In short ICOs are REKT… Period, end of story… How did we get here? What can we do to FIX IT? I have spent the past month doing a deep dive into many different matrices of ICO prices/holdings. Along with how the ICO companies are progressing with their plans… In doing so I am left disgusted and dismayed of the pure greed and absolute fraud-ridden landscape. This makes up our current ICO space.

Table of contents

Many ICOs were nothing more than money grabs by greedy, well-spoken liars. Leaving many REKT people behind them. Hence, with the realization of the downward one-way ticket to ride. Many of the ERC-20 Tokens. Along with the magic unicorn Ethereum that shat out these magic poop coins. Smart contracts? For who? Smart for the ICO teams/sellers who raised funds, maybe, but not for the investors/hodlers of the tokens.

You think they got REKT? The majority of these ICO companies will slowly sell their ETH at some point going forward and simply fold/vanish/disappear. Only a very minor few will survive the ICO apocalypse as each of them turns into the living dead… Etherum is a poisoned well of this coming ICO apocalypse IMO.

I will share with you below my thoughts findings and a solution to pull Ethereum back to shining star status. Btw if you are an anonymity nut, well phuck off this article is not for you. Privacy is one thing, but anonymity is the calling card of criminals/thieves in business/money.

The fundamental problem = NO ACCOUNTABILITY!

That is the real problem of the current ICO market: there is no accountability. Hence, there are a high number of scams and shams with the ICO promoters and teams whose alignment is not the same as that of their token holders. The path to REKT!

Sure, many ICO teams would love to see their token value increase. They do have stakes in said tokens. They get the funds raised and equity in the coin along with unregulated control. This allows them to exact their will on the marketplace.

I am horrified by just how many of them view their token holders as not investors but rather just REKT donors, free money for their storytelling skills. The problem is that they promoted their ICOs as investments.

–> INVESTMENT <–

The keyword here is not as a donation as the Breitmans of Tezos would like you to believe. This attitude is why many of them will end up in court and even possibly prison. These actions are the bedrock of what is killing Ethereum and leaving the ICO marketplace REKT, too.

*** PLEASE NOTE – Some viewers may find the further reading of this REKT article disturbing. Discretion advised!

At least with a handful of sh*t, you have something, with ICO tokens you don’t even have that…

Yes, that is right, owning tokens, in the vast majority of cases, you have no equity/voting rights or anything but a token; in many cases, they are not even exchange-traded as the ICO companies are often too cheap even to list them on a liquid exchange, to add insult to injury many of these projects are not even bothering to create the product/technology they agreed to in the first place. In short, they have the money, and you have their REKT empty promises. That is why, in the future, and as you read further along in this article, there is a need to tie the token to equity/rights in the ICOs outside of the purely conceptual nature it resides in now. Let’s take Reggie Middleton, CEO of Veritaseum; he stated emphatically in his Telegram chatroom:

“One more time, buyers of our VERI tokens are not investors in Veritaseum. You have purchased our prepaid fees and expenses. This was clearly stated and outlined in the documents that you agreed upon purchasing the tokens from us.”

Terms VERI

How many fellow CEO’s of the ICO landscape think this way!? Veri Veri scary, pun intended lol. If that is not bad enough Reggie wishes to bring back E-Gold which he now calls VE-Gold, uhmmm Reggie E-Gold was shut down by the U.S. government long ago, so you might want to rethink that! I wonder in the future how long it will be until we see him and others in court, all a ticking time bomb to me, fast track to REKT…

Many ICOs think of our investments as donations…

That is right. Take, for example, Tezos, run by a nerdy couple of puppets who were at the strings of cutthroat financiers, hence all the lawsuits against them. But they likely will pay off the government. Recently, they tried to have the lawsuit in the U.S. dismissed on the basis of their ICO being just donations—a $232 million donation, lol. It would be sad if they got away with this, as it could leave many REKT.

Then they wonder why they are being sued!? The judge denied that, and he probably was rolling on the floor laughing in the back of the courtroom for an hour, which is my bet. Yes, many companies are using the unregulated nature of the blockchain just for money grabs.

Worse, they still own large amounts of ETH from their raises that will be in future supply in the market. Many of them will fold and exit the space because they really had no other intentions outside of getting paid from the hype that occurred in the past. Imagine how this played out.

You are an ICO and come out with a white paper/coin/team, etc, raising a large sum of ETH, which in the past was valued at much higher price points from investors = REKT; you then take those funds and resell it over time into the market back at a lower price, along with in many cases they will liquidate their own coins as well. All of this adds insult to injury with no product or completion of their stated goals. But look on the bright side! We people in the crypto space are SUPER CHARITABLE!!!

