Table of Contents (click to expand)

- 2x Crypto grid trading – Anti Rekt

- The logic of the 2x Crypto Grid Trading Strategy

- 2x Crypto trading accounts

- 2x Crypto Grid Setting buy and sell orders

- Statistics and brackets

- 80/20 Rule Pareto principle

- Nobody can predict the future!?

- Trade Using Math

- Frequently Asked Questions

- Final thoughts on 2x Crypto Grid Strategy

- * WARNING *

2x Crypto grid trading – Anti Rekt

In this article, I am going to teach some logic and give you a strategy. I have applied over the past 3 years in crypto with the large parabolic top at the end of 2017 in Bitcoin and Ethereum as well as a few others. Due to the nature of how you can fractionalize your amounts. This strategy can work well for small and large traders alike. Of course, with the amount of work that goes into this trading strategy, it is really designed more for deeper pockets and WHALE sized traders.

One of the key benefits of this strategy is simply to build up your crypto by taking advantage of the oscillation of high volatility up and down in a given range over time. There are limits and honestly, the amount of statistics I do in analysis from 1000s and even millions of angles gives me such an advantage over even the best firms/quants around. For them this is a job, for me, it is my life.

These concepts may seem complex for the 2x Crypto Grid, but understand that compared to quantum mechanics and other mathematical studies this is fairly basic and if you are willing to do the work, it will illuminate a whole new way of thinking about numbers/charts. All it takes is a bit of open-mindedness to understand the concepts/logic. One note even if you think you don’t understand what you are reading, your mind likely will be in the background.

The logic of the 2x Crypto Grid Trading Strategy

Bitcoin and Crypto from its very start back in late 2000 had some fundamental peculiarities built into it. It was developed by a rag-tag bunch of programmers of the cypherpunk realm, not by some financial entity/corporation that could stabilize and control Bitcoin growth. This means that this invention of a decentralized currency was RAW at its core as if it was sprung from the ground by whichever spirit of creation you believe in.

The great thing about it being a raw asset is no institutions/banks control it with their algorithms and market maker mafias, at least not yet.

2x Crypto trading accounts

For this method we will have 2 trading accounts, one for long and one for short, now here is where it gets interesting, as I don’t care who the accounts are with, as IMO I would use Coinbase and Bitmex to trade myself, as I trust their exchanges/security. Other crypto traders I know will use Binance and Bybit or Deribit, Bitfinex, and the list goes on. This is a personal choice as long as one can have 2 separate accounts “1 long & 1 short” we are good 😉 The 2x nature of this comes into play as the futures/margin trading account is 2x the size of the spot trading account.

Why do I need to have 2x the amount of funds in the margin account you will ask? Well, let’s examine spot vs margin on a risk basis and calculate relative value. So with a spot account, I own whatever I can buy with my tether or USD values converted to Bitcoin or whatever cryptocurrency I am buying. So I pay x amount of dollars/tether for Bitcoin. No issues whatsoever life is good. Dollars vs Bitcoin all equals out, my only binomial decision is to what % I am in one or the other.

On a leveraged/margin Exchange

On an Exchange like Bitmex, this is where you must calculate total sums of value between the two accounts for the expression of leverage in trading the 2x Crypto Grid.

Simply put I am not only going to hedge the bitcoin which is the fixed base currency of say Bitmex but I am going to express 2x accounts hedged for value. So with Bitmex, I keep double the amount as I am going to hedge both the spot and the bitcoin I own natively on Bitmex as they don’t accept fiat, this is common with most leveraged/margin exchanges btw.

Examples

I want to hedge short 100% of vs my Bitcoin, so first I have whatever % of my account in Bitcoin on the spot account = we will sell short the amount of BTC I own there, then I will hedge short the amount of Bitcoin that I deposited on BitMEX to create @ max 1x short. So in total, I can be both long and short 100% and scale in and out of my future 2x Crypto grid trades.

