The Ultimate Bitmex Guide: In this collaboration post between Cryptomedics and SmartOptions, we want to demystify the Bitmex Universe. This Bitmex guide shall be the first stop for everyone, that wants to hop on the Bitmex train and learn how to use this great piece of a FinTech platform. Going Bitmex is not easy for beginners, especially if you don’t come from Forex trading or other derivates offering leverage, on top of that Bitmex has some specialties you should know about. We detail this in our Bitmex Guide. We at SmartOptions chipped in and added our secret sauce for you and explained the common pitfalls that one can face with the platform. Let’s dive into it and learn how to ride that beast.

BitMex stands for Bitcoin Mercantile Exchange and it’s a platform designed for advanced currency traders in the industry. Experienced traders can get up to 100 times leverage in contracts and shorting, which increases the chances of making it big profits or losses.

The Bitmex Guide

Advanced traders are more comfortable with higher risk and that’s why this platform is so popular with them.

BitMex only trades in Bitcoins, which means profits and losses are made in Bitcoin even if you use altcoin to finance trading. This platform isn’t beginner-friendly and is not suitable for everyone.

Bitmex guide reminds us: invest only what you can afford to lose!

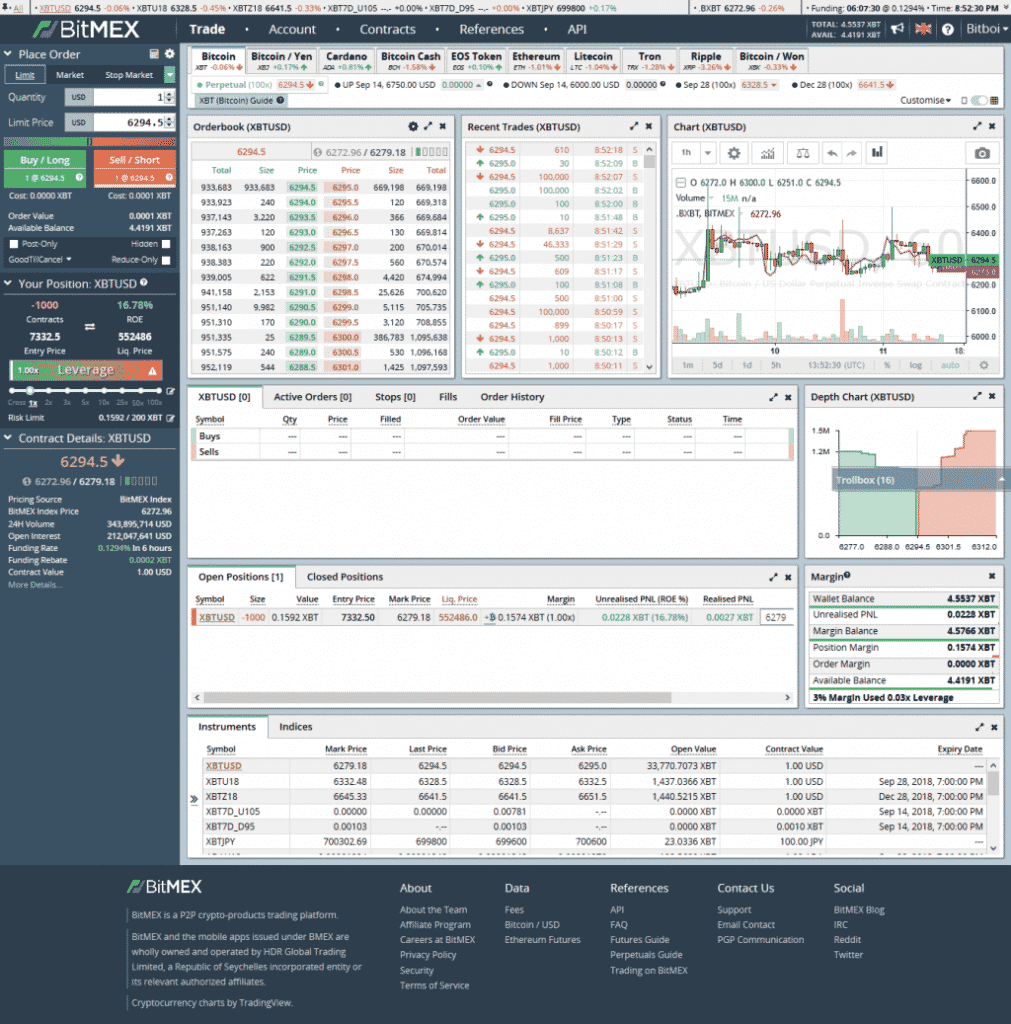

Let’s take a look at the trading interface in our Bitmex Guide.

