The Reason why you always blew your account

Whether stocks, cryptocurrency or forex trading, the top thing that most of them don’t use is “money management”. This is more important as this topic is your risk management. The risk-reward ratio is not the best in the world of binary options and the traders need not only an exact rule-based strategy but also protection of the capital. The losses can come in series, even with the best strategy, and so the trader must protect a particular amount, so he won’t get thrown out of the place, once the time has come to recover from the prior losses.

Smart options trading is an investment and not some kind of gambling. You can make money here, but discipline and patience all over the trading day are mandatory.

With our plan to protect your money, you invest a certain percentage of your capital and try to stay on the good site where your profit exceeds your loss.

Losing your profits and reducing your winning numbers can be a tough game mentally. But the answer always lies in your percentages, the numbers tell us if we have a winning strategy for the current market conditions. The high returns are teasing and therefore it is even more important to use a small limit for your maximum success. Many brokers are suggesting 10% of your capital, but you can’t just say it like that. Inexperienced traders will lose their shit quickly.

You need a money management plan for your trading strategy without risking your account all the time. Additionally to the rules you find below, it is important to put a stop loss for you. For beginners, something like 5 winners or 2 trades losing is a well-balanced way of trading. The trading amount is crucial to make everything work.

Don’t worry, we got you covered. Save, print and laminate this money management cheat sheet. Then glue it on your desk and follow.

Oh – and if you decide to stay without any money management rules, we have the right song for you:

Money Management the nerd way

Money Management

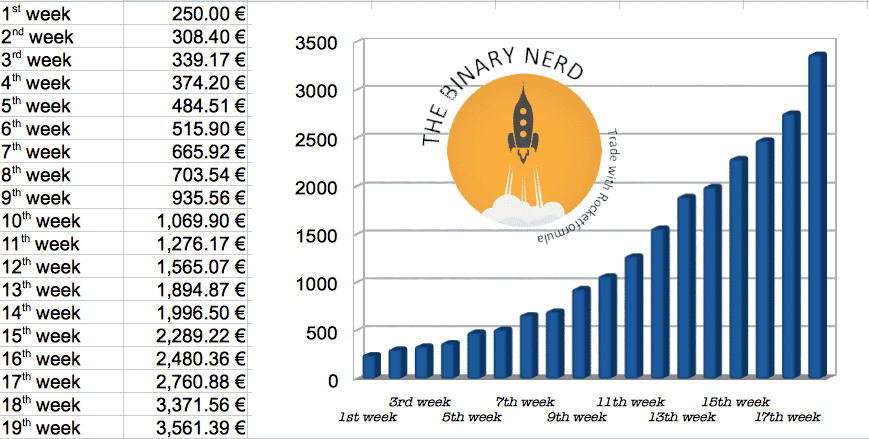

A Money Management System built per asymmetrical exponential growth projections

There is no quicker way to blow your account than through a bad money management. The volume of your trades must correlate to the size of your account.

This ruleset is a scientifically proven way of money management that will help get you through stormy weather without turning belly-up. We provide you with the roadmap – you just have to stay on the route.

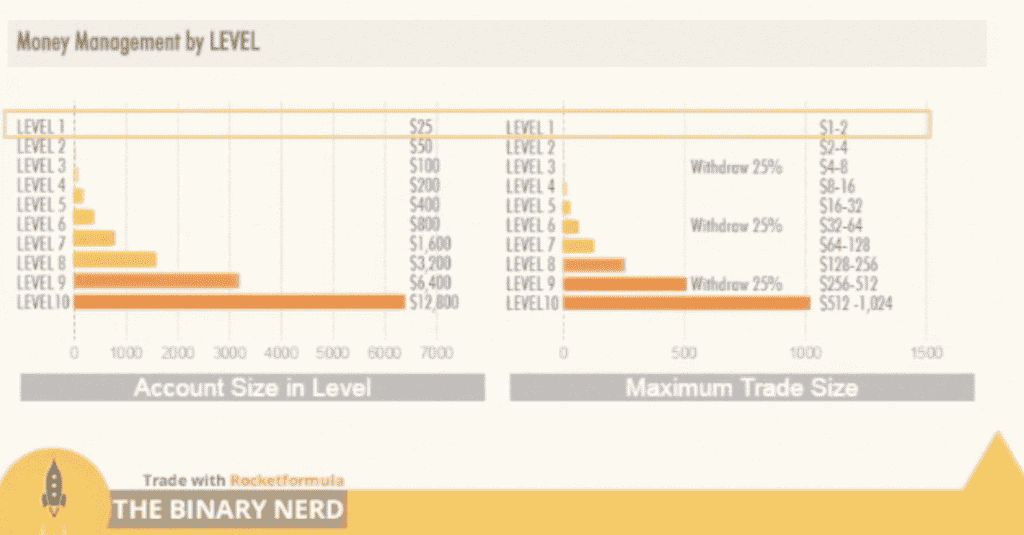

Level 1 $25 = $1 to $2 a trade

Level 2 $50 = $2 to $4 a trade

Level 3 $100 = $4 to $8 a trade Bank / 25%

Level 4 $200 = $8 to $16 a trade

Level 5 $400 = $16 to $32 a trade

Level 6 $800 = $32 to $64 a trade Bank / 25%

Level 7 $1,600 = $64 to $128 a trade

Level 8 $3,200 = $128 to $256 a trade

Level 9 $6,400 = $256 to $512 a trade Bank / 25%

Level 10 $12,800 = $512 to $1024 a trade

The Ruleset

1) Every 3 levels up you can take out 25% and go back 50% of the previous level at the next touch you keep going forward.

2) You can trade 50% of the size at any one level if you don’t like the market conditions or trade.

3) You can trade 50% of the size till you pass. 50% or the halfway mark to the next level.

Example:

You can change the levels to fit a % per trade example instead of $25 trading 1-2 a trade you can change that to maybe $50 or even $100 if you want to be conservative.

If you lose a level, that is ok. You trade back 50% of the prior and if you advance, you can double on each level. The win rates depend on the stake size, so if you are starting out and win rates are low, then use 1-2% a trade. If you are more experienced, use 2-4%. Most likely a cap at 5% is reasonable.

The main point is to be disciplined to follow using money management and learning to trade levels like a video game.