- Bitcoin on a spot trading account

- Bitcoins on a futures/leveraged account

This = 2x crypto grid account. So now I can hedge 100% of both accounts margin/spot short 1 Bitcoin and then hedge short 1 bitcoin for the spot account. At worst I will have a net neutral position of which I do not gain/lose any value if it trades outside of the grid brackets in the future. After this is set you are ready to create your grids for buying/selling.

2x Crypto Grid Setting buy and sell orders

Now that you have your account in order we can develop our strategy for the 2x Crypto Grid, the first thing we want to note is the type of market we are in, Trending or Ranging? We must be in a ranging market as a trending market = DEATH for this strategy.

Now that we have our sites and info that tells us we are in a good-ranging market, we can now set our brackets for trading, but where do we start to buy or sell? Now this is where depending on your TA “Technical Analysis” skills and how well you can match up this strategy to the market will determine your profitability over time using the 2x Crypto Grid method.

I will give you some common ones I know bank traders who trade in a like manner but with different assets and apply the logic here.

2x Crypto Grid Method

A 50% retracement level is used as a base for a ranging market buying below and selling above with a 20% oscillation bracket/buffer. The grids are set @ 1/20 to 1/50 bracket values up and down. Some will use various TA-based overbought/oversold methods in addition if they don’t trade a fixed grid up and down. Historically Bitcoin after parabolic breakouts has retraced 80% or greater and also back to visual support levels in the past repeatedly.

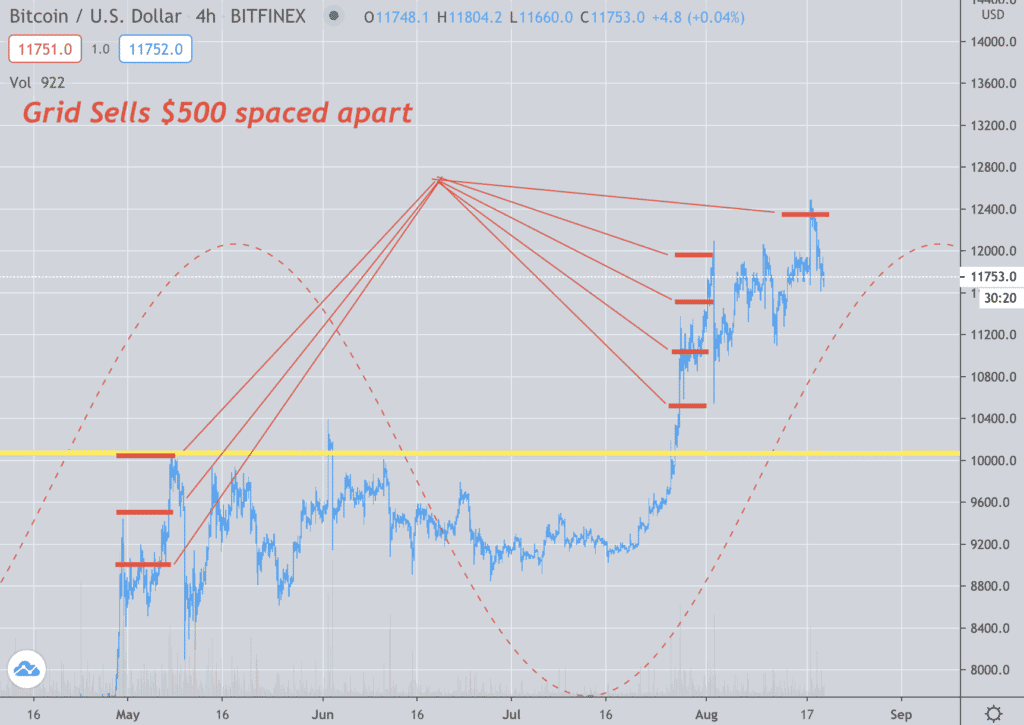

Fixed Grid Trades

Two ways I have seen traders trade this is with either fixed buy and sells at price levels spaced apart every $1000 or $500 and even as low as $200 a part say Bitcoin as an example here.

