Table of Contents (click to expand)

Where are my bitcoins!

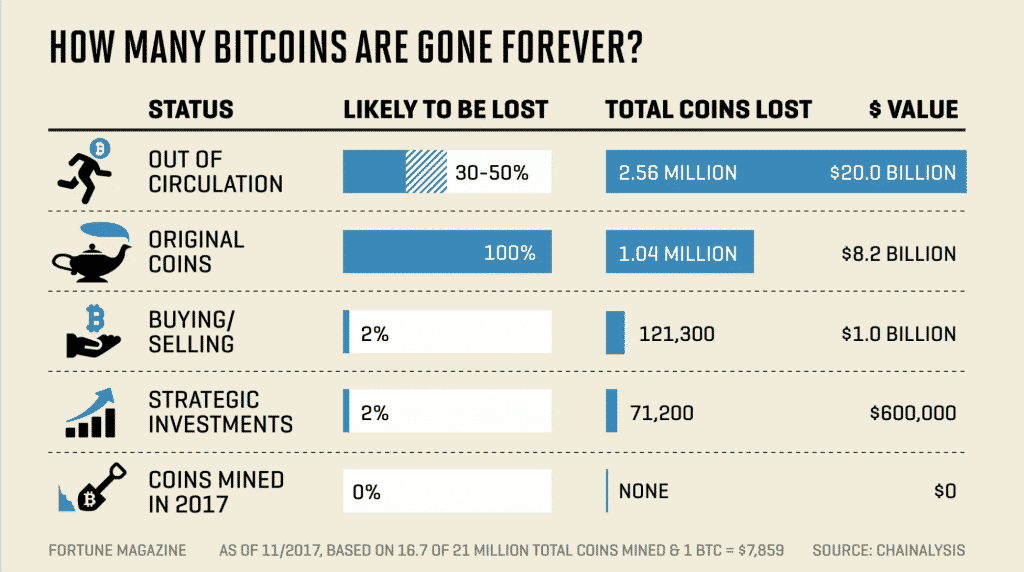

Noting a recent report by the wall street journal that cites around 20% of all the bitcoins created have been lost. Being this the case thus increasing the scarcity of bitcoin in the future and even possibly giving credence to very large upward price moves that many pundits have been expecting, due to the diminished supply of BTC. With the inherent nature of cryptocurrency being anonymous by design, many of these coins will likely never be recovered and further add to the value of future bitcoins prices. If ever there was a reason to FOMO, this is a big one…

As the above article states, a whole new industry has popped up trying to hunt down these lost/stolen coins, many cases it is a futile effort such as the one where it is calculated that bitcoin’s inventor, Satoshi, has 1,041,715 bitcoins that are gone for good. Another example is the man who threw away a hard drive & Key containing over 7,500 bitcoins. Many cases of these lost/misplaced wallets & accounts have been cited as diminishing the overall supply of bitcoin and thus creating an increased time compression for future rising BTC prices.

Due to the nature of transactions alone, more bitcoins are expected to be lost, just like treasure ships sinking into the sea. The price analysis of Chainalysis’s metrics segregates the bitcoin supply based on age/transaction activity. They used various forms of statistical sampling to come up with a reflective summation of these lost coins. Many factors occur to conclude the diminishing supply going forward into the future.

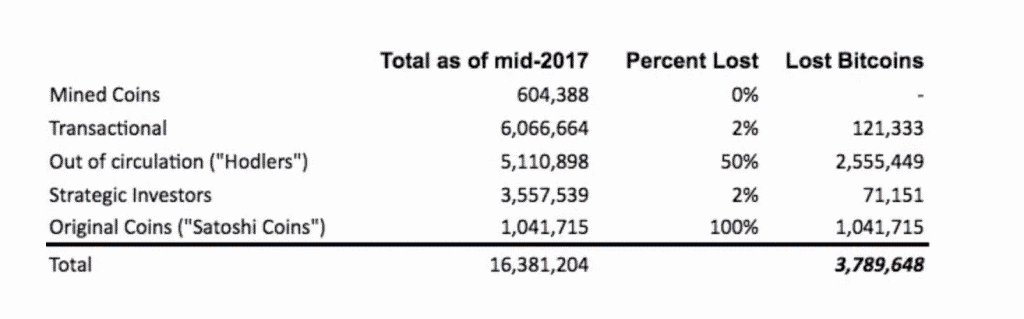

Chainalysis came away with some startling statistics for 2017 such as:

