Bitmex versus Deribit? Things have changed a great deal since this article was first written, along with the whole cryptocurrency market growing up to a large degree. Add the U.S. charges vs Bitmex and well the mighty have fallen indeed. So we have updated certain parts of this article, keep in mind we have kept much of it for historical reference too.

Choosing an appropriate cryptocurrency exchange for leveraged trading is hard. There are not many choices at the time in the space for leveraged trading to note. However, the selection between the few options can often make or break a trader’s career before it’s even started. With the continued growth of cryptocurrencies and the emergence of multiple unknown exchanges. We believe finding the perfect exchange is often a daunting task. Hence this is especially true if you want to trade with leverage.

In the recent past two particular exchanges have gained significant prominence in the industry. They are BitMEX (as the market leader) and Deribit (as a new challenger). In this article, we are going to look at a critical comparison between these two exchanges.

BitREKT

BitMEX or Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows leveraged contracts in Bitcoin. BitMEX combines margin trading and derivatives of crypto assets for traders. The company was founded in 2014 by HDR Global Trading Limited. Bitmex is currently the world’s largest Bitcoin futures and derivatives market by trading volume. It has its headquarters in Hong Kong, China.

Deribit which is coined from both derivatives and Bitcoin is a futures and options trading platform. Utilizing Bitcoin exclusively for depositing, withdrawals, and trade collateralization. Deribit was founded in 2016 and has its headquarters in Amsterdam, Netherlands.

Table of Contents (click to expand)

Bitmex versus Deribit: The Battle

Perpetual swaps

BitMEX was one of the first exchange platforms to launch perpetual swaps for its users. After every 8 hours, the system calculates a time-weighted price versus a post price presentation. If the result is a premium, the traders in the long position pay traders in a short position. Consequently, taking a long position is less attractive and hence the premium is reduced.

Conversely, if the result is a discount the traders in a short position pay those in long. Hence attracting buyers and consequently raises the price. These perpetual swaps are aimed at providing the benefits of the future without expirations.

Similarly, Deribit’s perpetual swaps are conducted in the same manner with a slight distinction. Instead of paying out at intervals of 8 hours active positions. They receive continuous payouts based on the premium or discount versus the spot price. Overall, the Deribit system allows for smoother adjustments between contract deviations and the underlying spot price.

Order execution and transaction speeds

The average time taken to execute an order at Deribit is only a couple of milliseconds. Thus in comparison, BitMEX takes 20 to 40 times longer during a stable market. The difference increases considerably when there are high-volume trades being executed. Test have shown that Deribit can perform an average of 1000 orders in a trading block per second. In contrast, BitMEX performs 500 orders per second.

This is an amazing advancement in the crypto space. Speed is one of the most important elements of a trader’s bottom line.

Bitmex: Pump and dump allegations

For a long period, BitMEX has faced grievous accusations of price manipulation through pump and dump. A recent example is that of August 22, 2018, where the company had scheduled maintenance for its engines. Shortly, after BitMEX went under maintenance Bitcoin was pumped by 10%, liquidating numerous shorts.

On the same day, BitMEX reported a DDOS attack that resulted in 5% dumping. A thing that might puzzle most of its users. Well is how a company of this size cannot afford faster servers! So that they can handle the number of transactions when the action happens.

The notorious “System Overload” is an issue most of the BitMEX users might have experienced when the action starts. If you failed to set up your stop-loss before placing your actual order, it can REK you. On the other hand, Deribit remains quite credible and has not faced such allegations since they began operations. One has to consider that Deribit faces much lower amounts of traffic.

The brand is lesser-known than Bitmex. Which is the market leader. Hence, it is hard to compare this point. As only the future will show how Deribit behaves to attacks. So until the volume and brand awareness are granted on a similar level, it is a moot point.

Deribit still no real complaints

Time has gone by and Deribit still has not had any real complaints of manipulation/downtimes. Especially during heavy trading or any of that nonsense. Ironically enough it seems neither has Bitmex to any real degree. Well since now interestingly enough it all seems to have stopped. All ahead of the U.S. government filing charges vs Arthur Hayes and the other owners. So what does that really tell us…

It tells us there are a lot of unethical people in crypto. Maybe the owners of Bitmex deserve what they get with the current charges being leveled against them. Much of this can be also seen in a recent update I did on Bitmex.

