Algorithmic trading schemes. The are widely used in traditional trading. Firstly starting in the 70s & 80s. Stock markets integrate automated digital tools. Thus to facilitate the traders’ experience.

Thus, today, 90% of stock trades are algo based, according to JPMorgan. It’s obvious. Machines are way better in monitoring rates 24/7 and making swift deals. You know, reaction matters.

But what about the crypto space? Being even more dynamic. Indeed never stopping traditional exchanges. Inherently, this industry faces a number of concerns related to automation.

What are the reasons? How does algo trading work? How for cryptocurrency? What are the pros and cons? What approach for experienced market players? Let’s figure it out.

Questions to ask yourself:

Firstly, why do you want to use Algos to trade?

Secondly, where will you find/get these Algos?

Thirdly, how will you use the Algos?

Lastly, how will you maintain/optimize the Algos?

Table of Contents (click to expand)

Three Sides of Algo Algorithmic Alogorithms in Trading

In a nutshell, algorithmic or automated trading stands for making deals using specially-programmed software. Most of the pro traders have certain plans or strategies. As follows, e.g. open a long position when BTC below $10,000. Set a Stop Loss at $9,500, and take profits above $11,000. In short, this and other strategies are algorithms that a user can input in the program to automate execution.

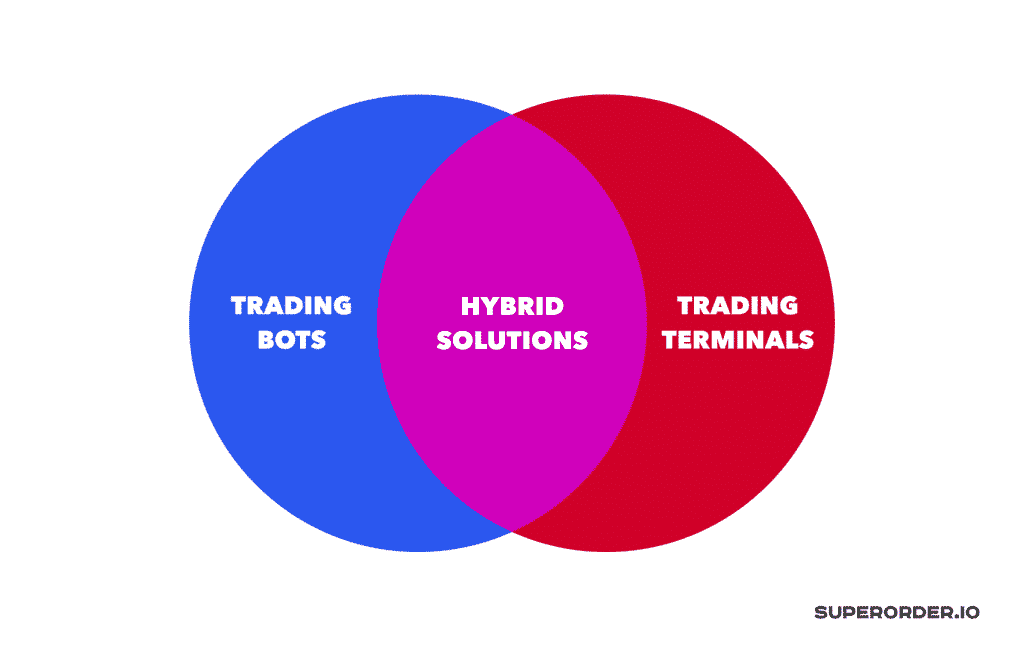

Algo crypto trading has three main incarnations:

- Automated bots.

- API-based terminals.

- Hybrid solutions.

Moreover, there are modern algorithmic systems. Many are based on machine learning and AI. Above all, they provide for predictive trading. This means users don’t have to create specific strategies. To enter the markets.

Instead, they should develop or purchase a preprogrammed solution trained on Big Data. Despite the lucrative potential, such neural networks are in the nascence stage only.

Now, let’s look at three key algo trading options.

Bots

The most famous approach is based on automated programs. That trade on your behalf. Bots connect to crypto exchanges using API keys. To track market conditions.