- Out of Circulation {“Hodlers”} between 2009-2010 50% Lost = 2,555,449

- Original Coins {“Satoshi Coins”} 100% Lost = 1,041,715

- Transactional 2% Lost = 121,333

- Strategic Investors 2% Lost = 71,151

- Mined Coins 0% Lost

A lost understanding of the lost coins.

One thing not noted in any of the articles/analysis by the wall street journal or Chainalysis would be the future impact upon Bitcoin prices. Scarcity is a prime reason in exaggerated upward price movements for all crypto coins. BTC’s case being it is #1 in market share dynamics could easily lead to some real exaggerations in the years ahead. Lots of future price data/Analysis has not taken into account the missing 1/5th of all Bitcoins. Adding to a positive time compression ahead.

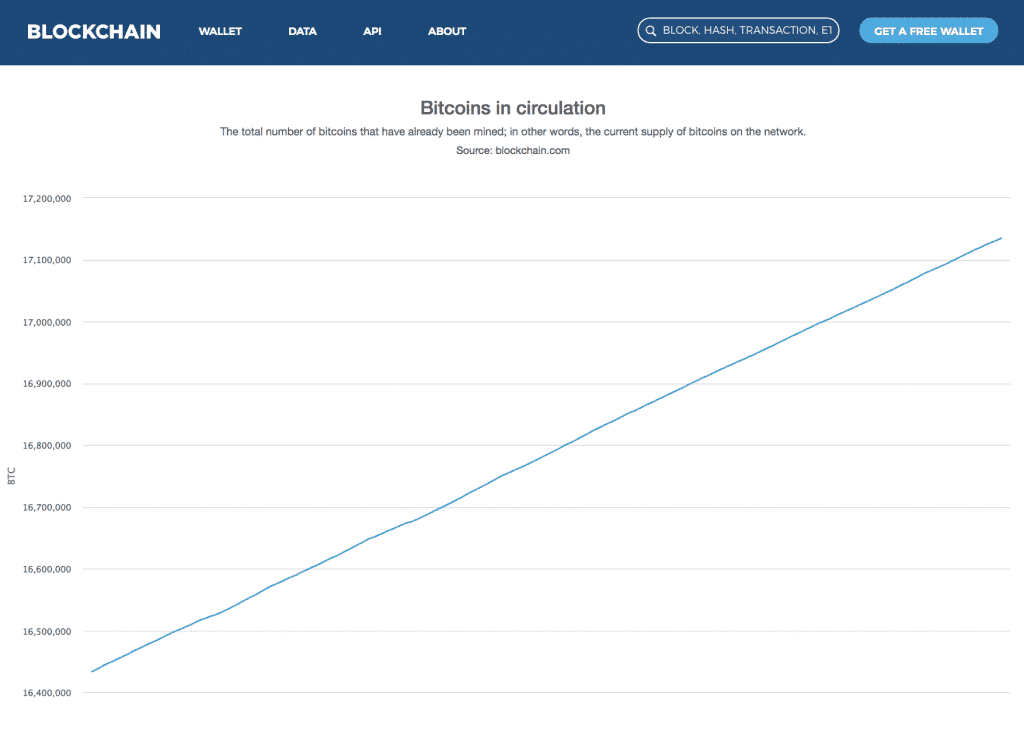

Miners conundrum, as there are only around 4 million Bitcoin left to mine the scarcity factor is set to rise at some point and become a constant reminder of the limited coins available in the future. Miners rewards get halved every 4 years increasing the scarcity and with it the likelihood of higher market prices. Since above 80% of all coins mined now this is set to start to creep into the thinking of most bitcoin enthusiasts to possibly cause FOMO panic buying sprees or die-hard hodlers.