Crypto Taxation… 🙁 Two words to crypto traders that are as bad as F__ You! It is not surprising that with the rising volume in crypto Uncle Sam spreads his embracing arms. And looks into our pockets greedily.

As to reach out for the due taxes on your Bitcoin & Crypto earnings. Recently the I.R.S. has closed the last loophole. Now we all know tax evasion is an even worse crime than blowing up a Kindergarten… So we should take this seriously.

Table of Contents (click to expand)

Crypto Taxation the full story…

The tax act in Sec. 13303 amends IRC Section 1031 (a)(1) to delete “property” and replace it with “real property” … So, you can see that now I can no longer take certain positions. As my Bitcoin to Litecoin exchange was a like kind one under Sec. 1031, and I have to recognize the gain when I do it.

U.S. gov taking advantage

Source: Fortune.com

The new tax law, issued by Trump, will treat capital gains coming from Crypto as a taxable event. Meaning that for every single trade. So if you trade-in, you trade out = tax to be paid for the trade. The bad thing is in the past, you put fiat into Crypto, and made your trades. Then you withdrew to Fiat and have been taxed on the achieved capital gain.

Due to the loophole closure, you may pay taxes for each of your trades. Buying Ethereum worth of $1000 with your Bitcoin funds and exchanging it back to Bitcoin after a 25% rise, will make the value gain of $250 taxable – even if you leave your gains on Bittrex or another exchange. The capital gains tax applies now to every Crypto trade you place. Obviously, the base of this calculation is made in USD. Other countries like India also followed a similar model.

Don’t be turned off by taxes

Despite the taxation, Crypto still offers insane returns – but yeah, you have to forward a part of the cake. It might seem to be unfair, it might hurt, but at the end of the day paying taxes might increase the overall wealth within the country you are living in (OK, well. that depends – we are just trying to stay optimistic). With all that mess you will need good tools to stay up with the paperwork. If you trade like a mad monkey, it might get outta hand and become difficult to be able to provide the needed documents. Imagine that 50k row Excel file for a year of trading – your tax accountant will just love you (and shit into your mailbox once he leaves).

Portfolio Tracker to the rescue!

Gladly, we recently discovered and tested a Portfolio Tracker. This great tool, which we can say it is the best one money can buy. Cointracking.info is a German quality project. Tidy coding and dry, but clear graphical user interface. That will not only help you to estimate your success and growth on your Crypto trades.

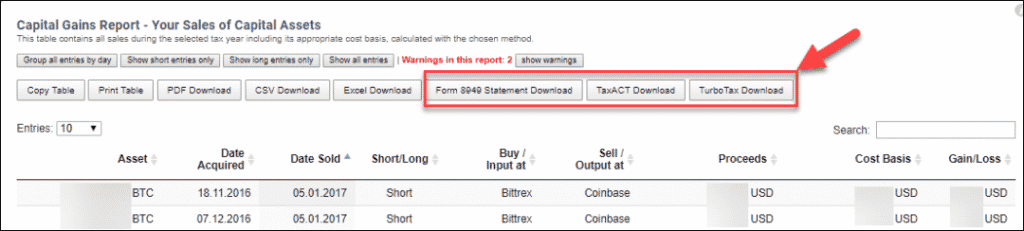

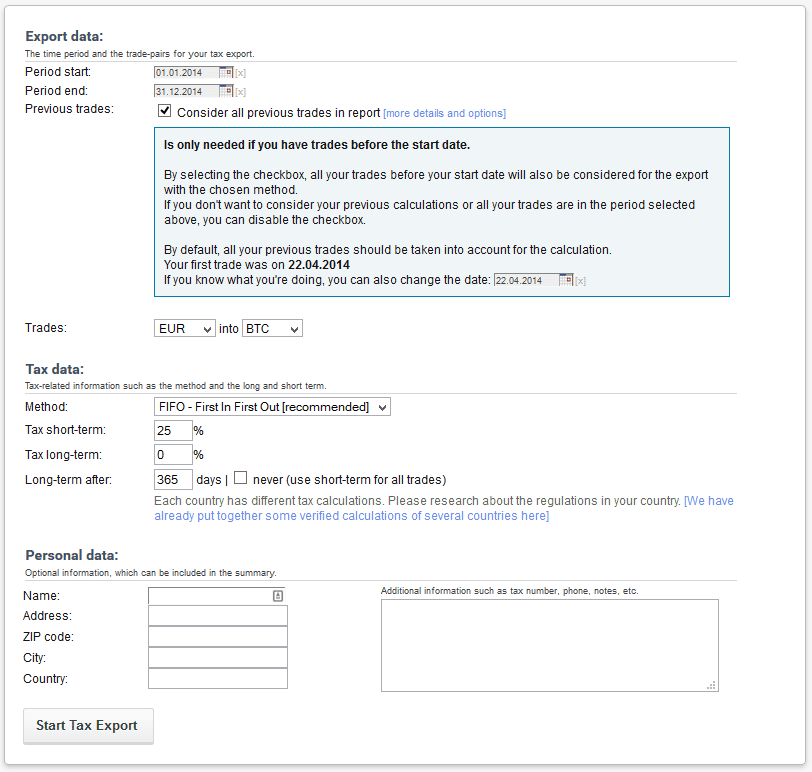

It also will provide all the needed data for your tax accountant (clean mailbox, yay!). This portfolio tracker helps you to track your profit/loss calculations and provide the needed data for the crypto taxation declaration. You can download the report as PDF, CSV, Excel, and especially as Form 8949 Statement, in TaxACT and TurboTax format.

According to the methods FIFO, LIFO, HIFO and LOFO. CoinTracking calculates all your trades exact to the cent and prepares them automatically.

So that they only have to be attached in the tax return. Our tool is designed to adapt to the laws, financial statements and forms of different countries. Such as Capital Gains, FBAR, Form 8949, the German tax declaration and many more. Making the crypto taxation you face a snap!

Cointracking.info

In conclusion…

Cointracking.info can be used as an Android and iOS App or per their web app directly in the browser. You can put your trades by hand into the system. Or whichever is way better and more comfortable. Connect the exchanges via their API to Cointracking.info.

Other than most portfolio trackers. They also offer almost all the exchanges you might ever have dreamed of connecting. We didn’t find a single exchange not available, though we don’t know all. However, we can guarantee that all the big names are available. Crypto Taxation

Click, Connect, Import – it is easy as that. Once your trades are imported you will see the profit/loss ratio. Then the realized and unrealized gains. This tool takes away the headache of providing the reporting for your government tax agency.

You will be able to deliver a ready capital gains report to the tax office. The tool offers multiple variables to be able to provide the report for most of the other countries as well.

For now, you can start with the free edition. 10% discount here for the full edition! to test out the waters. Again, Enjoy!