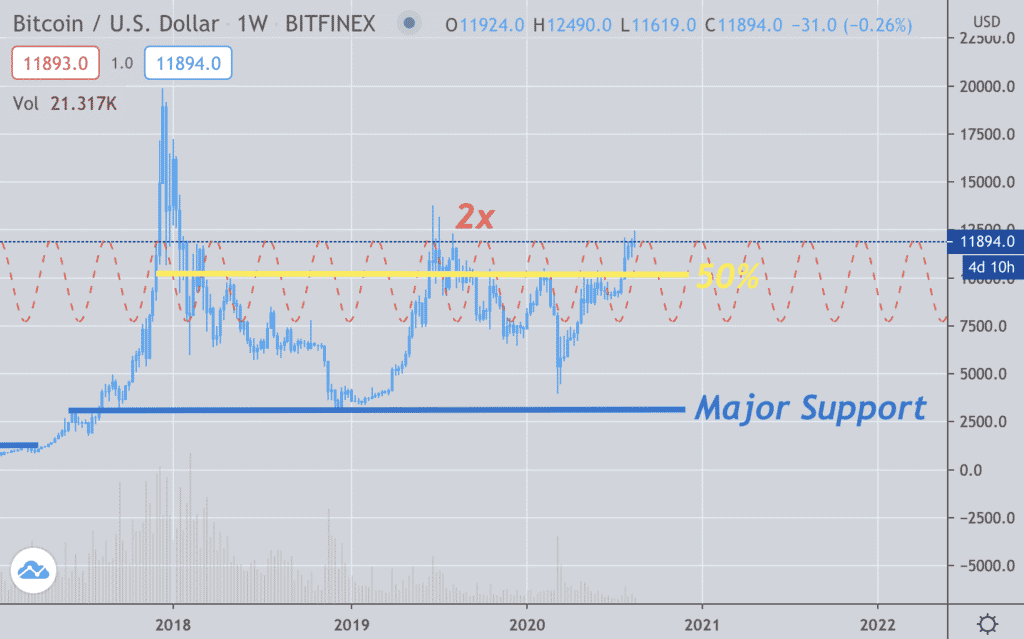

In the above chart, I am going to take you through the 2x Crypto grid logic so that you can understand how I have made greater than 300% ROI in 2018, over 150% ROI in 2019, and likely to make over 200% ROI in 2020. Now to be fair this is an aggregate of many strategies/methods, not just the 2x Crypto grid logic alone. I also did this with very little risk as most of my trading is hedge trades vs what I own, and almost all of the time I am net long Bitcoin & crypto in general. Still, it does represent fairly well very profitable trading logic, from there it is up to the market.

