This post is also available in:

![]() Português

Português

Global Crypto Adoption Index Overview

People worldwide are increasingly adopting cryptocurrency. Their motivation? Better access to financial services. They seek more control over their money. Plus, they’re exploring new investment avenues. It’s a more straightforward, affordable alternative to traditional banking, knocking down barriers like hefty fees and tedious paperwork.

The 2025 Geography of Crypto Report by Chainalysis shows how far global crypto adoption has come, and how fast it keeps evolving. This year’s index covers 151 countries and reveals a shift where both developing and advanced economies are embracing crypto for real-world use. The report shifts focus from countries with high transaction volumes, often richer and bigger nations. It highlights areas where ordinary people use crypto extensively. This approach provides a clearer view of the worldwide crypto scene. It shows how digital currencies integrate into daily financial practices globally.

Asia-Pacific dominates the charts once again. India leads the world in adoption, while the United States secures second place thanks to a wave of institutional growth and ETF-driven investment. Latin America and Africa follow closely, proving that crypto is no longer a niche; it’s part of daily life.

Crypto Exchanges are key to this change. They simplify buying and selling cryptocurrencies. These platforms cater to various needs. Gradually, they’re becoming part of daily life.

Table of Contents (click to expand)

Content:

- Global Crypto Adoption Index Overview

- The Top 10 Countries in Global Crypto Adoption 2025

- 1. India: The Global Leader in Global Crypto Adoption

- 2. United States: The Institutional Powerhouse

- 3. Pakistan: Crypto for Everyday Survival

- 4. Vietnam: Crypto in Everyday Life

- 5. Brazil: Latin America’s Crypto Giant

- 6. Nigeria: Africa’s Crypto Engine

- 7. Indonesia: Innovation Meets Inclusion

- 8. Ukraine: Crypto Resilience Amid Crisis

- 9. Philippines: Crypto as a Lifestyle

- 10. Russia: Europe’s DeFi Giant

- Bonus: countries ranked 11 to 20 in Global Crypto Adoption Index 2025

- Regional Insights: Where Crypto Adoption Is Rising Fast

- Why Stablecoins Are Taking Over

- FINAL THOUGHTS

- FAQ

- You may also like:

How the Global Crypto Adoption Index Is Calculated

Chainalysis builds the Global Crypto Adoption Index on four key sub-indices. It measures the on-chain crypto value that users in each country send or receive, both retail and institutional, across centralized exchanges and DeFi platforms.

The 2025 report made two major updates. The retail DeFi sub-index was removed because DeFi is now dominated by professional users, not small-scale traders. In its place, a new institutional activity sub-index was added. This change reflects how traditional investors, banks, and ETFs now form a large part of the market.

Together, these changes create a fairer, more balanced picture of true global adoption from daily retail use to billion-dollar transfers handled by institutions.

The Top 10 Countries in Global Crypto Adoption 2025

The 2025 Geography of Crypto Report further emphasizes this trend: in countries with unstable currencies, economic conditions, or restricted regulations, there’s a marked increase in grassroots crypto adoption. People turn to these digital assets as a safeguard against inflation and to mitigate the uncertainties prevalent in their markets. Check the top 10 out of the 151 countries:

1. India: The Global Leader in Global Crypto Adoption

India holds the number one position for the third year in a row. It ranks first in every category: retail, institutional, DeFi, and centralized exchange activity. A young, digital-native population, widespread smartphone access, and a booming fintech sector drive India’s leadership. Crypto integrates seamlessly with tools like the Unified Payments Interface (UPI), bridging fiat and blockchain transactions effortlessly. Local organizations such as the Bharat Web3 Association promote education and regulation, helping crypto mature responsibly. India isn’t just adopting crypto, it’s shaping the global digital economy.

2. United States: The Institutional Powerhouse

The United States takes second place and stands out for its institutional dominance. Following the approval of multiple Bitcoin ETFs and new clarity from regulators, the U.S. attracted enormous investment. American ETFs now manage over $120 billion in Bitcoin, while tokenized U.S. Treasuries surpassed $7 billion in 2025. The GENIUS Act established clear stablecoin rules, ensuring the dollar’s dominance even in digital form. Major financial firms like Visa, Mastercard, and Citi are integrating blockchain into payments, while retail adoption continues through platforms like Coinbase and Cash App. The result is a powerful blend of innovation, regulation, and mainstream finance.

3. Pakistan: Crypto for Everyday Survival

Pakistan’s crypto use is driven by necessity. With limited access to global banking and a volatile currency, millions rely on stablecoins for remittances and savings. Freelancers, small businesses, and families use USDT and USDC daily. For many, it’s the only stable financial option available. Pakistan’s large diaspora also supports its crypto economy by sending digital remittances home. The government’s shift toward regulation rather than restriction has helped growth continue. Pakistan demonstrates how crypto can empower populations underserved by traditional finance.

