Bonus: A interview with the CEO Pavel Matveev

WireX – one of the few working crypto debit card projects. 1.5 Million Customers. 1.5 Billion Transactions. Over 130 countries are available. A hybrid personal finance platform that bridges old world banking and new world.

Updated 6/21/2021 – Wire has agreed to halt UK signups after it consulted with the UK Financial Authorities. It seems the story for Wirex is now officially over 🙁

When you try to use your cryptocurrency holdings in the real world, you will face boundaries and limitations. Mass adoption has not gone that far, that you can spend it anytime, anywhere. Until that happens, there is the WireX crypto debit card as another kind of Fiat bridge. I am currently on vacation, and I paid for the flight, the accommodation, the restaurants, the thousands of little things you need for a trip like that with some of my Bitcoin funds. No, this article won’t contain an affiliate link, we want to provide you with an honest, unbiased review, though I can say that Wirex is for me the best bitcoin debit card, and I will explain why. But first, see where I am right now, brought here with the help of my Wirex crypto debit card:

With the big blowup of cryptocurrency debit cards (thanks to WaveCrest), many cards became liquidated and not working anymore. See where the TenX card and similar ICO – driven cards are now? They are working on a solution, but they face strong resistance from the banks. Searching for a solution to make my Bitcoin spendable in vacation, without paying outrageous fees and waiting weeks for a bank transfer to become issued, I found the free bitcoin debit card by Wirex. I doubted it at first, as I read some bad reviews of the beginning days, but created an account anyways.

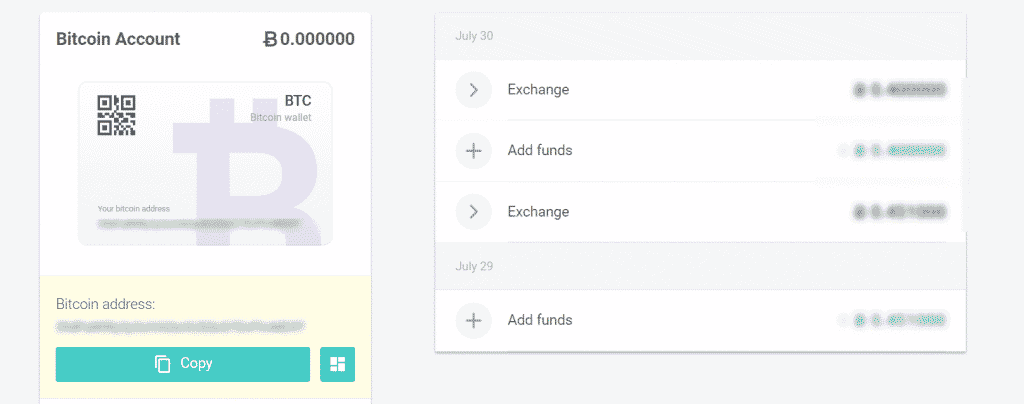

Their web presence is very professional and gave me some trust to try it out. Once you signed up, you don’t have to verify the account in most of the countries, but once you exceed ~5k in USD value, you will have to do it (but later more on it). You have several wallets in your account: BTC, LTC, and XRP. ETH is currently not yet available but in the making (within the next weeks, according to the TG chat). There should come an update anytime soon. The wallets are very convenient and easy to use, along with the Android & iOS app, a nice everyday wallet for itself. Though, I would not use it for this purpose, as you cannot get the private keys for this wallets due to security reasons. Always remember: not your key, not your coins.

