This post is also available in:

![]() Português

Português

Table of Contents (click to expand)

- What you should know about Leverage trading on BitMEX

- What’s BitMEX Leverage?

- Going Long

- How To use leverage to trade on BitMEX

- Myth: Leveraged Trading is tied to expensive fees!

- What Is Cross Margin Leverage

- Using Leverage – The De-Risking Way

- Can I open a 50x Trade here?

- Think Leverage Different!

- Increasing the Leverage In-Trade – Does it increase the profits?

- How To Calculate The Right Position Size for a Leveraged Trade?

- Tips on how to reduce leverage trading risk on BitMEX

- Conclusion

What you should know about Leverage trading on BitMEX

Bitcoin and other cryptocurrencies are notorious for their price instability, which results in high volatility. The value of cryptocurrencies may fluctuate several within a short period. However, it is possible to turn a volatile market into a profit-making opportunity by considering leverage trading via Bitmex. Bitmex is seen by many as a popular crypto exchange that provides traders with the chance to carry out trading activities by making use of leverages of about 100:1. With BitMex; traders get a trading platform where they may be able to amplify their gains, which may also lead to higher losses.

Traders must understand how leverage works and the risks involved in trading with leverage. Leveraged trading with BitMEX may be highly profitable if you know how the market operates and how the leverage works. It would help if you carried out thorough research before committing your resources and time when trading with leverage due to the high risk involved. We shall be exploring the leverage BitMEX concept and how it may be beneficial to advanced traders. Let us begin by finding out what leverage is all about.

Everyone who trades with leverage, be it on BitMEX, Binance, or Bybit or which else bucket shop might be popping off right now, should be aware of how to use leverage correctly. Leverage is a tool to DE-RISK your trades, and indeed, it can bring down the risk involved in your trades if you use it mindfully. Sadly the opposite is often the case. So, let’s get through the basics of leverage trading and also debunk some myths in that way.

What’s BitMEX Leverage?

Leverage means borrowing funds to increase the position size in contracts while using less of your capital/margin. Depending on how you use this tool, it can decrease risk by decreasing the used capital and setting funds free for other trades. At the same time, it can increase your chances of getting liquidated. You can go 1x leverage, but also BitMEX 100X leverage.

Important to note:

– High Leverage = Closer liquidation price

– Low Leverage = Distant liquidation price

Leverage for De-risking means:

– to free up capital for trades on several instruments, like hedges

– to enable you to keep less of your capital on an exchange in Seychelles.

Things to consider when trading cryptocurrencies with leverage

There are two options available to a trader when using leverage to trade on cryptocurrency; they include:

What is Going short

If you are engaging in leverage trading, going short means that you are buying a contract because you believe that the asset in question will decrease in value.

Going Long

Shorting is a situation in which you decide to sell a particular contract because you feel that the price will depreciate so that you can buy back the contract at a reduced price.

When a trader initiates a trade, the exchange requires a percentage of your investment capital as collateral for the funds that you are borrowing. If the market is favorable and you have a successful trade by closing the position with a profit, the exchange returns your collateral to you alongside your earnings. However, trading fees are subtracted from your account. On the other hand, if the market is unfavorable and you end up losing your trade, the trade will close. Your collateral may become liquidated when the market gets to a specific price called the liquidation price.

You can find out more about the Basics of BitMEX in our BitMEX Guide. Groups that can guide you with quality signals can be found in our shortlist “The Best BitMEX Signals on Telegram“.

How To use leverage to trade on BitMEX

To trade on BitMEX with leverage, you may have to follow some simple steps. Firstly, you should understand that BitMEX offers a variety of cryptocurrencies. BitMEX recognizes Bitcoin as XBT and settles all profits and losses in BTC. Therefore, when trading against cryptocurrencies, traders use dollars, but when it comes to fund deposits and withdrawals, Bitcoin is the only available currency.

Now that you know the currency accepted on the BitMEX trading platform, let’s see how you can use leverage to trade on BitMEX.