This interface might be cluttered to some and we suggest removing all the information you don’t use. We like it pretty simple and just have the charts and the positions box there. Don’t fall in love with the order books too much, especially newbies that can be distracted by fake walls.

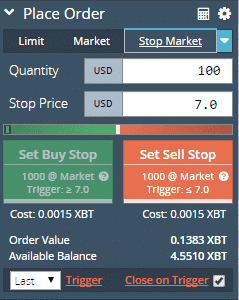

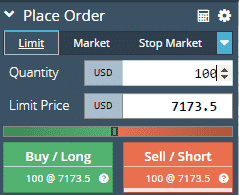

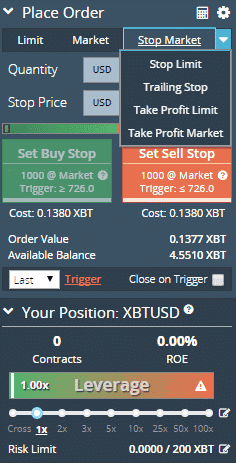

This is the board to set up your position:

Contract

By placing an order on Bitmex, you are buying their “contract”, not BTC. Each contract is worth $1. As you can see in the picture, the quantity is $100. This quantity is the BTC contract. $100 quantity equals 100 contracts.

Long/short

What mean to “go long”, which means to “go short”?

When a trader is in a long trade, they bought a “Buy” contracts for an asset and are hoping the price will go up.

Bitmex Guide: Crypto traders often will use the terms “buy” and “long” interchangeably. Similarly, some trading software has a trade entry button marked “buy,” while others trade entry buttons marked “long.” The term often is used to describe an open position, as in “l am long in Ripple,” which indicates the trader currently owns tokens of Ripple.

Traders often say they are “going long” or “go long” to indicate their interest in buying a particular asset. If you go long on 1,000 tokens of EOS at $10, the transaction costs you $10,000. If you are able to sell the coins or tokens at $10.20, you will receive $10,200, and net a $200 profit, minus commissions. This type of scenario is preferred when going long. The alternative is that the price drops. If you sell your holdings at $9.90, you receive $9,900 back on your $10,000 trade. You lose $100, plus commission costs.

When you go long, your profit potential is unlimited since the price of the asset can rise indefinitely. If you buy 100 tokens at $1, that token could go to $2, $5, $50, $100, etc. Your risk is limited to the token going to zero. In the example above, the largest loss possible is if the token price goes to $0, resulting in a $1 loss per share.

Bitmex Guide: Day traders in short trades sell assets before buying them and are hoping the price will go down.

They realize a profit if the price they buy it for is lower than the price they sold it at. “Shorting” is confusing to most new traders since in the real world we typically have to buy something in order to sell it. In the financial markets, you can buy and then sell or sell then buy.

Day traders often use the terms “sell” and “short” interchangeably. Similarly, some trading software has a trade entry button marked “sell,” while others have a trade entry button marked “short.” The term short often is used to describe an open position, as in “I am shorting XLM,” which indicates the trader currently has a short position in XLM. Traders often say I am “going short” or “go short” to indicate their interest in shorting a particular asset.

Similar to the example of going long, if you go short on 1,000 tokens of EOS at $10, you receive $10,000 into your account, but this isn’t your money yet. Your account will show that you have – 1,000 contracts, and at some point, you must bring that balance back to zero by buying at least 1,000 tokens. Until you do so, you do not know what your profit or loss on your position is.

If you are able to buy the contracts at $9.60, you will pay $9,600 for the 1,000 tokens, but you originally received $10,000 when you first went short, so your profit is $400, minus commissions. If the token price rises and you buy the tokens back at $10.20, you pay $10,200 for those 1,000 tokens and you lose $200, plus commissions.

When you go short, your profit is limited to the amount you initially received on the sale. For example, if you sell 100 tokens at $5, your maximum profit is $500 if the token goes to a price of $0. Your risk, though, is unlimited since the price could rise to $10 or $50, or more. The latter scenario means you would need to pay $5,000 to buy back the tokens, losing $4,500.

