This post is also available in:

![]() Português

Português

Silver is sexually exploited

Silver manipulation = CRIME CRIME and more CRIME! This is how I would sum up JP Morgan’s operations, especially in the wake of the Covid 19 pandemic.

Table of Contents (click to expand)

- Silver is sexually exploited

- NEWS UPDATE 1/29/2021

- Silver Trade: The Journey So Far

- Silver’s Susceptibility to Suppression and Price Slides

- How is the Silver Price Manipulated?

- JP Morgan’s Alleged Price Manipulation

- Should You Invest in Silver?

- What allowed JP Morgan to corner the silver market?

- Here is what you will find from Koch and friends the Cato institute

- JP Morgan gives us all the middle finger as they buy Silver.

- In conclusion…

NEWS UPDATE 1/29/2021

Here comes the SILVER BUGS & WSB Short Sqeeze attack on JP Morgan and other institutions. Anger of the elites screwing over retail traders in big institutions has hit a tipping point. With recent trades on Gamestop/Dogecoin and now Silver!? The Reddit crew has much to say!

Yes silver the most manipulated asset is now being targeted by the Institution screwers. Can Wallstreetbets beat a JP Morgan or other banks? This could get interesting. Wallstreetbets wants Silver in the mid-twenty dollar range above $1,000 a troy ounce! Crazy man! Would love to see it!

Now do note that much of this RANT I am going on about here is of my own personal opinion and can be argued many ways, but who cares look at the cause/effect and numbers, as they don’t lie. Jamie Dimon can spin it any way he likes, obvious is obvious.

It has been a challenging year for the financial markets, to say the least, leading the world through a near recession phase – which doesn’t seem to be receding.

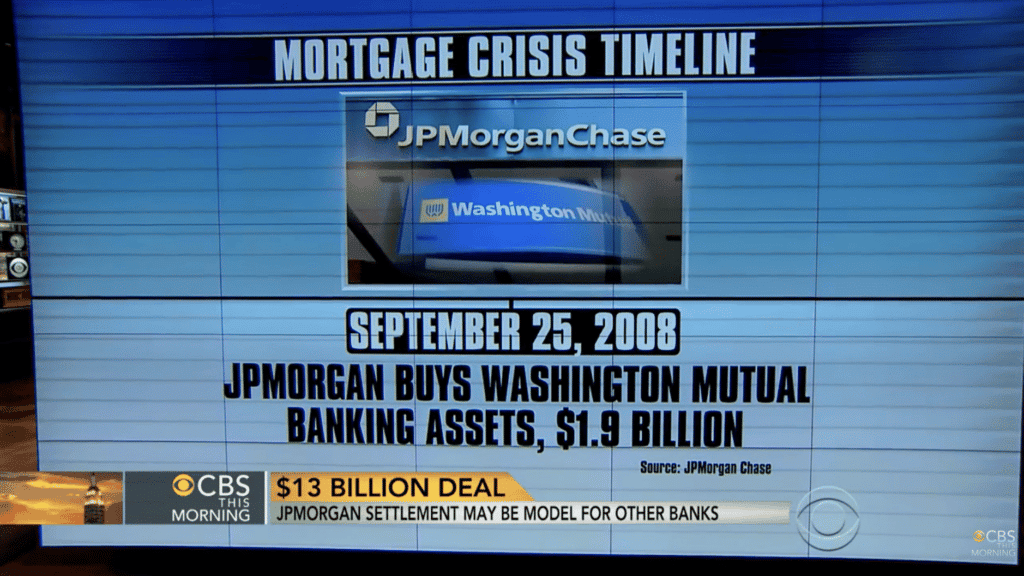

It also set governments and financial authorities towards reviewing several policies and investors moving to secure their holdings. As JP Morgan was able to gobble up all their competitors in the wake of the 2008-09 financial crisis of which they helped cause, this entity like

Amazon has become too big to fail and many should start to watch out for the “Monopoly Effect” this will have on our economies in the near future.

With the covid 19 crisis, there has been a surge in the precious metals market and a renewed interest in mid- and long-term trade of safe haven assets like gold and silver. However, one setback this market is the macro price manipulation of the metals markets by JP Morgan and the other market entities that suck their boots and follow their order flow in the marketplace, which causes for one giant sh*t show of which the government in the U.S. either is too stupid to understand or willfully ignores what is going on.

