What are Crypto Signals?

Is there anyone who does not like money? – Certainly not! Who does not like to wake up, receive many signals, pick one or two, execute the trades, and watch the money roll in? I certainly would love to, but in reality, that is not how crypto signals profit work.

Trading signals are not just a bunch of stats and stories stringed together – it is a number, and here is its formula:

Gain expectancy = Win% * Avg Win% – Loss% * Avg Loss%

Signals can be a great tool, but you need to know how to use them. First, you have to understand how this tool works. In other words, what strategy is the signal provider using to place his trades?

Following someone’s signal is like adopting their belief formalized in a trading system. Ex. A professional short seller who is naturally risk-averse(with a prudent position sizing) but disciplined may not jive well with someone who likes big high conviction bets.

When you follow someone else’s strategy, kindly note that you half-heartedly embrace the person’s personality without fully understanding it.

A lot of times, all you need is a place to start.

Trading signals are tools that can make your trading profitable. Other than candlesticks, market volume, indicators, etc., they are an excellent place to start.

- They give you a place to start when analyzing the market for an entry point. You should use the entry points offered only as a reference point and then analyze. Does this seem right? If not, why not? What is off, and then how will you change it to make it right for you? Stop Loss and Take Profit offered. Keeping in mind your risk management strategies and your profit goals, you can see if the ones shown by signals make sense.

- Trading signals serve as portfolio adjustments that hint traders when to buy more, sell more, or hold a commodity. They are good to know which trades to enter because they alert you if a trade is good and so you aren’t riddled with FOMO.

Trading signals might work perfectly on other financial systems. But in cryptocurrency, they tend to be less effective on leverage trading due to its high volatility in cryptocurrency.

Things you should look out for when using a trading signal service

Time-Zone.

- Trading signals are time-bound. Make sure your signal provider’s time zone tally with yours to avoid getting outdated or signals.

Compare and Contrast.

- Don’t just stick with the first trading signal you find; you can look for others, and sometimes you might find better ones.

Backtesting

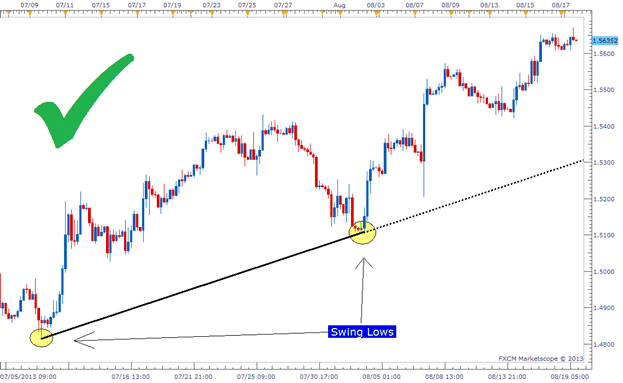

- As the name implies, backtesting is using trading signals or strategies on previous or historic charts to know the win rate and how effective a trading signal is.

Full-Analysis.

- Run from signal providers that only give entry signals and stop loss/take profit. Your signal provider should give you the entire market and chart analysis, and they should tell you why the signal will work.

Know your trading philosophy.

- Be sure the signals provided tallies with your trading style and philosophy. Are you a long-term or short-term trader? Is the signal provided in line with your trading style?

Doing research, managing expectations, and following your trading psychology is your responsibility. But if you can find a reliable provider, signals can prove to be excellent indicators.

Conclusion

The thing to note with signals is that they are only forecasts generated on the laws of probability, using past data. Therefore, don’t expect them to be 100% reliable. You can make good crypto signals profit just the same way you found the right trading indicators. Most importantly, you’ll need to rely on yourself and not someone else’s intuition when it comes to trading. Trading signals might give you alerts and help you streamline your strategy at the right time, but they are not always accurate.

Checkout our approved Signal Providers

I think this is among the most significant information for me.

And i’m glad reading your article. But want to remark on some general

things, The website style is wonderful, the articles is really excellent :

D. Good job, cheers