurrency.

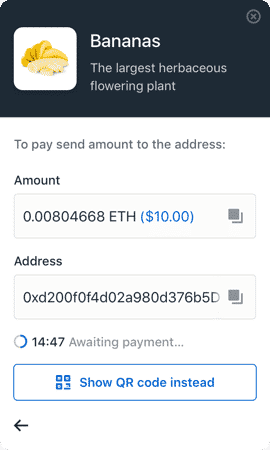

Their solution is quite simple and comes as an overlay or in kind of a widget. The website has a demo prepared for you so that you can see experience it yourself. The approach of Coinbase is not an advanced one, the website does not offer much of information, and shows only one plugin for Shopify – other e-commerce systems seem not to be available plugin-wise and must be integrated by API. A Coinbase checkout would look like this:

Pro Coinbase

- Most significant exchange with a good reputation.

- Insured Bitcoin deposit.

- A variety of fiat and withdrawal and deposit options (ex, bank accounts, credit card).

- Mobile and online wallet services.

- Elementary back office

Contra Coinbase

- Functionality very basic

- Only Shopify Plugin

- Few coins accepted

- No Spot Conversion

We suspect the Coinbase solution to be for smaller business or if you provide particular services to your audience and cannot see it widely accepted for the major shopping carts – not yet at least.

Features:

- Intuitive User Interface: Coinbase is known for its beautiful user interface. New crypto investors won’t have issues navigating through the platform.

- Recurring Transactions: Coinbase allows users to buy, sell or trade cryptocurrencies in a scheduled time on a recurring basis. This feature makes it easier for users to take advantage of low crypto prices and helps with investing.

- Coinbase Insurance: In addition to its high security, Coinbase provides up to $250,000 of insurance for US accounts. However, it doesn’t cover unauthorized user access to your accounts.

Coinbase might be a suitable option if you live in the US and want to accept cryptocurrencies for small business or freelance services.

Website

Company from USA

Available shopping cart plugins:

- Shopify

Fees: 0% flat fee on every transaction, but a 1% conversion fee.

Coins/Tokens accepted: Bitcoin, Litecoin, Ether and Bitcoin Cash

Withdrawals in Fiat: Yes, in USD, EUR and BTC (with their own exchange)

ID Verification process: Yes, extensive

Back office, Features, Settings: very basic, but also straightforward and beginner-friendly

API/IPN: Yes

POS solutions: No

BitPay

BitPay has gained enough worldwide exposure that it’s become a global Bitcoin payment provider. It works by regulating the payment process for sellers, buyers, and merchants. You can simply create a BitPay wallet and start making public transactions within its platform.

If you’re concerned about their fees, they charge 1% on every transaction. Sometimes, they can cost you higher if you have high-risk industries. Even though they do have fees, BitPay makes up for it with their automatic payment exception handling, multiple user login access, and email support. In fact, PayPal has partnered with BitPay. PayPal’s partnership with BitPay was regarded as an essential and significant development for cryptocurrency.

Features:

- Multiple Accounts: BitPay allows users to create multiple accounts with one wallet. This enables users to create multiple accounts for personal and business when using BitPay to trade cryptocurrency.

- Open Source Project: BitPay’s wallet and the server is open for users, making it easier for developers to create innovative additions to the platform.

- BitPay Card: Another unique feature is there BitPay card which acts as a cryptocurrency Visa card. You’ll be able to transfer your fiat and cryptocurrency assets through using this card.

Pro BitPay

- Configurable. BitPay allows users to set their own callback location which, is routed to the users after payment.

- Simple callback function.

- It has a professional appearance. They have a “Click to Pay” button that’s compatible most Bitcoin clients.

- BitPay Visa card.

Contra BitPay

- Login process can be a pain.

- Just a few coins accepted.

- Works only with a fraction of the available wallets (customers can purchase only with specific wallets)

- No Spot Conversion

BitPay is a source of freedom and security while giving investors a sense of anonymity. A company like BitPay that can handle your transactions might be the payment provider that you’re looking for.

Available shopping cart plugins:

- Shopify

- 3DCart

- Blesta

- NATs

- Foxycart

- ProsperCart

- Lemonstand

- Cydec

- MPA3

- E-GOV Link

- Bitmonet

- WHMCS

- MagentoEcwid

- Gravity Forms

- Membership Pro

- OpenCart

- OScommerce

- PrestaShop

- Drupal Commerce

- Spree Commerce

- Ubercart

- Virtue Mart

- WooCommerce

- WordPress eCommerce

- Xcart

- Zen Cart

- commerce:SEO

Fees: 1% flat fee on every transaction, but higher fees for high-risk industries

Coins/Tokens accepted: Bitcoin, Bitcoin Cash

Withdrawals in Fiat: Yes, in 240 currencies

ID Verification process: Yes, extensive

Back office, Features, Settings: Beginner-friendly and feature-rich

API/IPN: Yes, REST API

POS solutions: yes

| Payment Provider | Fees | Coins/Tokens | Back Office | Plugins | POS Solution |

|---|---|---|---|---|---|

| BitPay | 1% | Bitcoin, Bitcoin Cash | Very good – feature-rich and easy to use | Very much carts available, even niche store scripts | Yes |

| Coinbase | 0%, 1% conversion fee | BTC, ETH, LTC & BCH only | Very simple | Only shopify | No |

| Coingate | 1% | Major coins + 50 altcoins with shapeshift integration | Easy but basic | Major carts covered | Best solution |

| CoinPayments | 0.5% | More than 130 Coins and Tokens | Feature-rich and easy to use | Most important shopping cart systems covered | Yes |

Crypto Payment Gateways in conclusion…

No matter what crypto payment provider you choose, you have to make sure that they’re legally accepted in your country. Doing so will give you the ability to trade freely while also giving you a great platform to trade crypto amongst your peers and merchants. Ultimately, start using one of these platforms so that you can get started on your crypto investment journey today.

You have to look at cryptocurrency as a long-term asset to your business. While its value is volatile, its always going to be accepted in areas around the world. So it’s best for you to start allowing it so that you can obtain your profits faster, take more customers, and potentially grow your business. Give Crypto Payment Providers a shot!

Cool, I liked it! 😉

I absolutely agree with you. There is something about that, and I think it’s a good idea.

I recommend https://paycoiner.com/ from my own experience. They have the lowest fee from available operators, straightforward to implement, and they support 18 cryptocurrencies and add new ones all the time.