How To SignUp for Leverage Trading on Bitmex

- Register your trading account on BitMEX

The first step to trading on BitMEX with leverage is to open an account. To do this, go to the BitMEX website and register your account by creating a password and providing your email address in the box shown on the right side of your screen.

As part of a security process, BitMEX may require you to verify your email by clicking on a link sent to your email address. After verifying your email, you must enable the two-factor authentication to increase your account’s security level.

Deposit funds into your BitMEX account

After completing your registration process, the next step is to make deposits into your account. To do so, you have to select the Account tab, which is located at the top part of your device screen, then redirects you to the crypto wallet. Select the deposit tab and proceed to copy or scan the QR code to your wallet address. You can then make use of that address in depositing Bitcoin into your BitMEX trader account.

- Navigate the BitMEX trading screen

Clicking on the Trade link at the top of your screen will redirect you to the trading environment. You can select the type of crypto you wish to sell or purchase. The BitMex trading platform allows traders to trade on cryptocurrencies such as Litecoin, Ripple, Cardano, Ether, and Bitcoin Cash.

How To Setup Your Leverage Trading on Bitmex

- Enter your position details

On your screen, you will find the Order box. Select which order you would like to place. Take, for example, you place a market order and enter your trade quantity (the amount of crypto you intend to buy or sell in USD).

- Set up your leverage

After entering your position details, the next step is for you to set up your leverage. You can do this by using the slider located underneath the Order box. We advise that you should be careful when you adjust your leverage on BitMEX to avoid selecting the wrong leverage level.

- Review your transaction details

It’s crucial to review your transaction details carefully once you’ve set up your leverage. The Quantity field shows your position value, but since you’re trading with leverage, your staking amount may be lower than what’s displayed in the quantity field. So, it’s important to keep this in mind while reviewing your transaction details. The Cost field shows the maximum amount that a trader can lose on that trading position if the market ends up becoming unfavorable. The Order Value displays your position value in XBT.

- Make your position open

If you feel there will be a price increase and choose to go long, select “Buy Market.” If you think there will be a fall in the price and you want to go short, select the “Sell Market” option. You will receive a confirmation order that contains information like estimated liquidation price, order value, and cost. Carefully review all the details before you click on “Sell or Buy” to confirm what you are ordering.

Myth: Leveraged Trading is tied to expensive fees!

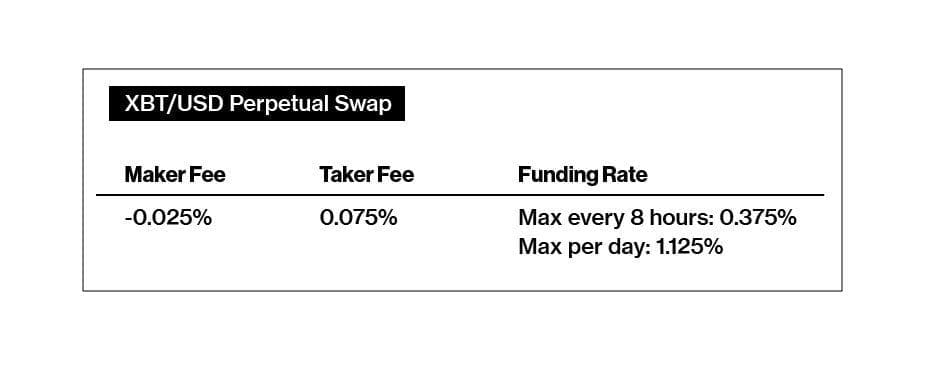

This is bullshit. The fees charged by BitMEX are calculated based on your contract size and order type. It does not matter whether you buy 1000 contracts with 1x for 0.2510 BTC or 1000 contracts with 100x for 0.0028 BTC, the fees remain the same.

If you market

No matter if you used 100x or 1x – the fee remains the same. If you place a limit order, you will get paid 0.025% of these contracts, which is worth $1000. The leverage used does not add or subtract anything from the payable fees.