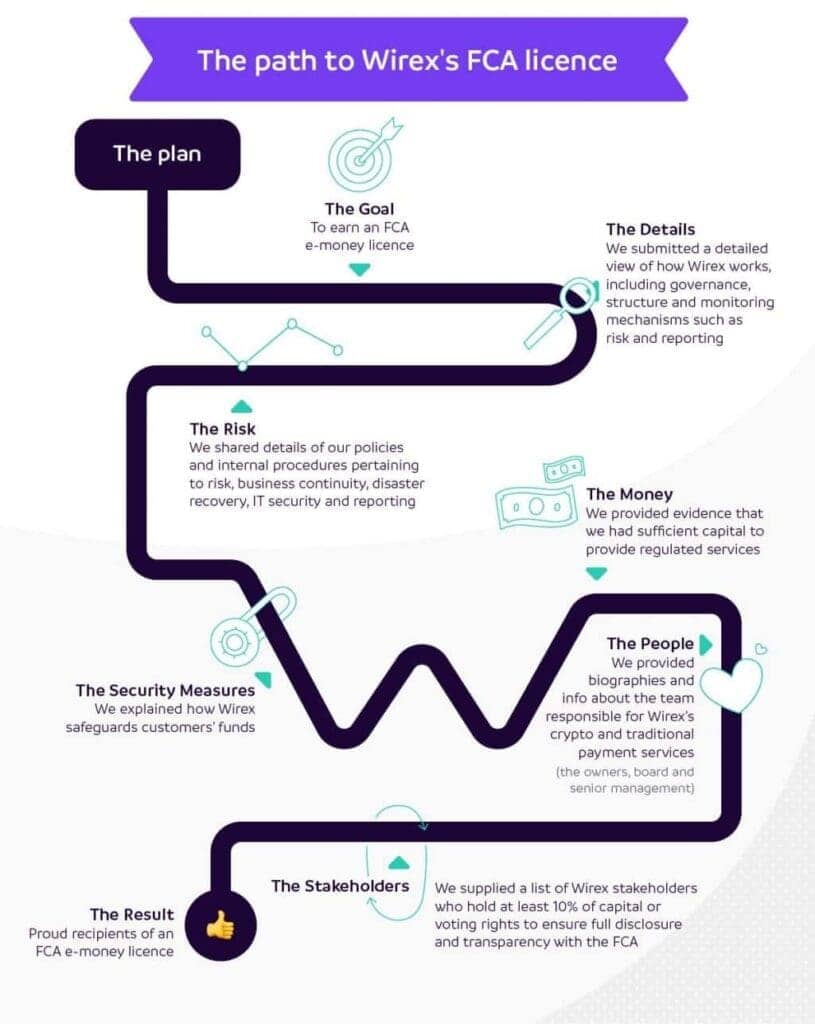

The real deal with the Wirex Crypto Debit Card is that they start moving into a very secure direction, as they just have been granted the FCA e-money license! This is big news – not only for Wirex but for Crypto mass-adoption itself.

Very proud to announce that Wirex Limited is now only the third #crypto-friendly company in the WORLD to have been granted an #FCA e-money licence. The approval process to be granted a licence is rigorous, it can take up to 12 months to be given even a decision. (1/2)

— Pavel Matveev (@matveevp) 23. August 2018

See the rigorous process they were following in this graphic:

How The Wirex Crypto Debit Cards Works

Once signed up with Wirex, you have several crypto wallets in your account. Just with every other wallet, you can transfer crypto coins like BTC, LTC and XRP (soon also ETH) to this wallets. For your virtual or physical cryptocurrency debit card, you have a fiat wallet on the platform. You want to exchange some of your cryptos now to fiat and deposit to your card by doing so. The insane thing is that you can exchange from crypto to fiat forth and back without paying any conversion fees (this fact alone makes it to the best cryptocurrency debit card)!

This makes this card so convenient to scale in and out and generate some extra profits. When I uploaded my first bitcoin to the debit card, it was around ~8k, and I exchanged a part of it to USD. Today’s price of BTC is 6.3K, so I can go back and repurchase much more Bitcoin for my fiat then before, isn’t that a nice feature? All these exchanges take outrageous fees for the conversion, which would eat up such tiny profits – here I can scale in and out with the blink of an eye, directly with my debit card app on my Android. Oh, darn, the excitement took me away – back to how the WireX works actually.

Well, you converted our BTC to your USD, British Pound or EUR account and from there you can spend it with a bitcoin virtual card, or you can order a plastic card (which looks super fancy). As I needed the debit card for a vacation, I ordered the plastic one, and it reached me within six days coming in a beautiful box. See it here:

The setup was a pretty straightforward process – no problems anywhere in the signup, verification or card order itself. The verification took around 10 minutes, and my card arrived after six days. It is as easy as it can be.

The first transaction with the Wirex Crypto Debit Card

So, I went to the travel agency (I prefer to sit with a real human sometimes – yay, old school, I am an old mug) and booked a flight and hotel. 5 Minutes before doing so, I converted my BTC to USD with ZERO fees (amazing, isn’t it) and then… I was shivering… the transaction went through without any problems. And from there I have been unstoppable – I paid for restaurants, groceries, travel supply, rented cars – not a single issue – and the beauty of it: after each of my purchases the Android app pinged me with confirmation and how much Satoshi I earned back with the transaction.

