This post is also available in:

![]() Português

Português

3Comma’s Trading Bots & the Future of easy!

Is it safe or not to use automated trading bots? I can see you raise that eyebrow; normally, I would raise mine along with yours. Not in this case. We wrote about 3commas in the past and recommended their very versatile tool with a team of super-active developers. Now we write a 3commas review. But their recent addition is just great and needs a small introduction. We will show you how we use the recently published automated trading feature and how to best sleep tighter with your trades running.

Table of Contents (click to expand)

3Commas and patience

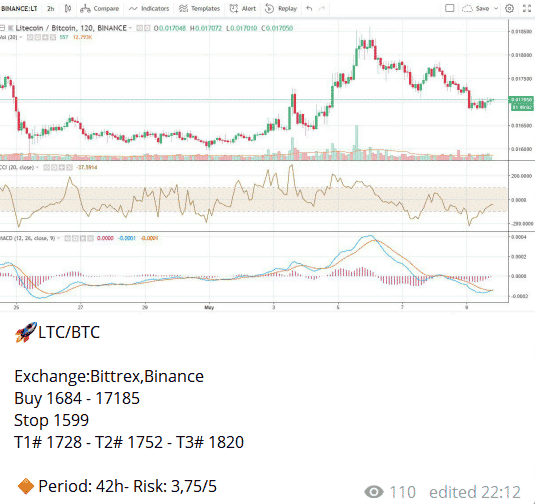

Patience is a virtue; everyone who trades coins and tokens has to know that to keep their trading strategies profitable. Also, common sense is that not every trade can be a winner, especially not immediately. We place our entry, and it becomes filled. Sometimes, the price might drop right after, “but, man, I thought I caught the bottom.” Moaning won’t help here, but averaging out will often do a helpful job. The technique of averaging is well-known and easy to understand. Let’s say you want to use 0.1 BTC for this signal by one of the best Crypto signals groups on Telegram on Litecoin.

The entry price would be the current price of 0.0172 sats. Some might place the whole buy order of 0.1 BTC at this price, but it would be smarter to just use a percentage of these funds and spread buy orders in the buy zone down to 0.0168, let’s say. This way, you lower your dollar-cost-average if the price drops, and you will recover faster, and/or chances are given that you are faster green again, measured by the total amount of funds this trade.

3Commas is known for its trading strategies and tools that provide conditional order setups, copy trader features and much more. In addition to their great setup of tools, they recently released several sweet trading bots, which enable the average trader to auto-dollar cost average your trading orders. The actual intention of this bot follows a simple principle: buy low, sell higher. The trading bot that they created recently is going to do exactly that.

We want to use this cryptocurrency trading bot as a safety option for a crypto signal we trade. Taking the example above, we want to buy LTC at 0.0172 sats with allocated funds of 0.1BTC for this trade. Of course, if we average a trade, we often end up trading only a part of the actual amount we planned for that trade, but that’s OK if we can manage our risk in exchange. Let’s take a look at the settings and how one could start with the trading bot:

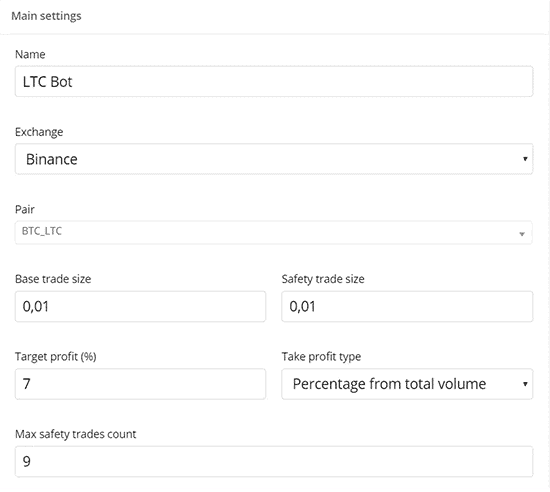

Legend:

- Target profit (%) The Take profit level at which you sell all opened trades in one cycle, ranging from 0.2 % to 10 %.