While the claims had not been legitimized, the recent spoofing probe of the global bank, JP Morgan, had called the attention of many to the possible manipulation of the market. This had also reinforced the idea that they might have been buying into a bubble.

For this article, we expound on the silver market and the resultant effect of price manipulation in the landscape.

Silver Trade: The Journey So Far

Silver is admittedly the oldest form of coinage and collectible that is mass-produced apart from gold. It was widely recognized as a store of value and set as a legal tender until it was discontinued.

However, the growth of silver in the market is fuelled by the simple laws demand and supply. It has been in high demand for applications in jewelry and other industrial purposes. It has an independence that makes it suitable as an alternative investment option and a hedge against tail risks.

The value of Silver has moved exponentially in the last few decades and has fought through periods of uncertainty to keep being relevant. Unlike gold, the price of silver is more volatile and susceptible to market manipulations, especially in the face of high economic risk.

Despite the uncertainty that swept through the financial markets due to the coronavirus pandemic, the silver value has been noted to hold its fort in the U.S. stock market.

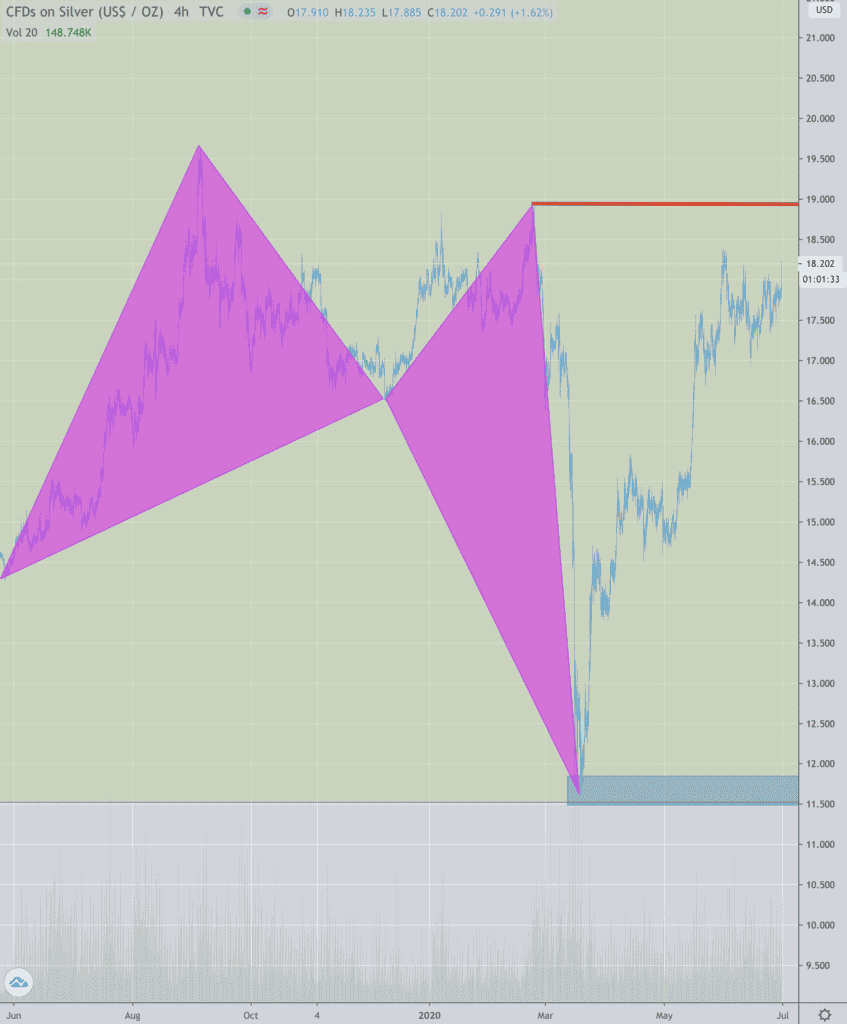

The market had experienced one of the worst stock sell-offs in mid-March, resulting in a decline in the prices of several assets and indices. S & P 500 fell 27% YTD, and May futures had dropped to about $12.34 per ounce of Silver.