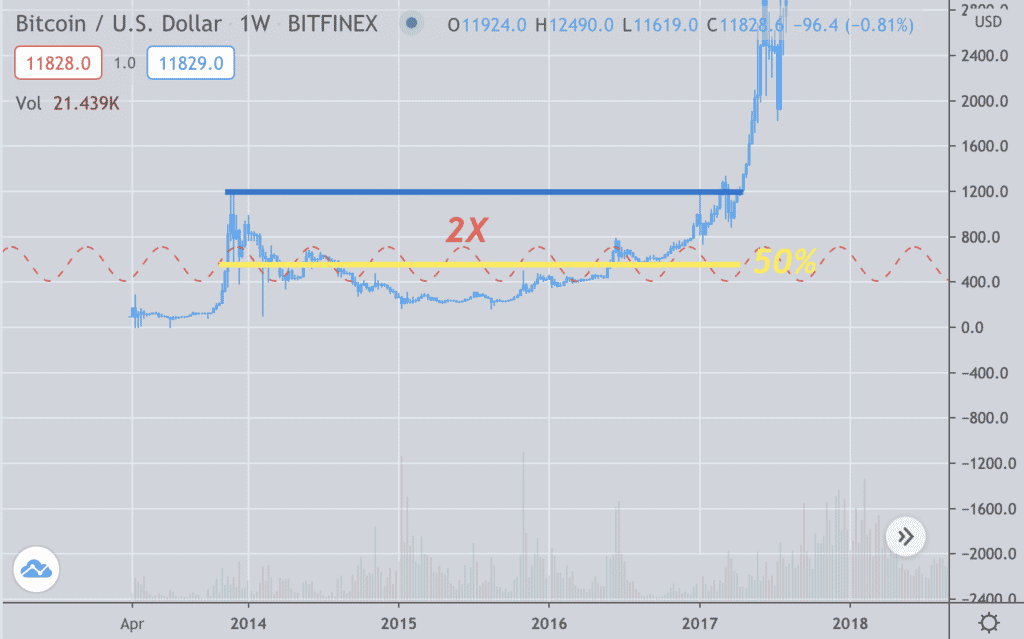

Notice what the 2x Crypto Grid looks like on a chart of the above Bitcoin from the end of 2013 till the summer of 2017 it had a range from almost $1,200 back to what I remember was in the $20 range but that depends on the exchange so mileage may vary. So first we set our 50% @ just under $600 with a 20% below and above bracket, from here you can tweak your entry-exit criteria to trade the 2x Crypto Grid methodology.

Statistics and brackets

What are the reasons to use the 20% bracket, well below we give homage to the natural laws of numbers as the 80/20 Rule Pareto principle in statistics. One thing to note on trading bitcoin and crypto pairs is the high degree of volatility, traders make their livings with volatility. I use the 20% bracket above/below the 50% retracement level because of the statistical hit rate historically on Bitcoin.

Due to the decentralized nature of this market at the time of various exchanges, it varies but that is ok because we can average it out = smooth, an example of what you can do with indicators to average out variance of numbers. Now we know we want 50% of the high/low so just under 600 say 580. So now we will apply the 2x principle to bracket the variance. Simply put we will give ourselves a buffer of 20% up and down, which is 1/5th the value of the range.

Sin Waves

Now as you see in the above 2x Crypto Grid chart you will notice the sin waves, this goes beyond what is being shown here today as they can represent the cycling of the market a more advanced topic I will save for another time. The main principle I want you to grasp is the simple logic of buying low selling high and anticipating profits by hedging.

So say I am using the 2x Crypto Grid method on a trade I am buying under that 50% retracement level every $500 it drops and I keep buying till I use all my equity in the spot account. Bitcoin never went that far down, the last down move took it just under $4000 before we moved up above to where we are today around 11-12k. What do you think looking at the above chart I am doing now in the other direction, exactly?

Remember the concept with 2x Crypto Grid trading and calculate in your mind some of the above, imagine you trade $500 brackets buying every move down in the spot trading account and sell on whatever overbought conditions/ta or even just the 50% retracement level as your guide above and bitcoin coin cycles up and down over and over many times giving you sweet profits on each of your trades. That is the primary concept of grid trading or even dollar cost averaging if you were an investor.

80/20 Rule Pareto principle

The first thing you will notice in the 2X Crypto grid method is the use of the 80/20 rule and 2x which inverted is 50%, so to put in logic people would get more if you double something 50 to 100% you get 2x the value but if you reduce by the same amount 50% you get 1/2 the value. This is the primary growth/decline variable we are going to use. So with the 2x method, we will relate a whole value of 1.0 20% to give us 80% of that value calculation. You are going to see this in many examples of calculations, such as 80/20 of RSI = Relative Strength Index.

Now why do we use 20% or 1 5th unit, in RAW markets this is a statistically more common occurrence. So when you see big 80% declines or greater in the market that is just normal in cryptocurrency trading 😉 The 2x Crypto method is fixed around the Pareto principle of which 80% of the effects come from 20% of the causes. Another way to look at it is 20% lead and 80% follow. 20% are wealthy, while 80% are poor. Again a simplistic calculation but one to understand why the 2x Crypto grid trading method gets its concept from.

Growth and Decline

Have you ever studied the natural cause and effects of growth/decline in charts/systems/nature or any number of things in school statistically? If not that is okay, you are likely normal. Unfortunately, I am not, and I studied/noticed at a young age and kept calculating such from that point on.

