This post is also available in:

![]() Português

Português

Futures is a new way to invest in the crypto world, but it’s not for beginners. If you’re interested in exploring this, learning how to trade on Binance futures can be a valuable skill. With more than 5000 tradable cryptocurrencies, cryptocurrency trading is gaining mass adoption.

As we continue to see a surge in cryptocurrencies, with coins like Bitcoin, Ethereum, and Solana setting new all-time highs, we have also seen an influx of users and exchanges, with everyone striving to get a piece of the crypto pie. While some people prefer spot trading, others are interested in futures to hedge their funds and make more money.

Besides being one of the most traded cryptocurrency derivatives, futures embody many long-established derivatives. What are derivatives? As the name implies, they are financial assets whose value is derived from another asset.

Table of Contents (click to expand)

Spot Trading Vs. Futures Trading – Difference

In Spot trading, you trade for immediate leverage, and they have expiry dates. That is, you can only make money one way. E.g., You buy Bitcoin at a price, then sell it at a higher price for profit.

On the other hand, futures trading allows the trader to buy or sell at a predetermined price. Perpetual futures contracts don’t expire and stay on for as long as you want. They are most common in crypto markets. In futures, you can make money both ways. Whether the prices rise or fall.

Why Trade Binance Futures?

Binance futures trading allows investors to take on more risk and make more money with little capital staked by investing in popular coins like Bitcoin and Ethereum, as well as other altcoins like Ada (Cardano).

The primary use of futures is to cover an investor’s position in the market, while others use it as an instrument of speculation for quick and easy money.

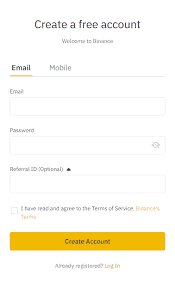

1. Open a futures trading account on Binance.

On Binance registration is effortless, and the process is straightforward with a discount if you use our link. The user interface/experience is easy to use and makes trading seamless. However, you will need to enable 2FA; this two-factor authentication will keep your account safe from third parties by doubling your account’s security layers.

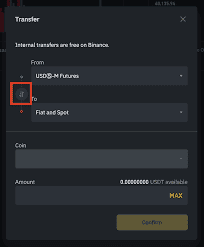

2. Deposit funds in USDT, BUSD, or cryptocurrencies supported by Binance Futures.

Once you complete the whole process of registration, you need to fund your account with either a p2p or direct bank deposit, and then you transfer from your spot wallet to your futures wallet.

You can fund your futures account with fiat currency like USDT, BUSD, and any other currency accepted by Binance. One of the reasons why Binance is far better than its competitors is that you can fund your account for as low as $10 and withdraw for as low as $10.

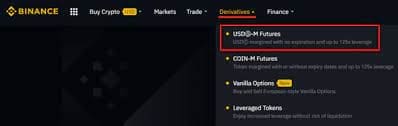

3. Select your preferred futures contract.

Before diving into trading futures, it is essential to understand the concept of contracts. Contracts get their name from the fact that the buyer and seller of the contract agree to a price today for some asset or security that is to be delivered in the future.

Two types of futures contracts are available on Binance: USDS-M Futures and COIN-M Futures. For example, if you want to trade BTCUSDT perpetual contracts, please select USDⓈ-M Futures.

- USDT margin futures are executed or traded with fiat currency. It has no contract expiry date; you can enter a trade any day, any time.

- COIN margin futures are executed or traded with crypto tokens. It has an expiry date, and no expiry date for the contract.

4. Select the appropriate leverage for your future contract.

The leverage on Binance futures range from 1x to 125x; you can adjust the leverage before placing your orders and after placing your orders on trade. You must click on the plus or minus button to increase or decrease your leverage.

Note: Adjust leverage based on the amount of risk you want to take; Leverage can make traders win big and lose big. Higher the leverage, the higher the risk.

Be careful; if the market falls to your “liquidation price point,” you will lose all the funds in your future wallet if it’s a cross-margin.

You should start your trade with a minimum investment that you can afford to lose. Keep taking profits in intervals; good luck.

When writing this, Binance Futures supports more than 210 trading pairs.

Finally, trading futures can be risky, especially with high leverage. Cryptocurrency is already highly volatile; you need a trading plan to help you manage risk and improve trading consistency.

In addition, working with a signal provider can minimize the risk associated with the future. Trading futures is risky, and a signal provider will help you navigate the intricacies of futures trading to your advantage. Their understanding of the market and experience over the years if correctly applied, can let someone make it big in futures trading.

Everything listed above is a guide to setting up a futures trading account. Check out our post on the best signal groups on Telegram if you want to know more, or just need help, or read our beginner’s guide to crypto trading if you are just starting, or take the trader vs investor quiz.

You have brought up a very wonderful points, thankyou for the post.

I reckon something really interesting about your web site so I saved to fav.