The Wirex Fees

Many of the available cards, like Revolut or MisterTango, will kill you slowly with the applied fees. This is another plus for Wirex – it is very cheap – actually, the only thing you pay is a monthly fee of £1.00 / €1.20 / $1.50 and withdrawals from an ATM. The account itself is free, the exchange from the wallets is free, the spending itself is free (in the most countries, US ePOS/POS transactions are charged with a $0.28 fee). See the pricing table yourself:

Account and Wirex card charges

| Mobile app | Free |

| Multi-sig wallet | Free |

| E-Money account | Free |

| Security features (2FA) | Free |

| Card issuance | Free |

| Card delivery | Free |

| Cryptocurrency AML | Free |

| Account management | £1.00 / €1.20 / $1.50 per month |

Top-Up charges

| Bank transfer | Free |

| Credit/Debit card | Free |

| Cryptocurrency | Free |

Transaction charges

| Cryptocurrency exchange | Free |

| FIAT exchange | Free |

| Wirex cryptocurrency transfers | Free |

| Wirex FIAT transfers | Free |

| Online card purchase (ePOS) | Free |

| In-store card purchase (POS) | Free |

| ATM (in Europe) | £1.75 / €2.25 / $2.50 |

| ATM (outside Europe) | £2.25 / €2.75 / $3.50 |

| Cashback in-store | Free |

I don’t think this will remain like this forever, but for now, you barely find a better deal card-wise. To be fair, there must be a way for them to earn some money with their crypto debit card. With this Wirex review, we will have an accompanying interview in a few days, where we asked this question (I am waiting for the reply by the time of writing this, and it will be a tough interview to be straight).

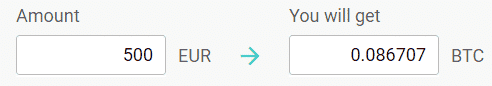

I assume they make their cut with not giving the best market price when exchanging, for example, BTC to USD, which could be considered as hidden fees. I made a test against Coinbase, and even it was not the best available BTC price, it was much cheaper than a Coinbase exchange. Check the direct comparison for buying BTC worth 500€ between Wirex and Coinbase:

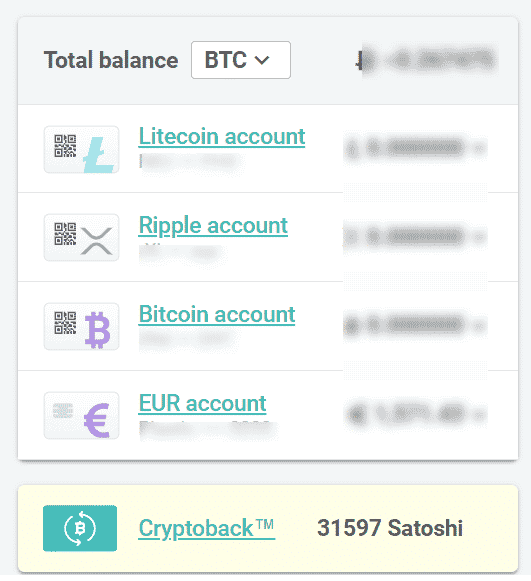

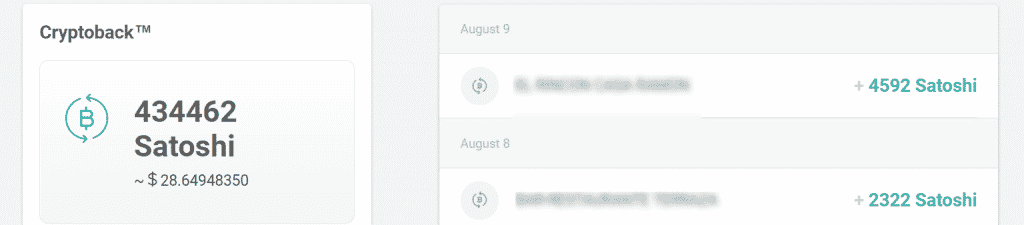

The Crypto Cashback

For every transaction you complete successfully, you get 0.5% of the purchasing value back in Satoshi. OK – given that most of the US cards offer a 2-3% cashback, it might not be the world, but consider the bitcoin volatility! If you keep spending with the card and collecting the cash back over time, it can sum up generate some sweet revenue – it is like a micro dollar-cost-averaging. With a low Bitcoin like right now, the value can easily skyrocket over time. I like the fact, that I spent money and earn Bitcoin while doing so. The crediting works instantly by the way, and you can see it in the neat app they offer.

The Support and Business Operation

When I was on vacation, I had to book a car for a day trip. The car rental company charged a $100 for the car and a deposit of $300 via authorize, which means, the total amount is blocked but not indeed charged. Usually, they would charge the $100 and release the block of the $300 once the car returned and everything is alright. Well, I returned the car, and after two days I didn’t see the amount returned on my crypto debit card by Wirex.

At the same time, there has been a maintenance update, and I was not able to see the particular transactions within the app, so I decided to write the support to make sure everything is working well. Within 1 hour I got my reply, the transactions have been visible again. On the same evening, the deposit returned to my available funds on the debit card.