The market had been projected to experience a 13% recovery from its two-year marginal losses. True to form, the metal had risen to $18.60 before crashing below the $12 mark. Though the price had stabilized at a $15 range, its price still fell 13% at the beginning of the year.

Silver’s Susceptibility to Suppression and Price Slides

Though like every metal and asset, silver is moved by market sentiments, it is an independent metal. This is so because its value is not tethered to any currency, and like gold, its prices are not subject to the U.S. government and Federal Reserve System control.

Its market is a global market with demands driving its price movements. The metal has a dual nature – which allows it to double as a monetary asset and commodity. While its nature highlights its suitability as a safe haven asset, the Silver appears to have not benefited from this due to the high industrial correlation.

Unlike gold, Silver has a base of its demands on industrial purposes. Towards the end of the first quarter of 2020, most industrial operations had slowed down due to the effects of the global pandemic.

Though questions had been raised about the result of the operational slowdown on the physical supply of the metal, more arguments and market sentiments had been placed on the industrial demand.

Reports indicate that nearly 60% of the total supply of silver is directed towards industrial use. This highlights the fact that the dwindling numbers in physical and industrial demand of silver are a prime reason for the price decline experienced – further buttressing price susceptibility to demand and supply.

It is worth noting that Silver’s place as a hedge or insurance against economic downturns makes it an excellent investment choice for portfolio diversification. This though, means that like gold, the price of silver is also influenced by real interest rates, the U.S. Dollar Index, and market sentiments or fear level.

Despite being a millennial metal, silver has a smaller market base than gold, and as such, liquidity is lesser. This makes the silver market tad more volatile and more susceptible to market manipulations.

Also, the futures market is admittedly one of the most dominant forces in price determination and trade of this metal. Price suppression is also subject to market makers like Goldman Sachs and JP Morgan.

However, due to the nature of the metal, this suppression is easily reversed.

How is the Silver Price Manipulated?

The discrepancies in current prices and projected prices mostly suggest a manipulation in place. Silver price is subject to market dynamics and movements primarily by the futures market players or commodity exchanges.

The manipulation occurs due to any of the following mechanisms or a combination:

- The placement of shorts in the futures market or naked shorts

- Spoofing is the placement and cancellation of fake orders placed.

- Rehypothecation- This entails placing the same ounce of silver as collateral for multiple loans and agreements.

- Tweaking and rigging of rules on commodity exchanges like the LBWA and COMEX: This usually entails settlements of futures contracts made in cash instead of the actual physical silver.

- Manipulative funding: this entails injecting false liquidity into the market by harnessing dark pools of money to fund trades in the market.

JP Morgan’s Alleged Price Manipulation

For years, the global financial markets have been awash with allegations of price manipulation for precious metals such as silver and gold, albeit with no legitimate backup. However, the recent probe of the financial institution, JP Morgan, expounded on these claims.

Six JP Morgan Chase and Co employees were accused of manipulating precious metals futures by the U.S. authorities. The bank had fallen under suspicion of spoofing thousands of gold and silver futures orders for its benefit and that of its premium hedge fund clients.

The accusation levied against the bank had led to a two-year probe by the US Justice Department and the Commodity Futures Trading Commissions (CFTC). The manipulation campaign had been to place orders on futures contracts and canceled them to mislead several market participants.

As mentioned above, one of the most critical aspects of the silver market is the Futures market, as well as the place of market makers. This aspect of silver trade takes advantage of the demand and supply of the metal to manipulate the price as they deem fit.

The bank had come under the radar of the U.S. authorities after an ex-trader of the bank’s precious metals confessed to a six-year spoofing scheme. The trader had stated that the price manipulation had taken place between 2009 and 2014 with the knowledge of superiors at the metal’s desk.

JP Morgan’s alleged price manipulation was done by the traders placing many orders on silver in the future market with no intention of following through with the contracts or executing the orders.

The plan is to inject false liquidity into the market and create a bubble to benefit their market position. With this, market participants without adequate fundamental knowledge of the silver market movers buy into this bubble and, in most cases, get stuck with limited exit.