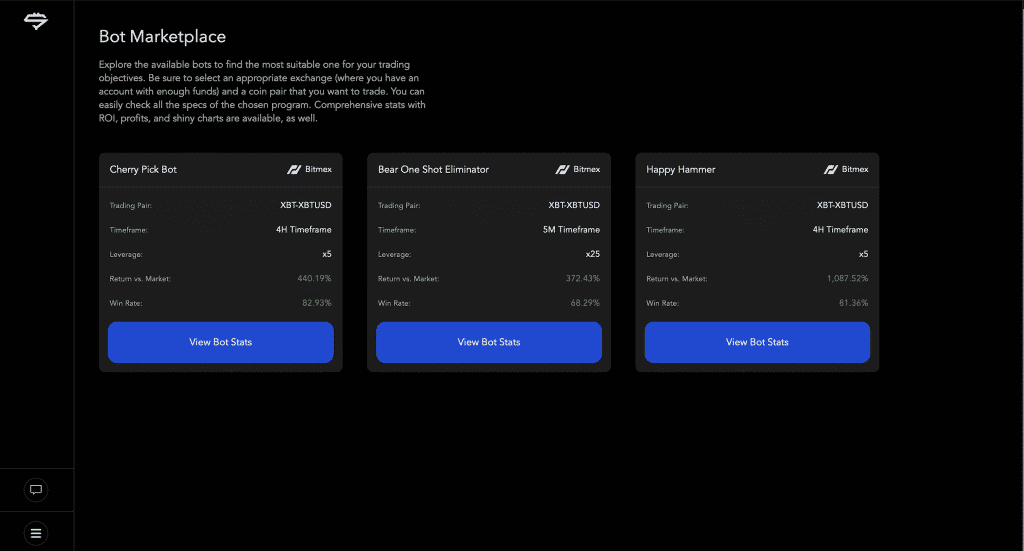

Thus executing orders once the required condition is met. Usually, each bot is designed for a specific exchange or coin. There are also universal tools one can use.

Moreover, there are two types of bots:

- Preset. Algorithms are hidden and traders can’t change them. Developers – provide excessive info about trading conditions, in this case.

- Customizable. Users can change or set their own trading strategies while the bot – brings them to life. Often, these programs require coding skills.

Additionally, these algorithms or algos as we call them differ by strategies used. For long or short trades, firstly for trend trading or day trading, secondly for scalping, for arbitrage, etc. Blockonomi has a comprehensive guide dedicated to crypto bots. This outlines their differences, pros, cons, and use cases. Check them out to find a few examples of solutions.

Terminals

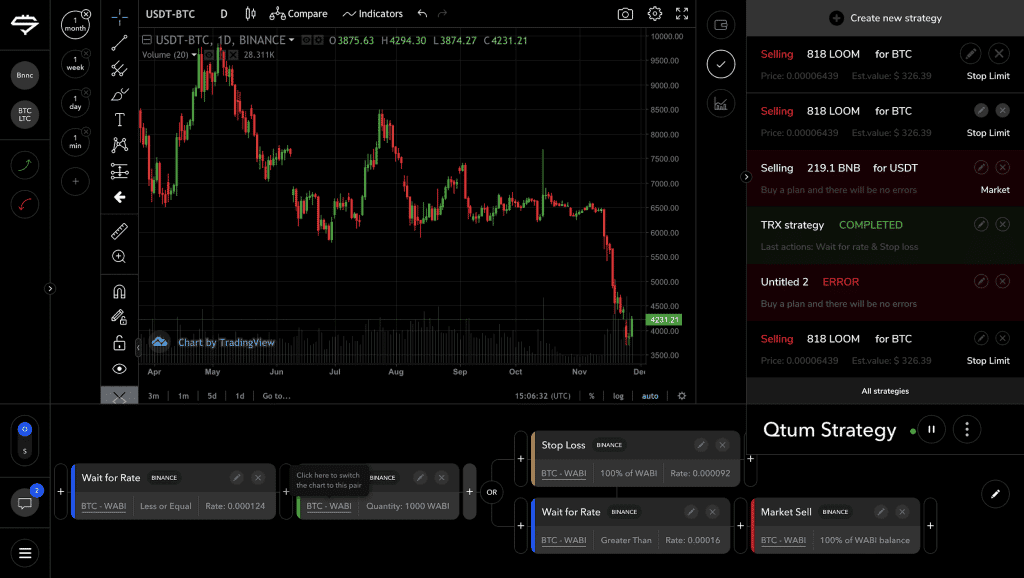

Unlike bots that are focused on automation but work with only one or a few exchanges, crypto terminals opt for the opposite. These platforms also use API keys but connect to dozens of exchanges simultaneously. They allow users to make quick deals by accessing several markets from one place. In addition, traders can access other tools like coin trackers, portfolio managers, etc.

Another distinctive feature of terminals is based on expanded functionality. While even the leading exchanges like Binance and BitMEX offer only basic orders. Terminals support advanced stuff: Trailing Stops, logical operators, hidden orders, and more. If you’re interested in this type, check out Superorder, Kattana. Be sure to do your due diligence before paying for any service.

Hybrid Platforms

Finally, with the algorithmic systems, there are systems that combine features of both terminals and bots. Knowingly, they support automated trading at several markets gathered under one roof.