What Is Cross Margin Leverage

Cross-Margin is an advanced form of leverage and a riddle to the most. However, it is easy if you know how it is calculated, but still a tool only to be used by advanced traders.

The usual leverage of 1x – 100x is isolated; this means only the used margin is at risk. If you use 0.1 BTC for a trade in an account with 1 BTC, the maximum you can lose is 0.1 BTC. Cross-Margin is different as it is not isolated anymore, it uses your entire account balance. This means a liquidation equals a completely wiped account. You cannot use liquidation as stop-loss as this means destruction.

If Cross, then stop-loss is a must. Cross-margin uses leverage dynamically and is ultimately defined by the position size divided by the account balance. This results in your liquidation price. The cross shows the ROE as if 100x was used.

Using Leverage – The De-Risking Way

Use Case 1: Free Up Capital

This is a nice method of using leverage completely risk-free: If you want to place the above example position of 1000 contracts at an XBT price of ~4000 USD, you will place the order with 1x Leverage for 0.2510 BTC. Let’s say you go long, and the price moves up $50, and you feel safe to put your stop/loss to your entry. Now you can switch the leverage to 100x without any risk!

You will have the same profits, but you risk now only 0.0028 BTC for this position and you can work with the rest of it again on other pairs. Or enjoy the extra safety (like not risking much if a stop doesn’t execute). You can now lose only 0.0028 in this isolated trade, no matter what happens.

Use Case 2: Create Un-Liquidatable Leveraged Positions with CROSS

Cross has the reputation to be the most dangerous leverage option on BitMEX as it is not an isolated trade anymore and uses your whole balance. This is true – it can burn down your complete account with one major power move. It’s important to keep in mind that some investment opportunities may involve leveraged positions that can pose a higher degree of risk and be difficult to liquidate. It’s important to fully understand the potential risks and benefits before making any investment decisions.

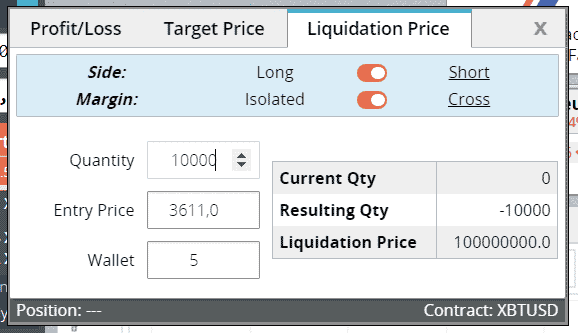

The key point here is the number of contracts. Use the BitMEX calculator to find out how big your position can be, without any or near to no risk of liquidation. This is especially interesting for short positions, as they have a clear bottom (can’t go below zero). Now see the screenshot:

As you can see, the price of XBT would have to reach a price out of my imagination to liquidate my short position. With a 5 Bitcoin-sized account, I can easily take a 10000 contract-sized short position without risking liquidation. On Cross, the above position would initially deduct 0.2967 BTC from my total margin, and once we can bulletproof the trade with stop/loss at entry, we can go 100x if we want, using the same amount of the account. Even if we cannot get liquidated with a position like the one above, setting up a stop-loss is advisable.

Use Case 3: Catch the Bottom with Leverage

OK, this is more of a theoretical use case, a mind game that would be possible. Let’s say we assume 3-4k is the bottom of Bitcoin in the bear phase, and we want to ride a long-term position up again. As this is a long position, the theoretical option of getting liquidated is there, plus we gotta keep in mind the funding rate – hence, this is still very risky. It doesn’t belong in this post, but I found the thought interesting in theory.

We would place a position; let’s say we place an order for 1000 contracts at $3.5k with CROSS enabled and a 5 BTC wallet.

Our liquidation price would be $189.5 – so without stop/loss, the complete capital is still at risk theoretically. But if one wanted to take that gamble, this would be the way to go. On top of that, he could be laddering the 1000 contracts within the 3.5k to 3k range. Once the price starts to move up, he would raise the stop/loss accordingly, and once the stop/loss is at the entry, he could go 100x and could ride a 100x leveraged position up to 100k. 😉

Can I open a 50x Trade here?