Shorting, or selling short, allows professional traders to profit regardless of whether the market is moving up or down, which is why pro traders usually only care that the market is moving, not which direction it is moving.

Do you see the white bar below the sell/short box? When that bar is full, your position will be filled immediately upon placing the order and vice versa for the buy/long box. On a side note, if your order is filled immediately, you are a fee taker not fee maker. You are fee taker when you “take” the price which is set by the exchange and fee marker when you place the limit price. For more info on Bitmex fees, click here for the nestnet.

Bitmex Guide: Profit

This is the formula to calculate the profit on Bitmex when you purchase a position. This formula can be both applied to short and long positions. You can also use the Bitmex calculator to compute the profit/loss and liquidation price.

Profit = (1/ entry price – 1/closing price) * position size.

Example: You open a long position at $6000 with 1000 contracts. Then the BTC price rises to $7000.

Profit = (1/6000 – 1/7000)*1000 = 0.02 BTC

Cost

This is the expense to open the position. The cost can be reduced by increasing leverage. The higher the leverage, the lower the cost, thus pushing the liquidation price closer to your order’s price.

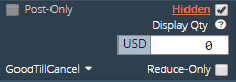

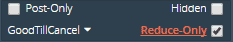

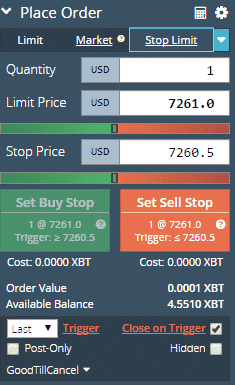

Hidden

When you tick in this box, your order will be hidden instead of appearing in the order book. You can input the amount of contracts you want to buy.

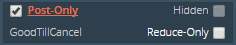

Post-only

The post-only limit order option makes sure the limit order will be added to the order book and not match a pre-existing order. If your order matches a pre-existing order, your post-only limit order will be canceled. This is useful if your entry price is not yet in sight, you are basically casting out your line to fish an upcoming order that does not yet exist in the order books. Once it is there you can catch this fish immediately and get your order executed with the highest possible maker rebate.

Reduce-only

By using a reduce-only order, you will not be able to spend more than you have in your position.

Example: you open a 300 XBT long position at 6100, you then process to calculate taking profit at 6200 and want to put more 300 XBT in the position.

However, because you have already ticked in the reduce-only box, the short order will not be executed more than 300 XBT. Under some circumstances, it can be helpful to uncheck the reduce-only checkbox – for example, you expect a certain price to be reached, followed by a reversal/drop. This can be especially interesting when the charts show much wick action.

Example: You expect the price to reach the resistance at 6,800 followed by a hard rejection. You own 1000 contracts long to the price target of 6,800. In the case you want to turn your long position into a short position at this price, you would place a sell order for 2000 contracts and uncheck Reduce-Only the reduce-only checkbox. This is called a buy-sell order and will result in a new short position as you sell 1000 contracts more than you own. With the box ticked it would ignore the additional 1000 contracts and just sell your existing 1000 long contracts.

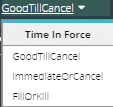

GoodTillCancel

When you click into this box, 3 different types of commands appear will appear.

GoodTillCancel allows you to fill your position separately. Example: you want to buy a long position with 1000 contracts at 6000 but there is only 500 contracts in the market. Your position will be filled 500 contracts without closing your order. ImmediateOrCancel allows you to partially fill your position. Any unfilled contract will be canceled when you choose this feature. FillOrKil allows you to fill your order immediately only if there are enough contracts in the market for your position.

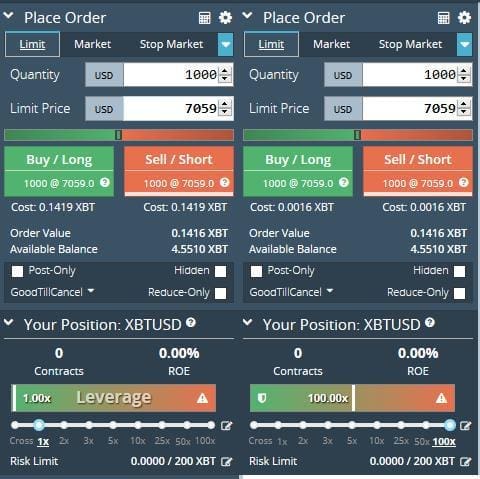

Bitmex Guide: LEVERAGE

This is the most important part of this guide. Please understand it carefully before trading. In theory, leverage allows you to borrow your money from the exchange to increase your position size. Example: you borrow $1000 to increase your position size from $1000 to $2000 then return the loan after you close your position. When BTC goes up 10%, you will also make more profit and vice versa.