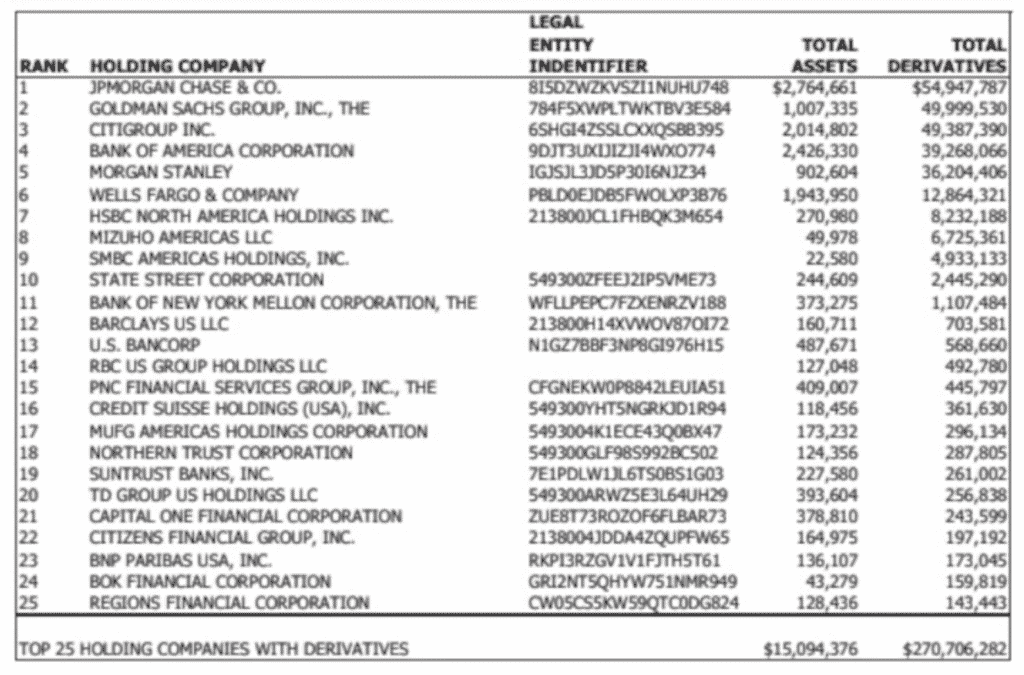

While JP Morgan has long been in the center of market manipulation allegations, several others were not left out. In 2015, about ten banks were also accused and brought under the radar of the U.S. financial authorities for metals and commodities manipulation.

HSBC Holdings, the Bank of Scotia, and the UBS group were reportedly involved in silver rates manipulation between 2007 and 2013.

Should You Invest in Silver?

Despite its susceptibility and the vulnerability of silver to manipulations, Silver appears to be the best fit for investors looking to hedge against market uncertainties, and especially now with the covid 19 pandemic and unknown effects of this further out.

Though there are significant concerns as to whether the suspension of mining and industrial activities could impede the supply of silver, experts believe that there are inventories that will accommodate global demand.

Despite the price of the metal and the upheavals in the market, analysts believe that buying silver is quite bright. Beliefs around the silver market highlight that price manipulation will soon be curtailed, and the market will see a positive shift.

However, while investing in silver could be lucrative in light of its place as a safe haven asset, it is essential to understand the fundamentals of the market movement and price determinants.

Signs are all over as we wrote of the likelihood of Warren Buffett buying Gold. A giant wave of inflation with the dollar printing machines going off the rails. We have printed nearly a quarter of all dollars in existence in 2020 alone! Scary stuff indeed…

JP Morgan views the U.S. government as a leech & cost of doing business.

This firm knows that the benefits of their criminal actions as most banks who continue to break the laws do, as a cost of doing business. With Trump’s tax cuts alone that benefit banks and allows them to easily absorb these fines as just minor business costs, even more than a few have been heard calling the government leeches that are not worth their time.

Macro price manipulation as a team sport being played by banks

The banks are working together as seen by the charts/statistics, the trades of JP Morgan you can think of as the team captain in this fraud laden activity they pursue and who is the victim of their activity, well their own clients, retail investors even the governments of the world, they set the prices they trigger the algos, they simply control the market and no matter how many fines they pay if they make many time more off these transactions, well they will keep doing them. It will not be until real criminal charges are faced by the leadership of these banks will they ever change their behavior.

“One ironic note is how during their hoarding of Silver and Gold, they had a policy of banning their own customers from storing silver, gold in safety deposit boxes and even requested customers to sell their holdings.” JP Morgan was all too willing to buy or should we say snatch the holdings of their own clients, disgusting behavior, this is how a bank is suppose to act now for the benefit of its customers! I think not…

What allowed JP Morgan to corner the silver market?

