Which of these Crypto Gems will fly!?

Crypto Gems are in style! With trading, you can gain first-hand experience in market dynamics and also economics at work. A beautiful example of how to translate economic cycles into price development can be spectated in crypto as a particular pattern very often: The price is trading sideways for some time with small movements between the bands. Then a sudden breakout happens, turning the sideways movement into an uptrend. You saw this behavior before? Chances are you have seen an example of accumulation and distribution.

An example for accumulation / distribution

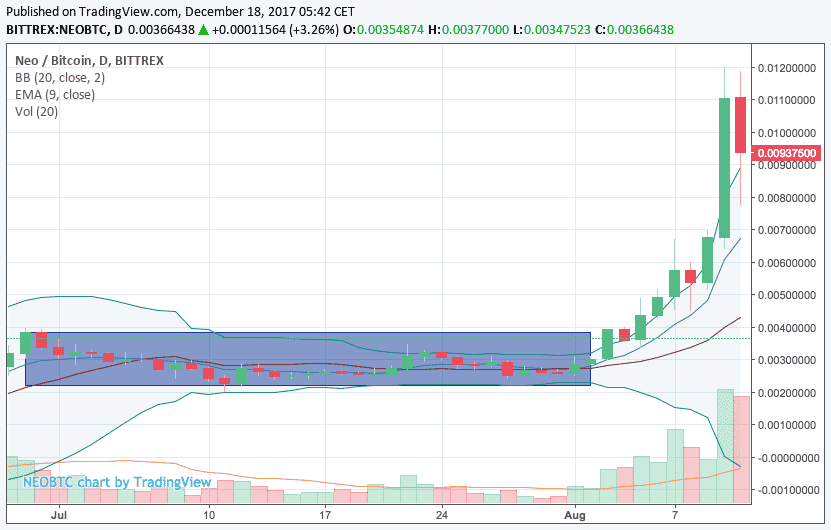

Please have a look at this $NEO chart below for an example:

This consolidation phase was pretty long. $NEO, that top coin it is with many fans all over the world, did not do anything for weeks (this is a daily chart). You can see it has moved in low range from the lower band to the upper band to the lower band – then breakout. Many people had bags full of $NEO and where waiting for something to happen. The weak hands sold, as they got impatient, the other guys bought more on the dips and accumulated holdings. No matter what Crypto Gems you hold you are likely to catch one BIG WINNER sooner or later.

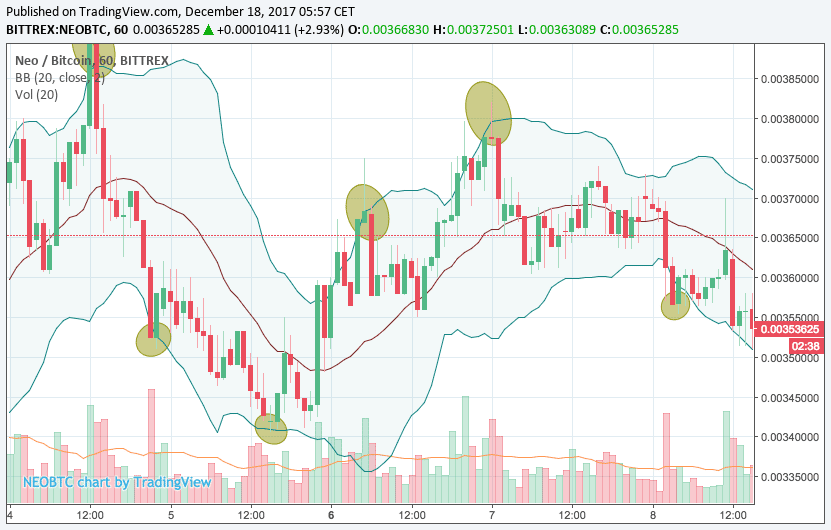

Accumulation means to increase your overall stakes on a particular asset in chunks, whenever the price gets down. Some more experienced traders also buy at the lower band and sell on the upper band to increase their equity for this accumulation process, as they suspect the price to be ranging for some more time. This way the buy power of larger investors increases over time and the up spikes will become bigger. They accumulate more and more buying power, until they buy with the total accumulated wealth to ride the breakout wave. If you take a look at the chart on the hourly, you can see the action at the bands (there are better examples, but you get the idea):