Bitmex versus Deribit: Liquidity

BitMEX boasts the enviable position of being the most liquid crypto-derivatives exchange in the world today. Due to its high liquidity BitMEX has some of the tightest spreads and least slippage in the market. Currently, BitMEX executes a phenomenal number of up to 400000 BTC a day, in comparison to Deribit 10000BTC.

Additionally, BitMEX offers a wider variety of product to trade. Such as XBT Perpetual, ETH Futures, ETH Perpetual, XRP Futures. Even LTC Futures, ADA Futures, TRX Futures, EOS Futures, XBT Futures, and Bcash Futures.

Deribit only allows BTC Futures and BTC Perpetual. This is one of the biggest issues with Deribit. Low liquidity means your orders are less likely to fill and the price action might be skewed to an extent. Also, the missing altcoin futures is a big drawdown for Deribit.

Since then Deribit has increased a great deal in volume, so the liquidity has come a very long way. Which again since you have no real complaints from users. Well, this tells us most are happy with Deribit and their volumes continue to grow with the market.

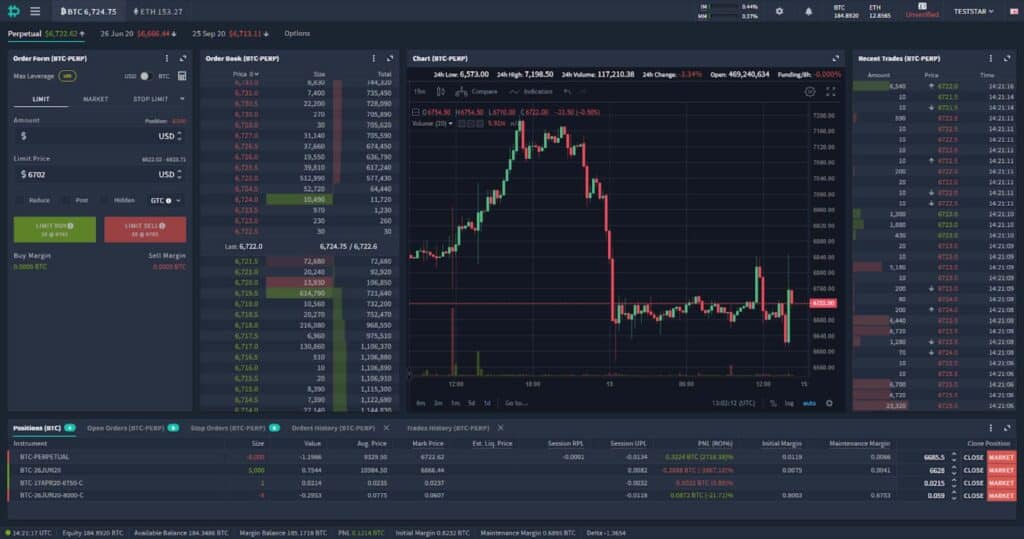

Bitmex versus Deribit: User interface

Bitmex versus Deribit: The BitMEX user interface is largely user-friendly and simplified. The interface allows users to drag and drop orders around charts. This makes it increasingly simple to execute and stop orders. Overall, this is an increasingly vital feature of the difference between making a profit or a loss. And in the volatile world of cryptos is all about timing. You can also customize the layout to your preference in BitMEX.

Again the UI of Bitmex is too far ahead of the competition it is not funny. Mainly this is due to the programming coming from real fintech professionals and not some second-rate Asian programmers. The thought and logic behind the scenes of the Bitmex UI is far superior to all other platforms out there. Hence it is a real shame that they suffer in other areas of the ethical treatment of their platform users.

Deribit user interface is rather clogged and users have to navigate and click around in order to edit positions. There is much air on the upside for improvement when it comes to the Deribit UX. Especially new traders will find it hard to navigate and set up orders properly. BitMEX in comparison is a very nice piece of web development. Which makes it easy to find your way into leveraged trading.

It is not what I would call horrible but at the same time neither would I call it really functional. The logic flow of the UI is clunky at best. This again has to do with the shared second-rate programmers.