4. Vietnam: Crypto in Everyday Life

Vietnam combines innovation with utility. Crypto is used for gaming, remittances, online payments, and digital savings. Millions of Vietnamese treat blockchain as part of their normal financial routine. The local gaming industry has played a huge role in driving mass adoption, while remittance services rely on stablecoins for cross-border efficiency. DeFi usage remains strong, showing that Vietnamese users understand both the risks and opportunities of decentralized finance. In Vietnam, crypto is not just an investment; it’s an essential financial tool.

5. Brazil: Latin America’s Crypto Giant

Brazil remains Latin America’s undisputed leader. It ranks fifth globally, driven by more than $318 billion in transaction value. Over 90% of Brazilian crypto activity involves stablecoins. Citizens use them to hedge against inflation, send money abroad, and participate in digital trade. The country’s Virtual Assets Law and central bank oversight have brought regulatory confidence and institutional investment. Banks like Itaú and fintech giants like Nubank and Mercado Pago now offer crypto services directly. Brazil’s mix of strong regulation, large retail activity, and innovative payment systems makes it a model for the region.

6. Nigeria: Africa’s Crypto Engine

Nigeria is the heartbeat of African crypto adoption. It ranks sixth globally and first in Sub-Saharan Africa. The country processed over $92 billion in crypto transactions in 2025. Bitcoin and USDT dominate as citizens turn to digital assets to protect themselves from inflation and foreign exchange limits. Beyond retail, Nigeria’s institutional crypto activity is growing. Stablecoins are used for trade between Africa, Asia, and the Middle East, proving crypto’s strength as a cross-border payment tool.

7. Indonesia: Innovation Meets Inclusion

Indonesia continues to climb the ranks thanks to its balanced ecosystem of retail and institutional users. It’s a nation where crypto connects millions of people to financial systems previously out of reach. Small businesses use stablecoins for e-commerce and imports, while DeFi projects attract tech-savvy investors. The government’s regulatory approach is supportive, focusing on licensing exchanges and protecting consumers. Indonesia’s success shows that inclusion and innovation can grow together when regulation meets opportunity.

8. Ukraine: Crypto Resilience Amid Crisis

Ukraine’s crypto journey is one of resilience. Despite the ongoing conflict, crypto has become essential for citizens, charities, and businesses alike. Digital assets allow people to store value, move money across borders, and fund humanitarian aid. Adjusted for population, Ukraine actually ranks first in the world for crypto usage per capita. This makes Ukraine a symbol of how blockchain technology supports financial survival and transparency during instability.

9. Philippines: Crypto as a Lifestyle

In the Philippines, crypto is part of daily life. Millions use it for gaming, remittances, and digital commerce. Play-to-earn models and blockchain games have introduced younger generations to crypto naturally. Overseas workers send stablecoins home, and local apps make conversion to pesos instant and affordable. The result is a vibrant, community-driven crypto economy built around utility, not speculation. As education improves and regulations mature, the Philippines will likely climb even higher in the coming years.

10. Russia: Europe’s DeFi Giant

Russia closes the top ten with a powerful mix of DeFi innovation and institutional activity. With $379 billion in crypto transactions, it leads Europe by volume. Sanctions pushed the country to develop self-reliant crypto systems, including the ruble-backed A7A5 stablecoin used in trade. Large-scale transfers and DeFi participation have surged, reflecting the nation’s adaptation to geopolitical constraints. Despite its challenges, Russia remains a major player in the blockchain economy, showing that crypto thrives even in restricted environments.

Bonus: countries ranked 11 to 20 in Global Crypto Adoption Index 2025

Beyond the top 10 global crypto adoption, the Chainalysis 2025 Geography of Crypto Report reveals another wave of fast-rising nations. These countries show how crypto adoption is spreading beyond traditional hubs, driven by a mix of retail participation, institutional growth, and regional innovation. Each one adds a new layer to the global story of digital finance.

11. United Kingdom – Strong institutional trading and growing DeFi interest keep the UK close to the top, despite stricter retail rules.