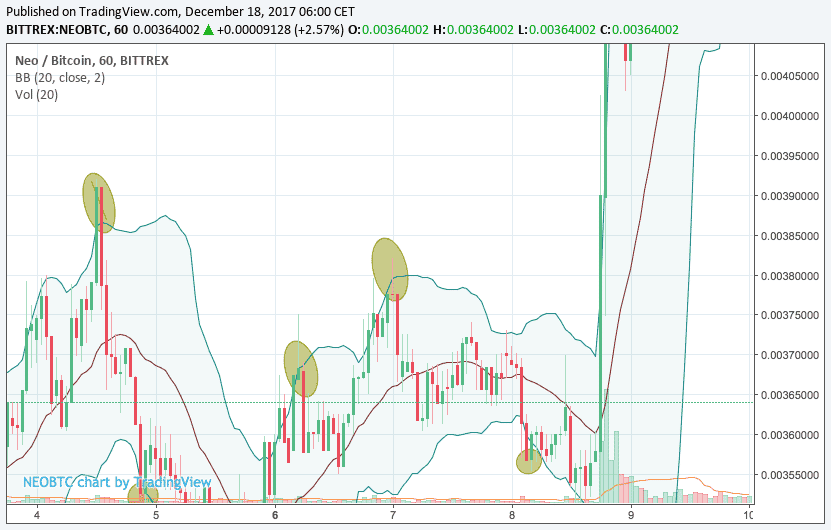

And then – boom, mars mission:

Of course, you can’t make a rule out of this and accumulate on every coin that is simply ranging. Firstly it is important to know, that is very likely, that after a consolidation phase a breakout will happen. Unfortunately, thus can happen southwards as well. However, in crypto the nice thing is, that people buy and sell pretty emotional. You surely heard the saying “Buy the rumor, sell the news” – this is nowhere more true than with crypto. Most accumulators are knowing that some news will come, which works as catalyst and empowers the price to breakout. I repeat many Crypto Gems can have like charts, so keep this in mind.

This can be from publicly announced news, insider informations or simply rumors spread in forums and channels. It doesn’t matter if those are true in the first place. Sometimes fake news getting spread and it pushes prices to orbit (see: $EMC2 Apple rumors, $NEO China rumors, $OMG Google rumors – all have not been true). The thing in such a case to get out at the right time.

Another, more advanced approach for experienced traders is it to check for their crypto gems in a downtrend, that come with a good buying volume. This is a nice signal that it could turn soon. Side note: increasing buying volume within a downtrend is called divergence and we will have another article up soon, where we explain this more in depth.

Crypto Gems: Finding the right entry point, if you missed the accumulation phase

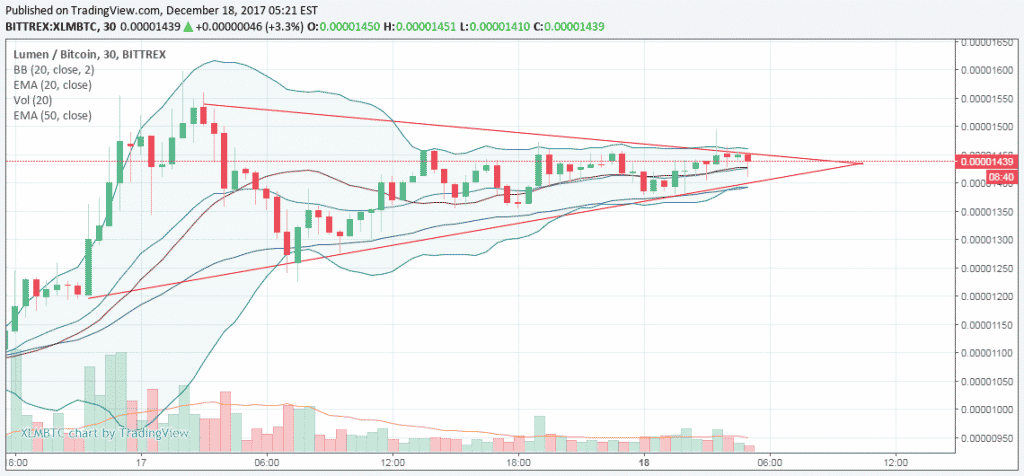

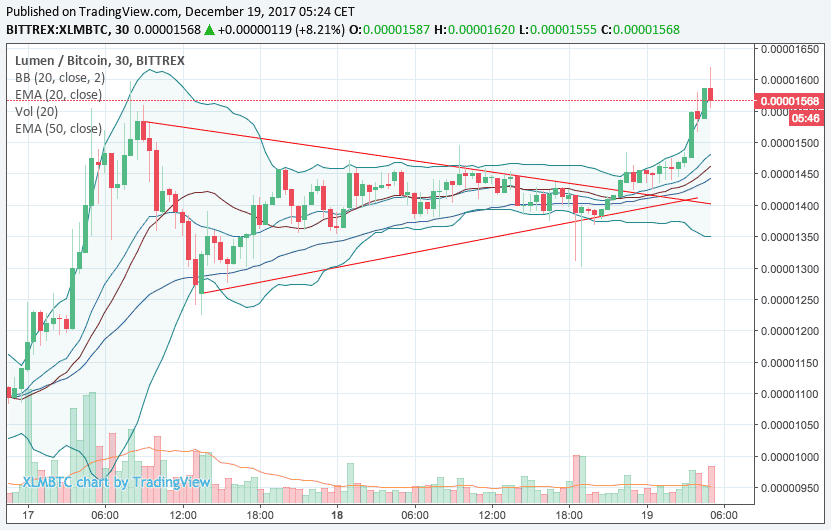

Check out the following chart, it is an example that happens right now, while we are writing this:

We saw a huge rise here before on $XLM, then it dropped into a sideways consolidation phase. This, by the way, is the typical behavior for legit coins. Low volume coins that are often exploited for pump and dump actions would drop to where they have been before. With legit coins, the crypto gems prices tend to consolidate on a higher level than on the last consolidation phase (if nothing drastic happens, like bad news, postponed releases, etc etc.).