Back in the 90s when hedge funds and trading houses such as Merrill Lynch, Goldman Sachs and others in the hedgefund industry were making huge fees/incomes the bankers became very very jealous and wanted in on the action. This is where the “Monopoly Effect” of which I will talk about in future articles and the negative impacts it has on our society as a whole will come into play. Clinton started the ball rolling by allowing the repeal of the “Glass Steagall Act” and then coupled with the Bush deregulation and tax cuts, the public were sitting ducks for the bankers evil plans.

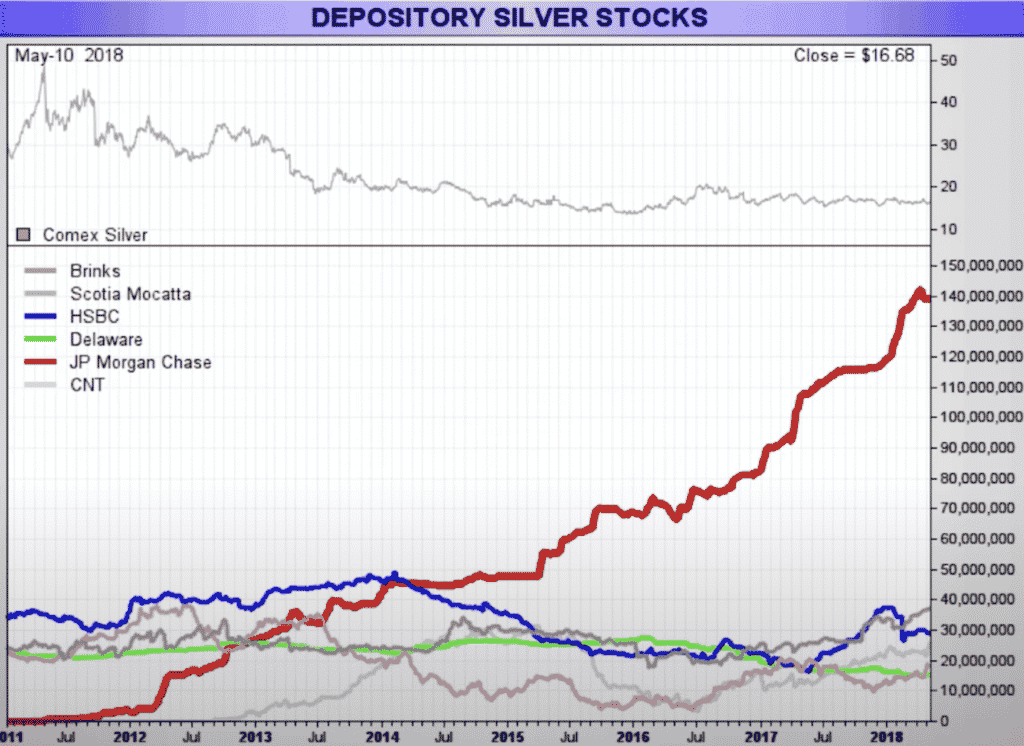

This is how JPmorgan was able to buy up and take over their previous competitors along with all their assets such as all of their silver holdings, giving them the power to corner the market.

‘JP Morgan now holds 133.1 million ounces of physical silver and the world record for most silver held under one name. Today, it also owns 50% of the world’s COMEX silver bullion.Jun 4, 2019”

The average person never thought of the quality of their lives being downgraded because of the sheer and absolute greed of the financial sector that now is as precise as a military operation upon the hollowed out remains of the middle to lower classes of western society. I want you to imagine you would be 2x to 5x better off/richer if it was not for the actions of these crooked parasites upon us all of which lead to the wide inequalities of the 1% and greater.

Bankers controlling the vast sums of wealth of not only the united states but the western world as well, we have the highest ever wealth inequality recorded and the negative effects are seen starting to bubble up with protesters and the echoes as the people realize just how screwed they are.

This is systematic, do you really think that the 2008-09 financial crisis was just a one off? Do you think the grand wealth transfer which cost many their homes/retirement savings and the like were not systematically transferred to an ever smaller organized group of individuals hiding in the shadows and filling the lobbies of Washington ever more in total control of the money spigot in this disgusting destruction of our society, Silver/Gold and other asset classes are just part of the big picture here.