- Base trade size Sets base trade size when the trading process starts.

- Take profit type Sets how the target profit will be calculated—as a percentage of the base trade size or from the total open trade size.

- Safety trade size defines the size of every insurance trade.

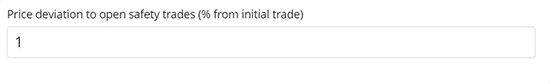

- Price deviation to open safety trades (% from initial trade) step to create safety trade. From 1% to 10%.

- Max safety trades count the safety trades limit from 3 to 100.

- Max’s active safety trades count From 3 to 10. The higher the number of safety trades, the more money will be reserved.

So, how did we set this up? When we activate that trading bot, we immediately buy LTC worth 0.01 BTC at the current price. The safety trade size is set to 0.01 as well. As the range from the buy area to the last targets of the signal suggests, there is room for an 8.3% profit on this trade. Conservative as we are we try to achieve a 7% profit. What does this bot do now, depending on the settings above?

Starting from our entry price it will buy more LTC at 0.0172, each 1% drop it will buy LTC worth 0.01BTC, for 9x times. This way we cover an ~10% drop in the price. What does the bot do next? It sells the purchased pieces on upward swings and targets until we reach our defined 7% profit.

One has to say that the described use of this tool is not the actual intention of the creators, I guess – though it makes total sense. You entered into a perfect trade, bitcoin makes one of its big-time moves and your setup is down the river. If you prefer to hold over stop/loss, averaging out might decrease your pain as you would break even much faster.

However, 3Commas’ idea was another one: The bot can use the provided signals by Tradingview. The charting platform provides a page, that analyzes cryptocurrencies (only automated trading on technical indicators, no humans involved). You can tell the bot to buy on behalf of “buy”-signals or only on “strong-buy” signals – up to you. The bot is checking for fresh signals every 15 minutes. To make it more transparent how all of this works, the website provides an example and a step-by-step explanation of what the bot would do:

Suppose ETH costs $500 and a trader with a $1000 deposit wants to earn $10 using the bot. So here is the step-by-step algorithm:

- Bot buys ETH at the rate of $500 on $100, that is 0.2 ETH

- Bot places sell-order on his 0.2 ETH at the rate of $550, that is $110. So, if the rate will reach that point, a trader will take $10 profit.

- Bot places safety-buy-orders on $100 at ETH rate of $450, $405, $364.5 (Step between orders is 10%)

- Eth rate goes down to $440, which means that first safety order went through and bot just bought 0.2222 ETH at the rate of $450 ($100/$450). But trader still needs to make $10 profit (5% from 200$ – current amount spent on position). Bot automatically moves TakeProfit from $550 to $497.4 (+5% from average purchase price in $474.7). If that order will go through, the trader is going to get 0.4222 ETH * $497.4 = $210. Trader reaches his goal of $10 profit.

- If the price goes down until next safety-order, the bot is going to repeat same actions as in the previous step.