To whit, hybrid systems are the most powerful but require solid skills from developers. That’s why they’re still rare and valuable for crypto traders. The team started with creating a simple API-based crypto trading terminal but added automation features.

For instance, users can build their own strategies and launch them on the connected exchanges. Also, Superorder supports preset bots that don’t require designing strategies at all.

Major Advantages of Algorithmic – Algo – Algorithms

Automation can bring trading experience to a new level. Without a doubt, you may be interested in the key benefits for pro traders:

- Error-free and emotion-free. A machine is a perfect executor. It lacks creativity in the good sense so it can’t move away from the predefined plan. As well, algo systems reduce various errors related to mistyped amounts or coins.

- Expanded functionality. A crypto terminal is a viable choice if you want to find new solutions. With advanced orders, it’s easier to define elaborate strategies. Simultaneously, all the tools in one place help to focus on the process.

- More time for analysis and/or rest. Bots and hybrid algo solutions take care of routine stuff such as rate checks and trades. Thus, a pro trader can dedicate more time and resources to market research or leisure.

- Nearly instant speed. Compared to common traders, bots and terminals are way faster. They are able to make deals in milliseconds to catch the required price or fill the order. It’s just impossible to outpace them without other machines.

Possible Issues and Pitfalls of Algorithms

Well, algo trading can be extremely profitable in the master’s hands. It benefits professionals, without a doubt. But there are a few drawbacks you should be aware of:

- Need for maintenance. Often, users rent a bot and forget about it. Algorithms don’t work in this way because of high market volatility. Thus, remember to check strategies regularly to tune them or get other bots.

- Scams and frauds. Most sadly, there are companies that just cheat on users. To avoid problems. Conversely one should conduct careful research and use algo systems that provide a free trial. Thus, you can ensure efficiency and trustworthiness.

- Tech issues. As long as bots and terminals interact with centralized exchanges, they’re vulnerable to disconnects, hacks, and data leaks. Remember that 100% reliable software is only a dream, as for now.

3 Indicators to watch for in the future

Firstly, we look for Big name investors.

Secondly, we look for Big name institutions.

Thirdly, we look for Bank.

Lastly, we will see the governments bend to the will of the crypto future.

All of this will end with Bitcoin above 100k or even 100,000,000 🙂

Final Takeaways on Algorithmic – Algo – Algorithms

Algorithmic solutions and, particularly, next-gen predictive services. These can reshape the whole trading layout. Algos will not replace humans. They will not take over the world. They will not show up like terminator robots. To end our existence as we know it. Though they can help us inprofitability for trading.

Thus, we must state their importance in the future of trading. Algos are the future of trading. We know this, it will be. Going forward you will see this.

We can see this occuring all around us over and over. Repeating itself in algorithmic rhythms, letting us know the future. We only need to put our ear to the ground. By doing so we dare listen to our future.

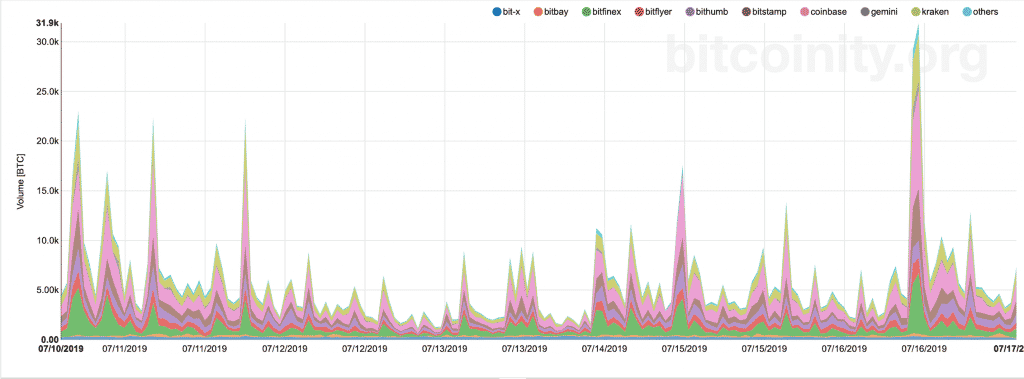

Even now, analysts from Bloomberg connect the rise of crypto markets with the higher popularity of algorithms, as Cointelegraph reports. The more institutions invade the space you will see this.

It’s impossible to predict the future of cryptocurrencies. But algo trading has bright perspectives to stay. It’s almost indispensable for professional active traders so be sure to try one of the mentioned projects. Good luck!

An fascinating dialogue is value comment. I feel that you need to write extra on this topic, it may not be a taboo subject however typically persons are not sufficient to talk on such topics. To the next. Cheers