On top of that, when I researched for this article, I also found a pretty active telegram channel, with the best community manager/live support person a company could wish for. She must be answering all day and night – always constructive replies. If you have any upfront customer questions, you can make use of their telegram channel here.

The Merciless Interview with Wirex CEO Pavel Matveev

SMARTOPTIONS: Many credit card based projects like TenX experienced the wrath of WAVECREST and have no active cards at this time. How can you do it, without the support of the credit card enterprises? How would you estimate the risk of getting the cards deactivated?

PAVEL MATVEEV: Wirex was one of the first, companies in the world to launch cryptocurrency-supported payment cards. We’ve been in this market from the very beginning. Since we were the first-movers in the industry, we built a lot of expertise and trust in the crypto/payment arena. We are currently working closely with several banks and card issuers all over the world, with the goal of delivering Wirex cards in every market.

We already have almost 2 million customers in over 130 countries. There is little risk of our card programmes being shut down, Wirex is one of the most compliant companies in the crypto space, with compliance being our third largest team behind development and customer support. Our recently awarded FCA e-money license underscores our commitment to transparency and integrity in operations. As you know, we are not an ICO, we are a privately – owned company, backed by a small group of fintech investors. The principal issue with ICO’ s is that they are often perceived as scams because many neglects to follow through on product delivery. According to a number ICO business analysts, it is estimated that approximately 80% of ICO’s operate in this space. With this in mind, it is safe to assume that they will have given little or no thought to their compliance and regulatory obligations.

From a regulatory perspective, their lack of compliance would be a major stumbling block when trying to integrate with regulated financial institutions like Visa or Mastercard. This would significantly impact their ability to deliver legitimate products.

SMARTOPTIONS: We know many people within the crypto community like to use crypto enabled credit cards to be able to spend their funds without having them hit a bank account. In which way is WIREX connected with for example to tax authorities? Do you have to “report” bigger accounts in any way to those?

PAVEL MATVEEV: At Wirex, we take compliance seriously and use a risk-based approach to mitigate the risk of money laundering. Therefore, we may ask customers for additional documentation (e.g. proof of address and confirmation of the source of funds) when they reach certain limits. Tax reporting is the customer’s responsibility and we offer tools which help with calculating taxes in different regions.

SMARTOPTIONS: Almost all crypto-enabled credit cards have been crowd-funded by an ICO – not WIREX. How is the project funded?

PAVEL MATVEEV: Wirex is backed by SBI Group which is an indirect subsidiary of Softbank – a large Japanese financial institution. Wirex has been profitable for the last 2 years, which is a considerable feat given that the business only started trading in early 2015. Customer trust is our top priority. We are proud of being a non-ICO company, in stark contrast to the plethora of crypto/blockchain companies that are issuing their own tokens with nothing to show investors in return. While ICO companies produce hype and promises with no tangible results, we deliver on our commitments to our users.

SMARTOPTIONS: How are your plans for the future? In your very active and helpful telegram support chat, there are many hints for GREAT additions in the future.

PAVEL MATVEEV: Wirex is growing very fast. We currently have 210 people across the group and we are planning to have 350 by the end of the year. This aggressive growth enabled us to launch our new XRP (Ripple) wallet and the Ethereum wallet should be added to our stable by the end of the month. We have several other exciting products in the pipeline, with card products coming online in North America and Asia in Q3 2018, which will accelerate client adoption towards the end of the year. In addition, we recently expanded our product range with a world – first cryptocurrency-based rewards programme – Cryptoback™ and will soon be adding more innovative crypto-backed services to our product offering.

SMARTOPTIONS: On Bitcointalk there has been some bad chatter about Wirex in the past. The start seems to have been a bit rocky, did you iron out these errors one can find in this old thread?

PAVEL MATVEEV: Our latest reviews are a testament to the considerable evolution Wirex has undergone. In contrast to old reviews, our recent reviews are almost entirely 5-star – as you’ll see from https://uk.trustpilot.com/review/wirexapp.com We are continually working to improve the group’s efficiency so we can deliver an ever-better customer experience, particularly in respect of fees. The reason we have been able to keep our fees so low is because our payment platform has been developed almost entirely in-house, which results in cost efficiencies.

We also integrate with the biggest exchanges and OTC traders, which means we get the best possible real-time rates. Many people do not realize that 70% of all bitcoin trading is happening in the OTC market. Most companies work with third-party providers, which increases costs. As we add even more liquidity providers, we anticipate that our fees will reduce even further.

SMARTOPTIONS: Thank you so much Mr. Matveev for finding the time to answer our hard-hitting questions. And now guys, go and have some real world fun spending your cryptos using your Crypto Debit Card by Wirex!

German Scam card. What a JOKE!