One thing you should know is that trading is not easy, and most don’t have the experience or knowledge to make a living at it. Many treat it like a casino in which they hope to pull the lever and become rich! A good reason why I often see so many casinos and DEFI gambling advertisements in the past year. here are mathematic tricks you can apply

In the future if we ever get an 80% decline or values on RSI that go above/below 80% you will see the effectiveness of this the future, that is of course if you can count and pay attention = do the work…

Below you can see I use a bit more advanced cyclical sin wave analysis to combine the 20% offset brackets, I might have an article in the future that goes more on about how to use/calculate such cycles so stay tuned!

An Example with Bitcoin

Now this is the current day on bitcoin of which I am currently holding short a certain amount for a certain price target neither of which I can tell as it is proprietary trading information, and we do not accept membership or offer signals FYI, all of this is purely for educational purposes only.

I use 1000s of combinatorial data sets mathematically developed with over 30+ years. What I do is going to be far more advanced than the average squirrel seeking a nut, but this does not mean you can’t gain insight into the logic to trade just as well using methods like the 2x Crypto Grid Strategy.

So the logic of the 2x Crypto Grid is simple, I am buying when it is overbought I can use the main 50% line from high to low on BTC as a guide, but I could use many other things, patterns, wave counts, ob/os indicators, bart patterns, TD Sequential, again you can use whatever TA just as long as your logic deems buying low selling and vice versa.

Nobody can predict the future!?

Let me state this here to show you why 2x Crypto Grid trading works so well and has since Bitcoin started trading. #1 it is likely most of, if not all of you reading this believe in Bitcoin and Crypto going to the moon in the future, maybe many of you don’t even want to trade, but that is ok because trading is hard and is full of risk. Anything that can give you great profits can also give you great losses.

Do yourself a favor and stay away from wild emotional people in trading, trading is about numbers, not feelings, the market does not care what you feel numbers are and will be. Poor Bitcoin Ben every time the market falls starts to cry and freak out, noted by the video below I made it more dramatic by adding a magical background to his rant lol.

Trade Using Math

The idea behind the 2x Crypto Grid is just to give you a path to follow and the logic to go along with it, 2x Crypto Grid or just basic DCA “Dollar Cost Averaging” are great techniques to add to your trading. Simply imagine you bought every drop on BTC below 5k and averaged down buying every $500 and selling every time it went above 10-12k and repeated that over and over. That is pretty simple logic but add using statistics and then you start to get real powerful returns.

I know more than a few people who have 5-10x more crypto than they started with compared if they just HODL’d their holdings, they again were using methods similar to the 2x Crypto Grid strategy.

Frequently Asked Questions

Yes, it can be profitable, especially in volatile markets. The strategy aims to earn profits from small price fluctuations. However, its success depends on market conditions, the correct setup of the grid, and ongoing management. Like all trading strategies, it involves risk, and profitability is not guaranteed.

The primary risks include market volatility, where extreme price movements can lead to significant losses and the possibility of choosing inappropriate grid settings for the current market conditions. It’s important to regularly monitor and adjust your strategy.

While you can technically use it for any pair, it’s more effective with pairs that have sufficient liquidity and volatility, such as BTC/USD or ETH/USD. Choosing the right pair is crucial for the success of this strategy.

Final thoughts on 2x Crypto Grid Strategy

I know it might seem daunting to conceptualize but the logic is simple, since the highs of 2021 I have been using the 50% range as a guide along with grid brackets for buying and selling over and over again to mark each trade in profit, so it is no wonder I have many more times the BTC I started out with because that is my job and I do my job well.

So if you just want ideas on dollar cost averaging or trying to start out in technical analysis and using real math in trading crypto, the stock market, forex, commodities market, or just about any market give this logic a go in sculpting your next trading plan.

* WARNING *

The above logic due to cycles statistically may begin to fail after the new year, this strategy has worked flawlessly for the past several years due to a ranging market, this may start to change statistically early to mid-next year and on. I will adjust my methods based on the matches of historical data in the future and even show you how I adjust to doing that in a future article. So until next time, enjoy!

I’m not that much of a internet reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future. Cheers