The manipulation they enjoy today of where they set the prices in this cornered market will have a reckoning as normal everyday people simply won’t be able to afford much because the banks own your gold, silver, home, money and pretty much your lives. The silver market is the just the most obvious of ways JP Morgan and friends show us how the banking sector after the repeal of Glass Steagall and Bush deregulations allowed a whole pandora’s box of bad actors to steal the wealth from the average American and the untold effects on economies abroad.

Here is what you will find from Koch and friends the Cato institute

Koch brothers and many like them now control Washington with an iron fist even try to spin and rewrite history with their funding of the Cato institute that has this lovely manipulation of history trying to downplay the effects of the “Glass Steagall Act” and Bush deregulation which the Koch family and others were able to feed their wealth all while their systematic racism in Flint echoed on harming mainly black families with contaminated water in Michigan.

These are the friends and partners of JP Morgan and Gang, these are overseers of our society that destroy lives without retribution or penalty. Silver is just a glaring example of what they have been able to do with the governments help to harm our society and average American citizen, Jamie Dimon thinks of himself as a patriot ha! You and your kind are just parasites that lower the quality of life for the average American you feed off of in your parasitic feast. I would argue more deaths are caused by these individuals than even the covid 19 pandemic, they are just in the shadows hidden from view, hidden from the headlines and hidden from justice.

Cato trying to hide the fact of the Glass Steagall act protecting our society from what exactly happened that allowed for the ever-widening wealth inequality of our society and the ability for JP Morgan to corner the silver market as they continue to do.

JP Morgan gives us all the middle finger as they buy Silver.

Do you really think JP Morgan did not benefit on the price collapse/exaggeration which imo I bet if anybody in the government with oversight would investigate could easily find in JP Morgan’s trading of Silver how they were responsible for much of the exaggeration/effect of the above chart on the fall of silver to the $11 range and how they are now looking to profit off the long side in a GIANT COIL of which they will benefit, too big to fail after all!

see how these two articles tie in, don’t be surprised if SILVER HAS A MASSIVE up move in the future, after all Jamie Dimon and friends need to get paid 🙂

Bitcoin Risks Breaking $9k as JP Morgan warns of stock selloff

So they are short the stock market that fools like the FED/Trump are trying to push up knowing the coming effect of their disastrous economic policies as well very long the metals market. Again this is mostly my personal rant but the problem is the numbers don’t lie, even if people do and the numbers I show in the above happen to be very very true.

In conclusion…

The offset of the coming inflation is in all the charts, wonder if Trump knows that Jamie Dimon is in FU mode and bets Trump won’t get re-elected, I am sure he is 100% fine with that? Maybe somebody should tell Trump that Wall Street and the Smart Money are betting against him lol. Anyway as I see Silver going above 18 I can only laugh, at some point when the effects of JP Morgan and their billionaire friends who they work for come to roost, there will be a price to pay, just not likely for them as all of their corrupt behavior is paid for by the people, or should I say sheeple…

Kudos for a well-written piece! It’s rare to find such quality content that’s both informative and easy to digest.

I am not sure where you’re getting your info, but great topic.

Excellent blog post. Agree with the majority of the areas you point out. Getting excited about the news letter.

I saw the 2008 crash coming way ahead of time and as far as the silver gold manipulation goes that’s blatantly obvious if you have any education at all how could so be so cheap 10 years and longer and it being in shortage as well above-ground vs. Underground hairdos June 2021 we’ll see what lies come Christmas time take care of everybody watch your ass..ets☝️??

This was perfectly written and spot on !! You have your fingers on the pulse. Rarely I get to read exactly what very few know in regards to the antics of jobe Morgan and many other big banks . However a lot more people are waking up to this realization that theses banks been doing this for decades . The scumbags that they are and Jamie Simon chief in charge scum bag . Ten years ago I thought he was one of the good guys and best ceo around only second to jack Welch from he. Then I grew up and read voraciously and taught myself with reading lots of Ted butler and Ed steer and many others . Thousands as it seems videos on silver and precious metals. Anyways ranting also. In closing I would like to commend you for your very accurate account of what’s been going on in silver but all the big 4 precious metals. Thanks , jim