Many ICOs, if they do complete their projects, produce crap, hence validating their Sh*t Coin Status…

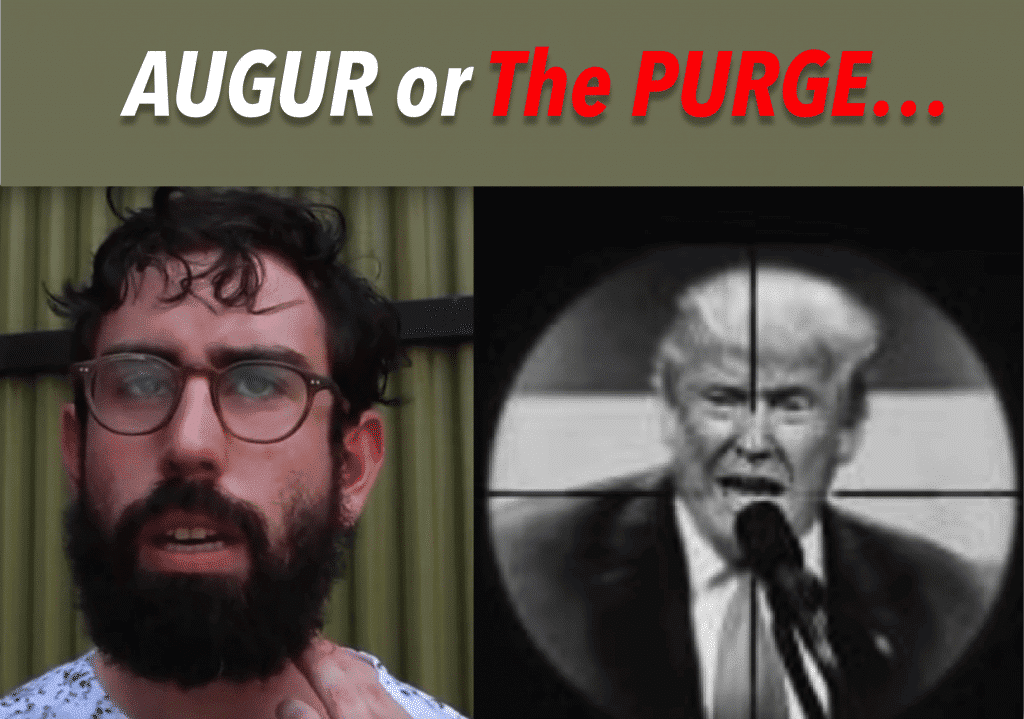

Augur is another REKT horror story that, too, is in court. It is worse with its project, which took over three years to get a beta of its platform out!? It is horrible ALPHA-quality code that teenagers could have programmed.

They also figured out somewhere along the line that they could not have the predictions marketplace because they would be sued. Now, Augur markets itself as a protocol alone—that’s a great vision!

So here again, in my opinion, we have an example that reeks of a money grab and pure incompetence. When financiers back fools, like with Tezos, you get these REKT kinds of results.

Read this article on Cointrust and this article on Bitcoinhivemind if you want a further understanding of how sad this is. If that does not beat all, then take a look at the quality of the people involved, such as Liston, one of the founders of Augur!

This article on Business Insider looks like REKT puppets of financiers to me. Worse, they produced assignation markets, which the president of my country is on!? Oh man, that p*sses me off, and I hope the U.S. government has some words with them in the future.

Look, Ma, I am THE FED! I can just print more TOKENS!

Once again, this shows just how bizarre and corrupt the space is, with no regulation and oversite to be found. Example of how corrupt the space is. We take a look at Edenchain. Who, I guess, took their name literally with the garden of token creation, too.

Oh hold on, it gets even better, look at Envion who raised $100 million, Nioooocee! Later on Matthias Woestmann, CEO of Envion was locked out of the project by his own coders! He then created a website to accuse the other team members of creating the additional tokens.

Along with all the problems caused. Read the statement by CEO Woestmann – yet later, with a court ruling, we find it was he who created the tokens instead! “REKT ENVION COLLAPSE“

WTF! REKT! After reading, you don’t think trust; you think REKT. I just get the urge to run! Ironically, both groups printed 40% of the additional tokens. I wonder if they use the same coders. Do they not know the dilutive effects and what a bad precedent this sets!? Do they even care? How many other ICOs will just print more tokens, or who knows what interesting schemes they will come up with to feed the greed? It is not like they have to answer to anybody and certainly not their investors, oops I mean REKT donators…

So, How do we Fix this and move Forward?

Consequently I can rant all day about all of the atrocities I have seen in the REKT ICO space along with the damage I believe it will have on ETH with lingering effects out into the future.

“Vitalik Buterins biggest failure was his success… = REKT.”

I will not be participating in ICOs in any way, shape, or form until they are restructured in the future to offer token holders real value. It is not hard to fix the problems, though many won’t like this, mainly because it aligns with the government’s ideology.