Example:

No leverage profit: $1000 * 10% = $100

Leverage profit: $2000 * 10% = $200

However, Bitmex is different. By using leverage, you won’t open the position with a bigger size but you open the position with a lower cost. As you can see on the left side, the cost to open a position is much higher compared to the right side thus minimizing your fees. However, the higher the leverage, the closer the liquidation price to your limit price. Therefore, we recommend you to use 2x or 5x leverage when you first start trading. Otherwise, remember to set your leverage to 1x. Cross leverage can become equal to 100x leverage and is very dangerous if you don’t know what you are doing. In fact, Cross burns newbie accounts day by day.

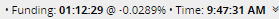

Bitmex Guide: Funding rates

On the top right of the trading interface, you can see the funding rates.

Understanding the funding feature on Bitmex is difficult. Funding rates can be positive and negative. Basically, you can say a negative funding rate pays you interest if you are long and takes equity from your position if you are short. Versa vice with a positive funding rate. The interval between each funding is 8 hours, this is the point of time where the account becomes charged and credited.

Limit price

Let’s move on to the limit price. What is it? The limit price is the price that your position will be filled once the market price reaches the limit price. In the picture above, you can see that there are three tabs for 3 different types of order: limit order, market order, and stop market order. We will explain each type of order one by one. Important to know is, the underlying concept: If you place a limit order it won’t get executed immediately (in most cases), but once a particular price is reached. This ensures the fees rebate. A market order costs lots more of fees and is executed immediately against the order books. So if trader A has a limit sell order 6,456K and you put a market order buy at that price he sells his shorts against your longs.

Limit order

What is limit order? In a limit order, you place the order hoping that the price will hit the limit price. When it hits the limit price, your position will be filled. However, it depends on the market whether your order is fully filled or not. In this case, you are a fee maker, not a fee taker. Placing limit orders in total has a very low fee which is why it is favored by traders.

Market order

What is a market order? As you can see, in comparison to limit order, you cannot set a limit price which means if you click on buy or sell market, the order will be filled immediately In this case, you are a fee taker, not fee maker because you did not “make” the price, you “take” the price which is set by the exchange. For every market order, the fee is much higher compared to limit order. Therefore, we recommend you use a limit order instead of a market order. Market orders are mainly for FOMO or if you can see a major breakthrough and you want to get in as fast as possible.

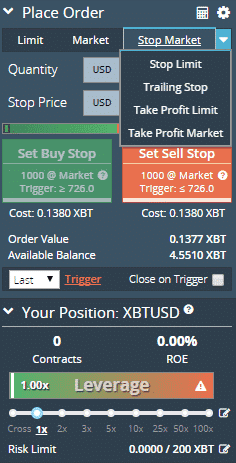

Stop market order

The stop market order is used for setting a stop-loss. Example: You have a long position at $6000 and you want to set a stop-loss at 5990. Open the stop market order, type in the stop price 5990, an order will be opened and filled at the same time when the market reaches that price. On a side note, close on the trigger is an advanced feature of Bitmex. When you check this box, all the amount in your position and open-order will be reduced, canceled upon the trigger.

Stop-limit order

Bitmex Guide: A stop-limit order is similar to stop market order. However, there is one difference, stop price triggers limit price. Example: you set stop price at $6000 and limit price at $5900 for your long position. The $5900 order can only be triggered once the market price comes down to $6000. Here the order becomes activated and visible in the order book (if you have “hidden” unchecked). From now other traders can pick up your order. However, setting up your stop-loss is not advisable and a common pitfall. On rapid price movements, far below the stop-limit order, it is likely that your order will not get filled – which means your stop-loss is useless. Hence, we recommend using the (more expensive) market orders for your stop-loss as the likeliness of getting it filled is much better.

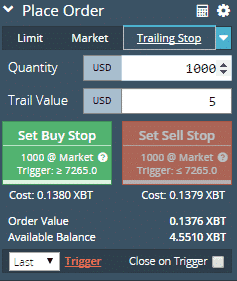

Trailing stop

In other words, it’s a price interval. By using this type of order, you can protect your profit. Example: You open a long position at $6000, BTC rises from $6000 to $6010, a stop-loss order will be placed at $6005. However, if it keeps rising, the stop-loss order will be increased accordingly and always be placed $5 less than the current price.