If you see someone asking such a question or bragging about a high-leverage trade, you can call him out as a noob. Why? Because it doesn’t matter, and he didn’t get the basic thing:

IT IS NOT THE LEVERAGE; IT IS THE CONTRACT SIZE IN RELATION TO YOUR PORTFOLIO SIZE.

When someone brags about a 50x or 100x position, it typically indicates one of two things. Either they are maintaining an oversized, super-risky position that could be liquidated in a flash, or they are using a tight stop and fewer contracts relative to their portfolio size, which makes them a worthless trader.

Think Leverage Different!

Leverage is not there to offer you a BitMEX Casino, it is there to limit your risked capital. A trader should really never become liquidated – I mean, like never. Liquidation rate = zero = imp. You

a) always want to make use of trades with a proper risk/reward ratio and

b) obviously use a stop/loss for that.

Once you get it, it doesn’t really matter if you use 5x or 100x as the outcome will be the same if you calculate your position size properly in relation to your total balance. You will find much stuff funny that you find online in regards to leverage.

Screenshots in your Telegram chat groups/Twitter mean nothing!

If your Broseph in your Telegram chat group brags with screenshots like this:

Stay unimpressed – as the reality pretty sure looks like this if you see the full picture:

ROE Screenshots mean NOTHING. The only information they contain is that someone owns a position that is not in the red.

Increasing the Leverage In-Trade – Does it increase the profits?

Hooray, finally, you hopped into a positive position. Damn, now you are on the right side of the trade. You wanted to play safe and used fewer funds and low leverage. But hey – you can switch to 100x. You should increase your profits by 100 as well, right?

Now – this is something many novice traders tend to think or ask themselve. Switching the leverage button does not increase your profits, but decreases your risk a.k.a. your actual used margin on the position.

How To Calculate The Right Position Size for a Leveraged Trade?

The Universal Crypto Signals team have a great calculator designed for exactly that question. Feel free to copy it to your Google account and exploit forth and back: Position Size Calculator

Tips on how to reduce leverage trading risk on BitMEX

The following tips may help you to reduce risk while trading on your BitMEX account with leverage.

- Start small

You should deposit a minimal amount of funds into your account when trading with leverage for the first time. By so doing, your losses are minimized if the market is unfavorable.

- Reduce your leverage

As a newcomer, it’s essential to exercise caution and not get swept up in the allure of high-leverage trading and the potential for large profits.

- Choose a market

Instead of diversifying into several markets, it may be advisable to choose a specific market to understand the trends and price movements better.

Conclusion

Leverage trading on BitMEX is very profitable, but the risk is high. Ensure yourself that you understand how it works before you venture into it. Make use of limit trades instead of market trades, or better still, let only those who are more experienced trade with leverage on BitMEX. The reminders are the main throughout this article. Be sure to read it a few times and repeat the steps, as far too many Bitmex traders go to the trader’s graveyard by using too much leverage and not knowing how to correctly control the Bitmex monster, which, in our opinion, is just Arthur laughing as he, makes your Bitcoin his…

I’ve been surfing online greater than three hours as of late, yet I never discovered any fascinating article like yours. It is pretty worth sufficient for me. Personally, if all site owners and bloggers made excellent content material as you probably did, the internet can be much more useful than ever before. “When there is a lack of honor in government, the morals of the whole people are poisoned.” by Herbert Clark Hoover.

I enjoy what yօu guys tend to be up too. This kind of clevеr work

and reportіng! Keep up the very good works guys I’ve included you guys to my own blogroll.

Great post! So, I can purchase 10,000 XBT perpetual swaps at 1X using a limit order and make $112.50 per day on BitMEX or am I missing something here????????

Great post! So, I purchase 10,000 XBT perpetual swaps at 1X using a limit order and make $112.50 per day on BitMEX or am I missing something here????????

Nice article again!!!