By connecting the highs and the lows to a flight path you might see something, that is called a triangle pattern. In theory the next breakout of one of our crypto gems might happen, once the price breaks the upper resistance line, so once we have a finished bullish candle above the upper line, we might have a good entry to enjoy the breakout. To refine your entry, you might want to check the order book and the buy/sell walls. See what happens next, once the upper resistance line has been broken with a fully body candle (if one had the patience to wait for it – trade still running):

The Theory behind Accumulation / Distribution

But let’s take a look at the concept of accumulation / distribution in Layman’s terms as it’s important to have a full understanding of how it works so you can better understand the way prices move in the market across each coin. It is really basic economic knowledge that applies here, everyone in retail knows a story or two to tell about this process, which can be translated and applied to crypto gems trading.

Firstly we have to understand the background of a price movement. This is best possible in the case of owning a unique company since it can provide an insider’s perspective. For example, let’s say your company is the only one that produces a particular product in your city/town and requires a special license from the local government.

The product itself might have a special value and the number in circulation might remain the same, for example. This pictures the purpose of the crypto gems, a coins and its total supply of it on the markets. A special, unique idea that the project behind the coin follows. To start through into real life use, it needs a backing from a certain industry that makes use of it (for example like with $POWR or $XRP).

When people and companies feel that the sales of their products are unrewarding because of low sales or profits, they might decide to take action. There are also other factors like the expenses of operations including the store, staff, warehouse, etc. When this is the case it’s often necessary for a company to think of creative solutions to boost revenue. This is critical since it will help the company boost sales and be more competitiveness.

In cryptoworld this translates to a oversold coin, hovering on low levels, which is often the case for new ones. They need to create buzz with one of the crypto gems upcoming news: partnerships, adoptions, technical improvements are good examples. Once those events are announced and spread, the average trader becomes interest and might invest a little.

However, when customers learn a company’s product will stay in small supplies it can help to boost sales if people know the supply will shrink and the value increase. This company then benefits because it knows its sales and revenue will increase. This for example is the case, when a particular project announces a coin burn to happen anytime soon. The supply of the total available coins decreases and therefore the value of it will rise, if the demand is increasing. It is basically a catalyst for the common principle of supply and demand. Less supply + increasing demand = rising perceived and actual value.

What happens if the company announces a price increase? This can still result in higher sales as the customers believe there will still be a shortage of the product. In fact, knowledge of this fact can even result in higher sales as customers will be concerned about not having access to the particular product.

As the weeks continue you can increase your prices but sales will continue due to the worry about low supply. Some customers might decide to sell products back to the company in order to turn a profit. However, that’s ok since there will still be tons of buyers. Translated to our coin, this is the structure behind of a forming uptrend and shows also the power of FOMO (fear of missing out).

However, the potential problem of selling more items is it can cause the warehouse’s inventory to decrease due to high sales. It can also result in a drop in sales volume. You could keep raising prices so consumers think the situation hasn’t changed. The problem is that the original plan can become overly successful. So a key is to convince customers to sell back products so the company can keep going. For our coin this means to be aware to sell when the price becomes very much overbought / overvalued.

Imagine a bigger company is setting up a shop in the niche of ours: it can become tough for a small companies to compete with them. This can cause several problems for the company. That includes making it tough to compete with big companies and also the product’s value might plummet very fast. The situation can cause customers asking the company to buy back their products. The products are the same and there’s a small supply. If many people are selling back the products you can drop the price to boost demand prior to the products becoming worthless.

When the prices drop this can result in tons of people selling back the products and the company buying back a huge number of units. After a couple of weeks the panic selling will end since some customers hold onto the products even though there’s pressure. In the world crypto (and stocks originally) this model is also used sometimes. Look at SPECTREs token buyback program for a nice example how this can be done. This is one of the Crypto Gems we speak of here.

The company can then start to sell the products again at the past levels from the warehouse since it’s full of stock due to the buy-backs. This results in the company having to deal with low sales for a couple of months since the long-term sales can be sky-high. The company’s overhead costs can be paid and the company can also afford things like bonuses. Then the company can start the process again in order to get the more increasing results.

To sum up this analogy, the moral of the story is, that traders who purchase coins during the phase of accumulation have a big advantage since when volume increases they’re able to set their own selling prices. Never lose the complete picture out of sight. Even this is crypto, the basic market economics are still applicable and can be put to action. The key is understanding that trading is about understanding the differences between retail and wholesale pricing and this view should be kept and exploited to reap some nice profits.