Options options options

To Deribits credit they have advanced their platform. No longer is it missing many advanced features. So now it has the speed and some nifty UI improvements. Mainly in the areas of options, which seems to be a primary focus for them to deferintiate their platform. This makes sense.

Bitmex on the other hand has done little to no changes with their platform. Not that it really needs any of these bells and whistles. It would be nice though to have some advanced optionality features that Deribit is now providing.

Cryptocurrency traders in the space have advanced a great deal. It will keep advancing at a rapid pace. Any platform that does not keep running will be left behind. Deribit seems to be keeping up, but Bitmex is falling far behind. The crypto ecosystem stops for no one…

Government attacks on leveraged platforms…

Bitmex is in real trouble as their creators all seem to be looking at prison time. The platform itself is just sitting their gaining dust, which is a real shame. Bitmex was originally the best derivatives platform in the crypto space. It seems traders are now shunning Bitmex. I guess due to all of its legal issues.

It is Bad enough the U.S. government went after Bitmex. The odds are they will look to attack other dervivatives platforms in the crypto space in my opinion. You have to understand they are systematic and don’t understand freedom of choice. There are no borders in crypto so they will attack overseas platforms and claim juristiction. They can do this because over 50% of the users in crypto are American.

The U.S. government is simply trying to protect its monetary system in respect. Controlled heavily by Wallstreet interests/lobbyists. We will see increasing regulations in this space for certain. All of them again will benefit the Wallstreet interests. That is life!

There is very little one can do. We are peons. But we are the masses. The nature of blockchain is too big to stop us, DEFI proves this. We keep growing asymmetrically. Leaving Wallstreet/Bankers/Governments scratching their heads. You can’t stop the future! FREEDOM! That is what crypto is all about. It is a losing battle without containment options for them. They have lost, they just don’t see it yet…

Bitmex versus Deribit Conclusion…

Overall, Deribit offers users ultra-fast transactions, advanced perpetual swaps, and enhanced trust and credibility. On the other hand, BitMEX provides users with a seamless user interface and TONS of liquidity. As things stand BitMEX still remains the market leader, update 2021, no longer the market leader. Their UX and the available liquidity is much better and this is a make or break factor to many. The liquidity issues of Deribit make it a bit dangerous to trade there. As you never know if a trade might get filled or not. Since 2021 Deribit no longer suffers from the lack of liquidity according to a large base of their users.

On top of that, it is a vicious circle as if the UX is hard to get for the masses. The lion’s share of leverage traders will stay away. Hesitating traders results in low liquidity. Remember that low liquidity is feared by pro traders. They would actually make use of the platform. However, if Deribit can overcome the challenges with UI and liquidity it’s might become a real challenger to BitMEX. Right now it is a pretty boring competition. We would need to see how Deribit would perform in the conditions BitMEX faces.

To end this. I would like to state my disappointment in Bitmex once again. I guess Bitmex was only in it for the money. Not to advance the cryptocurrency space. Well, that is too bad, you had the best-leveraged trading platform. Can Arthur make a comeback and set things right!? I sure hope he tries his best to. We don’t know the outcome of the charges or the case.

Men or Mice?

I think if he and the cofounders of Bitmex really tried they could bring back Bitmex from the dead. At least that is my hope. Maybe I am wrong and they are just money-grubbing losers who will go in hiding and ditch the space for good. Let us hope they are better than that.

Derbit, good job!

This little Netherlands company keeps adding features and keeping its platform solid. The number of users continues to grow and they are doing a good job. The Dutch have always been good business people and it seems they are once again proving it with Deribit. The options section of the platform is expanding along with trading assets. So keep an eye out for this company in the future!

In January and with the product in progress, we will chat again, do you think it’s okay? While I buy more DGTX Tokens;)

Yes, sure – I have Digitex on my radar, just never liked the company behind it.

Digitex Futures (DGTX) will destroy these two exchanges sooner or later, read about 😉

Sounds good, oh but then we woke up and joined reality lol. Fanciful ideas and hype don’t make exchanges, the quality that went into Bitmex still has them second to none, the manipulation and gaming of their platform is the only drawback. Show me an actual working product/exchange, not just an idea of ICO token pushing, as the more competition the better 🙂