12. Ethiopia – A fast riser in Africa, using crypto for remittances and mobile banking inclusion.

13. Bangladesh – Steady retail use through mobile apps as users bypass traditional banking barriers.

14. Turkey – Massive volume driven by inflation hedging and speculative altcoin trading.

15. South Korea – Home to active traders and rising stablecoin demand for liquidity and hedging.

16. Yemen – Crypto fills the gap left by a fractured financial system, supporting essential payments.

17. Thailand – Expanding retail adoption and DeFi participation under a more transparent regulatory tone.

18. Venezuela – Stablecoins dominate daily use amid economic instability and high inflation.

19. Japan – Rapid growth thanks to new stablecoin regulations and reduced crypto tax rates.

20. Argentina – Crypto remains a hedge against inflation, with strong adoption of USDT and Bitcoin for savings.

Regional Insights: Where Crypto Adoption Is Rising Fast

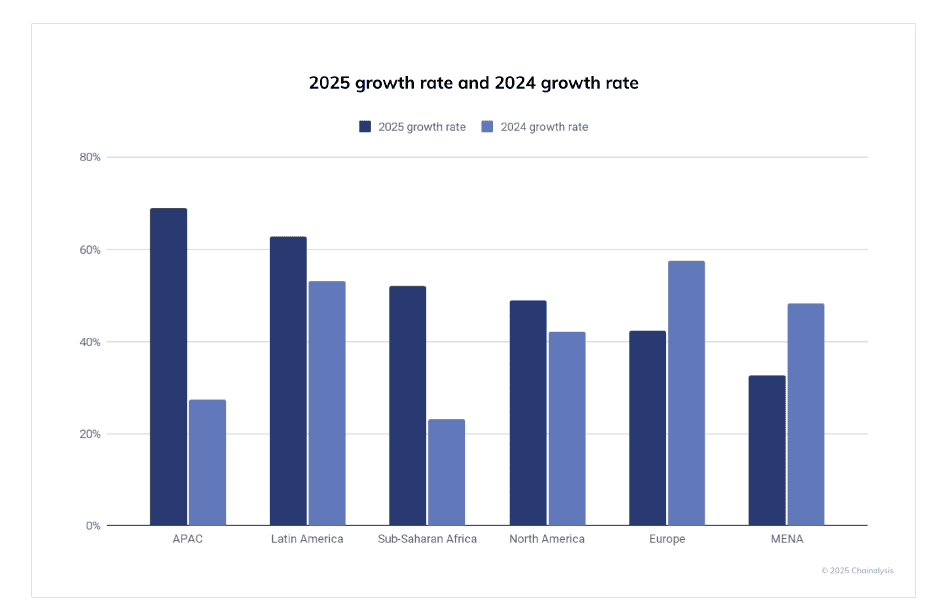

The 2025 Chainalysis Geography of Cryptocurrency Report confirms that global adoption is expanding across every income level. Asia-Pacific (APAC) leads with a remarkable 69% increase in transaction value, rising from $1.4 trillion to $2.36 trillion. India, Vietnam, and Pakistan continue to dominate, blending retail innovation with institutional inflows. The region’s strength lies in its diversity — from India’s remittance-driven use to South Korea’s professional trading culture.

Latin America follows with 63% growth, anchored by Brazil’s $318 billion in crypto volume. Stablecoins now make up over 90% of the region’s activity, helping users protect savings from inflation and currency devaluation. Meanwhile, Sub-Saharan Africa posts 52% growth, powered by Nigeria’s $92 billion market. Here, crypto meets necessity: mobile-first payments and stablecoins fill the gaps left by limited banking access.

North America and Europe remain institutional giants, processing more than $4.8 trillion in value combined. North America’s 49% growth reflects strong ETF and tokenized asset inflows, while Europe’s 42% surge is supported by MiCA regulation and the rise of the euro-backed EURC. Together, these regions show a new balance between retail utility and institutional strength, a dual engine driving the next wave of global adoption.