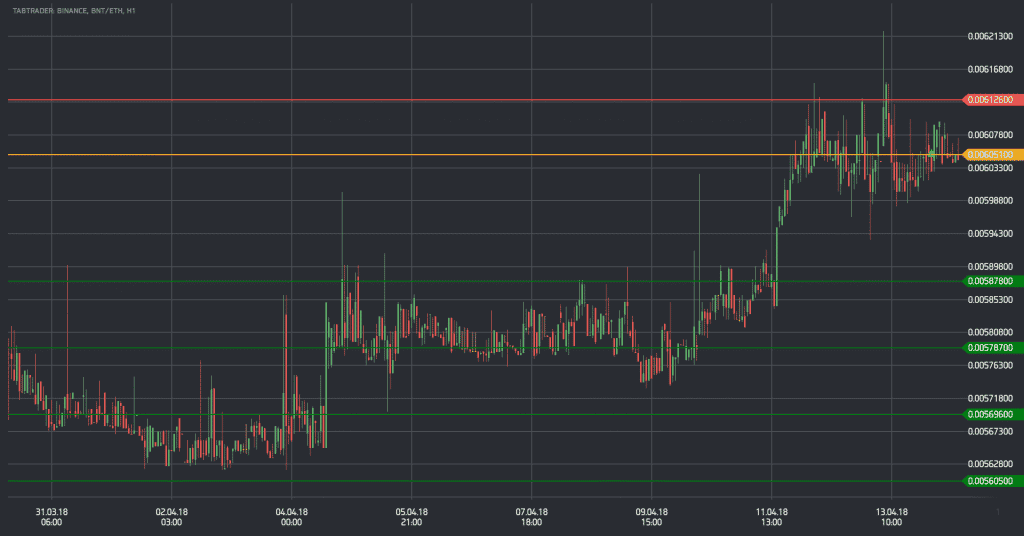

Auto Averaged Trade Example

Here is how an averaged automated trading with the 3Commas bot would like at the charts (green lines are the buys, the red line is the final sell):

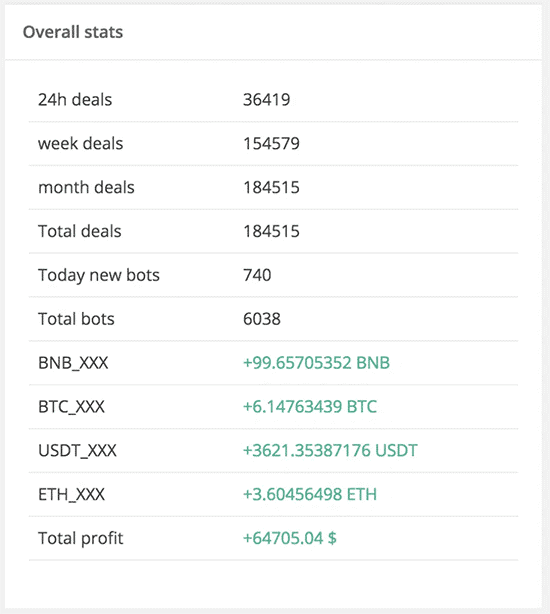

As this is an hourly chart, one can abstract that it needs some patience to let the bot do his job, although due to the huge volatility we can find in Crypto, it can be much faster also. 3commas shows off the overall stats of its tool (for their user base) and achieved quite sweet results – however, the future has to show how consistent these results remain. Consistency and long-term success are everything in cryptocurrency trading, so we would need to observe how this turns out ultimately. Here is a screenshot of the past results:

If you want to give this bot a try, check out 3commas. Hence all the other tools they offer it is worth it anyway.