Simply put, the space needs to mature or die. These are smart contracts; let us make them really smart. Right now, they are not; they are mindless to-own contracts. People are no longer buying the hype of the ICO market. It is a wreck on the side of the road, of which most just gawk at in passing. The four fundamentals of a TBO are below.

TBO = Tokenized Business Offering.

*which comes with

- Equity Rights

- Voting Rights

- KYC

- Taxation

There are a few other elements we can add here to the TBO. Four key ones are what really matter, for both the individual and government. I discussed/debated with the Kay the CEO of Spectre the past few weeks my ideas/finding of the ICO space, being he is a CEO of an ICO who I still hold in high regard, mainly because they took a dying asset class/marketplace full of corrupt players and with blockchain created a fair marketplace for its users.

He, too, is dismayed by the REKT space and wishes for it to correct itself in a grand fashion. Why can’t it? Blockchain, if you can imagine it, you can create it, or correct it.

Thus, blockchain is, in its pure nature, freedom… The freedom to correct and improve with great speed even. Kay has a pedigree/history being from the FinTech space, not just some kids/random people with an idea and backing from viperous financiers. Though even with his company’s ICO raise, he admitted one of the same fundamental flaws, that those who bought their tokens own nothing of the company, though that is certainly not his mindset or actions, as he holds himself accountable and acts with fiduciary responsibility, that just about everybody else in this REKT space does not.

The problem is

“We own a token.”

However no equity, No rights, just a REKT token… Which to me really sounds like more of a donation. So my mindset now is just that, and I have donated enough!

I believe in a tokenized company like Spectre, along with their vision, they hit their goals and live by their words, though they still suffer from that fundamental flaw of the ICO.

With the actions of many others who are not like Kay, I am stuck with this picture in my head of ICO CEOs/Teams busy at home binge-watching Netflix and smoking a spliff. The Image of Augur specifically pops in my mind, lol. Many ICOs mean well and are far from a scam. The TBO structure will allow legitimate projects to succeed and eliminate poor projects from ever starting in the first place.

To end my Rant with a Conclusion

This article has been more of a purge for me of the toxic buildup brewing for the past months, and it has to be said and released from my system. Hey, I am an optimist. Maybe some of these companies will produce something great that we just can’t see happening yet.

This is likely due to the sheer amount of crypto everybody threw at them alone. Remember, ICOs can be fixed! TBOs, as I will refer to them, are the way.

TBOs are not ICOs/STOs; again, both are conceptual, even if the latter has a few more transparencies to it, though with TBOs, you can have a bit of built-in leeway, depending on the teams’ desires.

You can classify TBOs into two tranches: startup TBOs that are STOs and have no traction and TBOs of existing private SMEs that don’t wish to access traditional equity market channels (an example being a well-to-do family office that wants to tokenize some of their equity, which is great for the space).

We need only change our focus and look for a solution to what obviously is not working. As the space matures, we must grow up and leave the hype/foolishness behind. Concepts/ideas alone are not good enough to be worth money. I want cold, hard equity/rights and accountability! Too many of these goofballs run amock because they have nobody to answer to; that has to change, or else enjoy the sh*t show. I, for one, will no longer be watching; it’s time to change the channel.

Frequently Asked Questions About ICO Scams

ICO scams include Ponzi schemes, where returns are paid to earlier investors using the capital of new investors; exit scams, where promoters vanish with collected funds; and fake ICOs, which mimic legitimate projects to mislead investors. Scammers may also employ tactics like promising high returns with little risk or using fake testimonials and team profiles to lend credibility to their fraudulent projects.

To identify an ICO scam, scrutinize the project’s whitepaper for originality and detailed information. Research the development team’s background and check their digital footprint on professional networks like LinkedIn. Be cautious of projects promising unusually high or quick returns, and verify the legitimacy of the hosting exchange platform. Projects lacking in clear communication and with anonymous teams are red flags.

Protect yourself from ICO scams by conducting thorough research before investing. This includes understanding the project’s whitepaper, examining the credibility and track record of the team, and checking for independent reviews. Diversify your investments to minimize risks, and always be wary of any investment opportunity that requires you to recruit more participants. Avoid projects that lack clear information or rely heavily on marketing hype without substantial backing.

I stumbled upon your blog post by accident, and I’m so glad I did! It’s rare to find such high-quality content online these days.

I wanted to thank you for this excellent read!!

I certainly loved every little bit of it. I’ve got you book-marked to look at new stuff you post…

I totally agree with everything stated, but it has to go further than that. Which means setup cryptosecurity division which can trace hackers and scammers in the cryptocommunity, so we can feel like we can deal fairly and safe with our decision.

This would provide some confidence to the new cryptians that wish to invest, feel somewhat safer.

Well done – it was about time someone had the balls to spit this out! 5 Stars from hre – and thats rare!

Yep… agree wholeheartedly… thumbs up emoji.