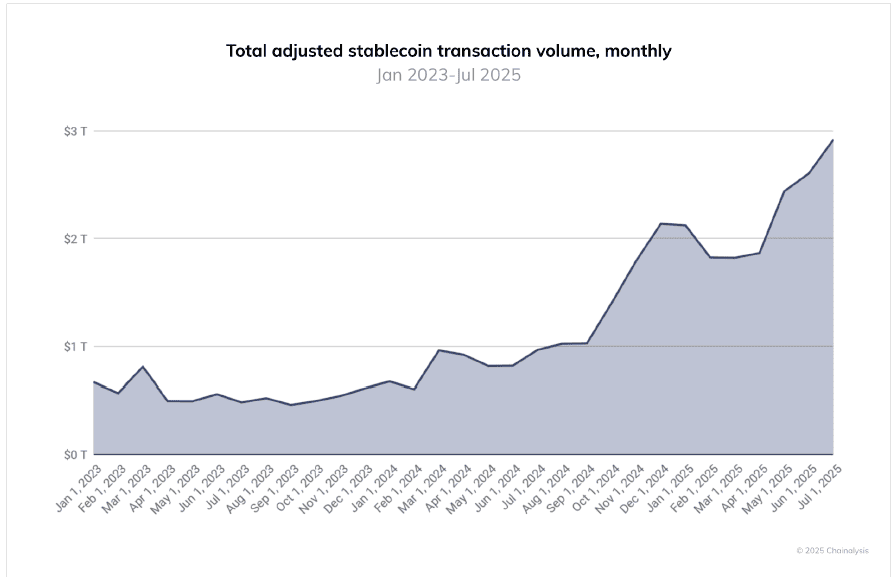

Why Stablecoins Are Taking Over

Stablecoins are now the backbone of the crypto economy. In 2025, USDT and USDC processed over $700 billion monthly, with USDT peaking above $1 trillion. They’ve become the preferred medium for payments, trade, and remittances, bridging traditional finance and digital ecosystems worldwide. Their role extends far beyond trading; they are the global settlement layer of the new internet economy.

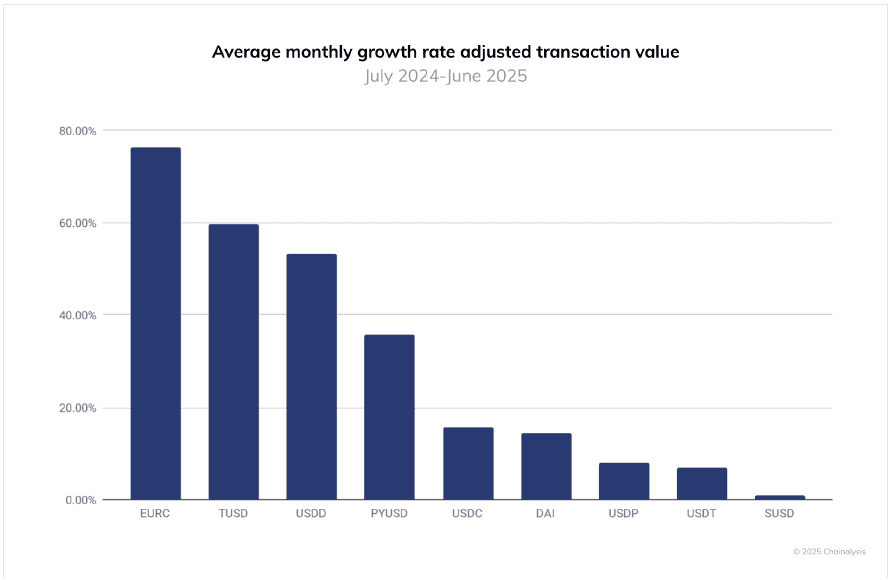

New entrants like EURC, PYUSD, and DAI are rapidly growing, reshaping how digital money works across borders. EURC surged 2,700% year-over-year, thanks to MiCA’s clear framework, while PYUSD climbed to $4.8 billion monthly. These numbers reveal a shift toward regulated, transparent stablecoins: digital assets trusted by institutions and individuals alike.

Major financial players like Visa, Mastercard, and Stripe now integrate stablecoin payments directly, while banks such as Citi and Bank of America explore launching their own tokens. In emerging markets, stablecoins act as lifelines against inflation; in developed economies, they enable instant, low-cost transactions. To explore which stablecoins have real potential, check our guide: The Top 5 Stablecoins to Invest. It breaks down where safety and growth align best in today’s evolving market.

FINAL THOUGHTS

The 2025 Global Crypto Adoption Index confirms what traders and investors already sense how crypto has matured. It’s no longer an alternative. It’s an integrated layer of global finance. This evolution is visible everywhere:

- In India, where blockchain scales across payments and remittances.

- In the United States, where ETFs and tokenized assets tie crypto to Wall Street.

- In Brazil and Nigeria, where stablecoins are daily currencies.

- In Europe, where EURC and MiCA compliance are reshaping finance.

The Chainalysis data shows that adoption now transcends speculation. It’s about resilience, efficiency, and access. Crypto has become a bridge between economies, not a bubble floating above them. Beyond trading, crypto’s integration into real-world use cases, from invoicing to settlement, marks the next phase of evolution. For example, digital assets are revolutionizing how businesses get paid, as detailed in Crypto Invoice Payments Made Easy – Ultimate 2025 Guide.

As institutional investors and everyday users converge, the ecosystem grows deeper roots. This transition connects perfectly with the reflections in How Crypto Shapes Experiences Outside the Scope of Finance. This transformation reveals a broader truth: crypto is not only changing how money moves but how trust, transparency, and opportunity flow across borders. The future of finance isn’t coming; it’s already here, one transaction at a time.

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do so Your writing taste has been amazed me Thanks quite nice post

Hello Leatha, We appreciate that you liked the post. We have every month new posts like this that you can also enjoy the reading and learn. You can subscribe to our newsletter and receive them first. You can also navigate our website and discover many other posts that you can like. Thanks for reading it.