On May 9, Terra’s UST stablecoin, which previously maintained a peg at 1:1 to the US Dollar, lost its peg. The next sequence of events triggered one of the most cloudy moments in the crypto industry.

The ‘stablecoin’ embarked on a downward spiral, sinking as low as $0.5086 — its all-time low. As this article will show, the UST de-peg — and the subsequent crash — should not have been a complete surprise. In this article, we unpack the key lessons that crypto enthusiasts and analysts must learn going forward.

However, before delving into the crux of the matter, it is important to note that stablecoins are not to be dismissed. A good number of them have genuine use cases as mediums for payments in the ecosystem. That said, the million-dollar question for this discourse remains: what are the lessons to be learnt from the UST crash?

Table of Contents (click to expand)

#1. Algorithmic stablecoins Like UST are susceptible to Harsh Market Conditions

Three of the top stablecoins, Binance USD, USDC, and Tether, are all backed by assets and not algorithmic. While bank balances and treasuries completely back the first two, Tether holds a variety of other assets such as cash, money market funds, commercial paper, and treasury bills.

Conversely, Terra UST is an algorithmic stablecoin, i.e. it uses arbitrage to maintain its peg to the dollar. Prior to the crash, Terraform Labs maintained its peg by burning $LUNA to create UST whenever UST’s price was too high, while UST was burnt to create $LUNA tokens when the UST price was low. The Terraform Labs carousel was spinning, and the user-generated enthusiasm in the ecosystem powered UST to overtake Binance USD in April, becoming the market’s third biggest stablecoin.

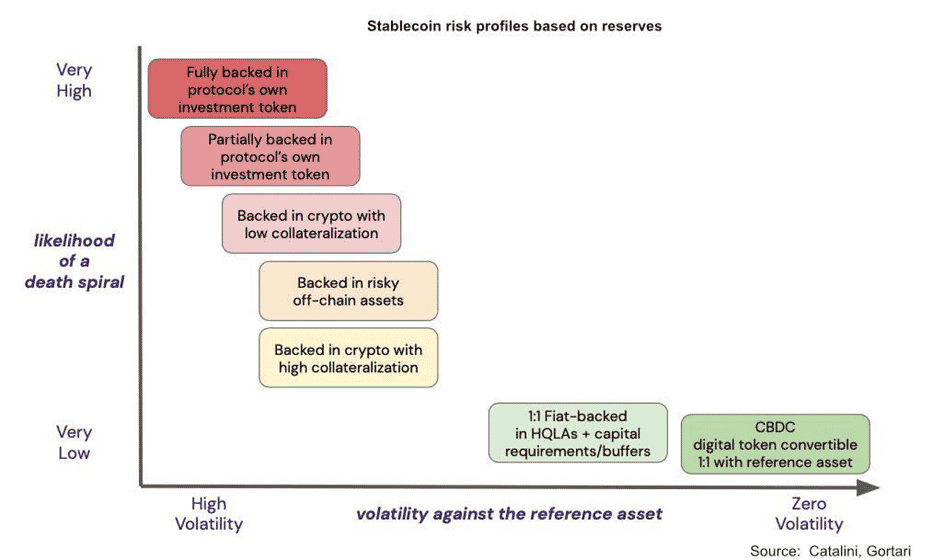

Only, the bubble was going to burst someday. Chris Catalini, a former economist at Diem, authored an article last year, explaining why algorithmic stablecoins and by extension, Terra UST, are always going to fail. As accurately predicted by Catalini, algorithmic stablecoins like UST are generally unlikely to withstand very harsh market conditions. That is what has happened to Terra UST, and although Terraform Labs and Do Kwon, its founder, has tried what Catalini describes as the solution — winding down the Terra balance — nothing has worked so far. Terra Labs is now trying to revive the $LUNA token by creating a new chain which will exclude UST, renaming the old Terra blockchain Terra Classic (LUNC) in the process.

Simply put, algorithmic stablecoins like UST are much more vulnerable to runs than asset-backed ones, more so if the native protocol tokens are involved in the price maintenance of these stablecoins.