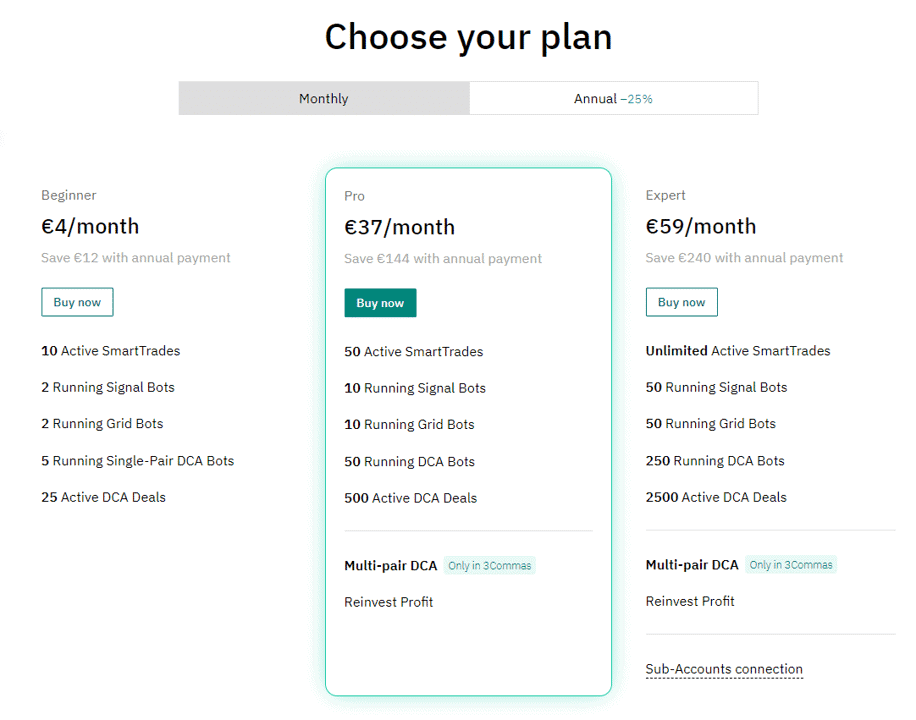

3Commas Review – Bot Pricing

Before you choose one of their 3 plans, I suggest you to sign up for the 3-day free trial on Pro plan. During the trial you’ll enjoy:

- All types of bots: Single & Multi-pair DCA bots, Grid and Signal.

- Advanced features: Backtest, Trailing Stop Loss, Reinvest, Futures trading and more

- Demo Account: Risk free way to gain hands-on trading experience

- Pre-built strategies & Presets: Convenient and time-saving solution for trading

The pricing on 3Commas is pretty straightforward depending on features. When you choose the annual plans, you get 25% discount. You have 3 different levels of which to choose from:

It’s important to mention that all plans include:

- Futures Trading

- TradingView Integration

- Trailing Up & Down

- 3Commas API

- Demo Account

- Signals

- Backtest

- 14+ exchanges

3Commas Review – Copy Trading Bot Feature

With recent updates in the past year, 3Commas has also a NEW Copy-Trading feature as we wrote about before. Hence to be fair we wish you have more than one resource for this article. So in our thinking what we really thought was useful we found here: “Is it possible to have the same results while copying someone else’s bot?”.

We found this at the 3Commas website itself. in this instance for example. It talks about having like results of the traders you follow and copy. We all want to have good results that track what we believe will be winning traders human or not. With a 3commas review, you see a lot of new features and improvements in automated trading bots.

Looking at all the improvements 3Commas has done this has been the #1 thing that IMO has caught our attention. We often get many user responses on this. Thus because many traders will choose to follow a signal provider who will “Dollar-Cost Average”. So you should take into consideration their trading strategy ahead of time.

You would not want to be caught not being able to get into trades or using a provider that is not profitable to you because they simply use trading strategies of auto-averaging their trades that you are not set up for or maybe is too risky to even follow, so food for thought! Simply put “KYSP” Know Your Signal Provider. This will prevent some of the mishaps that can happen when using 3commas and their auto-trading signal providers. That’s why it is important to read about the reviews on 3Commas Trading Bot.

Final Thoughts about 3Commas Review

To end this article, we would like to point you to Moonin Papa, he has many videos that use the features of 3commas in full detail and he is somewhat pleasant to listen to. You can find his youtube channel “Moonin Papa“ He goes over many of the inside features of the 3Commas platform and I find it super useful to have a visual representation being shown to me on youtube.

Yes, he is like the nerdiest person you could ever imagine watching on youtube and that is exactly why you should watch him! LoL he really hacks into what trading with 3Commas is and all the features 3Commas has to offer, so please check him out when you have time or need a better understanding of how some of the more cantankerous features or as I call them oddities of how 3Commas works. Until next time EnJoy and AUTO-ONWARDS!

I’ve read a few excellent stuff here. Definitely price bookmarking for revisiting. I wonder how so much attempt you place to create this type of wonderful informative web site.|