EEEK 50x – 100x! “But, but, but you told us to never use this kind of high leverage “- and yeah, it is still true, one should never exceed 10x in our opinion. However, there are times, like right now where the charts indicate a big breakout is due. The markets show strong signs of compressions and the longer this period is going on, the harder the move should be that follows. The bad thing is we have only clues in which direction this will play.

Let’s do a thought experiment how to play shorts and longs until the breakout happens and calculate the risks and returns. Don’t try this at home – this is just for demonstration purposes, to show how this Bitmex high leverage could be used for instead of against you.

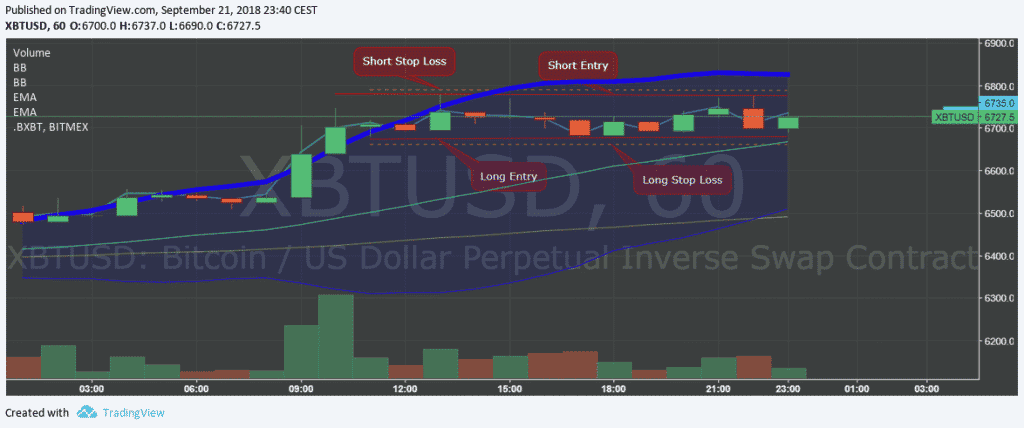

First of all – we remind ourselves to use this kind of high leverage 50x-100x only in this special case – and nowhere else. In times of indecision, we often see those dojis without any particular direction for a longer timeframe. These kinds of charts look like the following:

This is played on the hourly chart and we want to exploit the tight range of the indecisive sideway movement. 50x to 100x is dangerous!

Things to check before:

- No major news expected (like ETF decision).

- The Bollinger Bands are yet wide and have no tightening slope.

- The Bollinger Bands should be parallel.

- This should be traded on a pair with volume, as with low liquidity it is a risky thing.

Table of Contents (click to expand)

The process:

- We wait until we have at least four candles that appear as doji, starting to build that tight range we need. Keep it tight with 50x to 100x trades.

- We set up limit orders at the red lines: Short entries on the upper red line, with a stop loss just a few 10 points above, shown with the dotted yellow line. Long orders on the lower red line, with a stop loss just a few 10 points below, shown with the dotted yellow line. We use this method only with small amounts but with huge leverage here, otherwise, the profits would just not be worth it/notable. Both kinds of orders MUST be market orders, so we reduce the risk of getting burned and better our chances to get filled on the spikes.

- The trick is to have both orders of the same size of contracts. This way we don’t need the reduce only checkbox. So let’s say if the long trade from the lower red line gets activated, the upper red line (with the same amount of contracts) becomes automatically a take profit order as you will short the same amount of long contracts are touching it. Example: The lower red line gets touched and fills with 10k contracts. As we set up the same amount of contracts for the opposite direction, a sell order of 10k contracts is waiting on the upper red line already – once we reach it – jackpot. If you want to make sure to not get stopped out, you can also setup the sell order in the mean between the prices.

The beauty of this method is that we can play ping pong here. We just set up the orders in both ways and whatever happens, we can take some nice gains with us. NOTE: Once the Bollinger Bands start to narrow down, a breakout might happen at any time (more advanced addon method here would be to make use of a buy stop order (for a short position to actively exploit an upwards breakout – of course, versa vice as well – but this is for the pros). The immanent breakout danger forces us to close down all our orders immediately once the bands are tightening to reduce risk furtherly.

(Advanced Step/Optional) 4. If you think the breakout will be – for example – upwards, you could take 11k contracts against 10k contracts on the short side. This way 1k contracts would run further and you can take more profits with you.

Profit & Risk Calculation – Math time

Case 1: Short order

In this example, a short order might have been filled.

We short 50000 contracts for ~0.085 BTC at 6775 (Leverage 100x)

We take profit at 6680 and gain 0,1050 BTC with an ROE of 142.28%

If it would have gone wrong and we would have been stopped out at 6664:

We would take a loss of 0,0140 BTC with an ROE of -18.79% – Nice risk/reward ratio

Possible gains of 0.1050 BTC against a possible loss of 0.0140 BTC

Case 2: Long order

We buy 50000 contracts for ~0.0861 BTC at 6680 (Leverage 100x) (would not have hit in this example as the first wick was the longest)

We take profit at 6775 and gain 0,1080 BTC with an ROE of 144.29%

If it would have gone wrong and we would have been stopped out at 6670:

We would take a loss of -0,0115 BTC with an ROE of -15.36% – Nice risk/reward ratio

Possible gains of 0.1080 BTC against a possible loss of 0.0115 BTC

Imagine this method plays out very often as BTC is known for its wick action. More orders got active, but also more stops would prolly trigger. The only real risk of this method is that stop order might not get filled, which has never happened to us – but has been reported a few times from other users, hence the importance of market orders.

VCT showing what using good leverage is all about!