#2. 19.5% Interest Rate was Ultimately too good to be true

Lending protocols in DeFi, like Aave, Maker, and Compound, operate both ways — borrowing and lending markets where market forces determine the prevailing interest rates. For the Terra/Luna blockchain, Anchor was the lending protocol, albeit with an artificial interest rate which ran up to 19.5%. This was an important reason for the increasing amount of the UST stablecoins issued by the protocol, rather than any real use case within the ecosystem.

Three months ago, the Luna Foundation Guard (LFG) furnished Anchor with $450 million in grants to keep up interest payments to borrowers and lenders. At this point, worry among investors began to mount about Terra operating in similar fashion to a Ponzi, but since the market capitalization of UST and $LUNA’s price shot through the roof, there wasn’t much to be said. After all, you don’t fix what has no faults — at least not yet.

Responses to this grant proposal gave the first signal that the decision making in the protocol pointed to it being CeFi and not DeFi. One comment pointed out a $450 million outlay by anchor to a wallet. Suspiciously, this wallet didn’t seem to use the loan but paid a high interest rate nonetheless. The protocol dubbed this whale a “generous or irrational anonymous investor.”

These, and several events that followed, were key preludes to the debacle that soon followed.

Key lesson: if it looks too good to be true, it probably is.

#3. There must be more transparency and pseudonymity

Blockchain technology is revolutionary for, amongst other things, its transparency. However, cryptocurrency exchanges are opaque. Until the Luna Foundation Guard clarified what it did with its reserve in a series of tweets on May 16, everyone remained in the dark regarding what happened with much of the 80,394 $BTC in the LFG reserves. Thankfully, the LFG clarified that in the thread embedded below:

Worse still, CoinDesk reported earlier in May that Do Kwon, going by a pseudonym, was behind yet another algorithmic stablecoin known as Basis Cash. That, too, failed, and basis cash is worth barely $0.007 at press time. This points to the fact that track records of founders in the crypto space matter. This also points to the fact that members of the crypto space with fiduciary responsibilities to investors must be subject to stricter regulatory checks.

#4. Get Shelter Before the Storm

There have been various conspiracy theories circulating about crypto whales triggering the Terra crash. However, what is evident is that the numbers show that many saw the storm miles away, while the clouds were still forming. Evidence: UST dropped below $0.99 at around 5pm GMT on May 9. Prior to that, volumes began to pick up two days earlier at 11pm GMT and the value of UST dropped just below 99.5c three hours later.

Few hours after the latter event happened, OKX sent this message out to its users. This message stated it had redeemed rewards on Anchor Protocol for its users on May 8 at 2am. This was just before the UST depeg occurred. It bears repeating for everyone in crypto: sometimes if it looks like the storm is coming, it may come indeed. Get out before the stampede if possible.

#5. There will be more demand for algorithmic stablecoins

Despite the obvious risks with algorithmic stablecoins, the crypto ecosystem will continue in pursuit of them — or, in the worst-case scenario, demand for stablecoins backed by crypto assets, like DAI, will increase. This is simply because one of the pillar points of crypto adoption is decentralization, and fiat-backed stables remain centralized. It then follows naturally that distrust of traditional financial institutions among many will lead them to shun these fiat-backed stablecoins.

As central banks continue to promote their digital currencies, the sentiment for ‘decentralized’ stablecoins is likely to increase. Although CBDCs are more secure, they do not offer anonymity while transacting. And although the argument that criminals prefer anonymity of cash for their nefarious activities persists, the truth also persists. This truth remains: millions in Africa and Asia who are under the purview of despotic regimes cannot be too grateful for the anonymity of cash that DeFi provides them.

Conclusion

The jury is out — as it has always been — against the crypto community. Doubters are doubting, the feds are squeezing the knobs of regulation, and many are stuck in extreme fear. But what remains true is that despite the dip in confidence that this crash has caused, the crypto community will be back stronger — as it has always been.