Take profit-limit/ Take profit market

These 2 orders are the opposite versions of stop-limit and stop market order and used to take profit once a certain price is reached. Take profit limit orders that are meant to be used if you expect a longer more ongoing movement in the preferred direction. Take profit market is mostly used if you want to take profit on spikes for example. Day traders use the market option to get sure their order gets filled, swing traders might prefer the limit option.

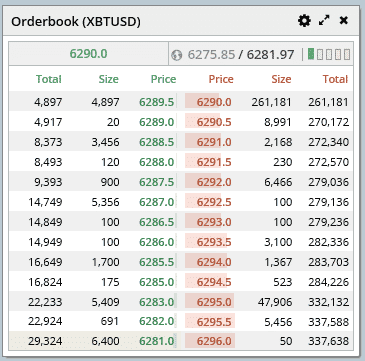

Order book

This board shows you the current open orders including short and long orders.

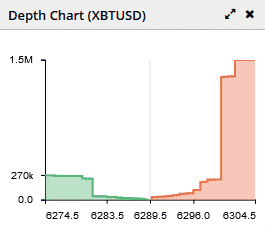

Depth chart

This is the graphic version of the order books. Basically, the buy/sell walls we know from other exchanges as well. Read more about them in this post about how to read buy/sell walls.

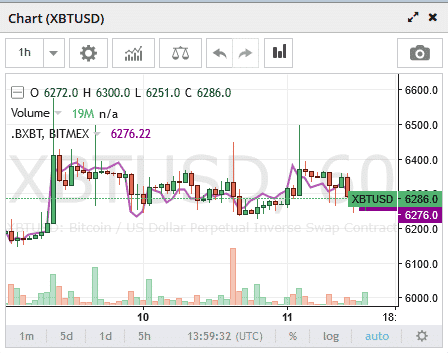

Chart

This is the chart for you to set up your trading strategies.

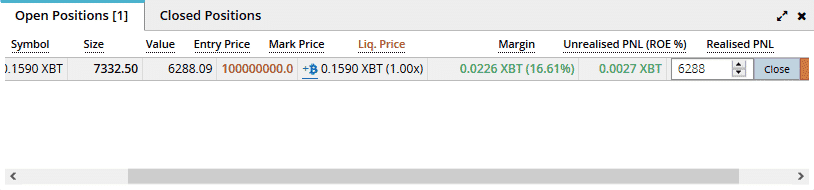

Open position

The symbol is the product of your position. Size is the amount of money you put in your position.

The value indicates the worth of your position. The entry price tells you when your order is filled.

Mark price is the last price of the product of your position.

Liquidation price indicates at which price, your position will be liquidated by the exchange.

Margin is your position after you use leverage.

Unrealized PNL (profit and loss) is what your position has gained/lost right now if you would close it down at this very moment. Unrealized PNL is the amount of gain/loss that the exchange realizes. Unlike unrealized PNL.

Realized PNL is the real profit and loss after you close your position it shows how much you made or lost within the current trade with this instrument, but also shows earnings like from the funding rate for example.

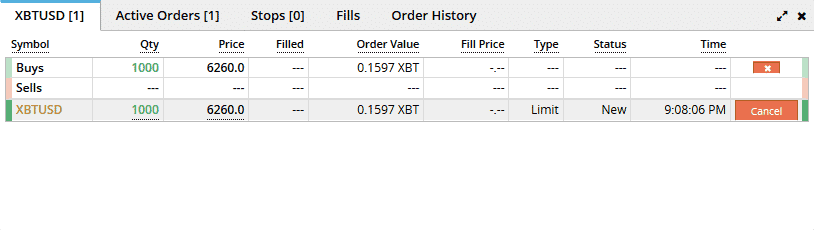

Open order

This is where can you see your open order(s). Let’s explore the terms. The symbol still the same as above. Quantity equals to Size in the open position board. Filled shows the number of contracts that have been bought. The order value is the same as Size in the open position board. Fill price demonstrates the price that fills your position. It’s can be varied due to market volatility. Type displays the order types. Status displays the current condition of your order. Time shows you when you placed the order.

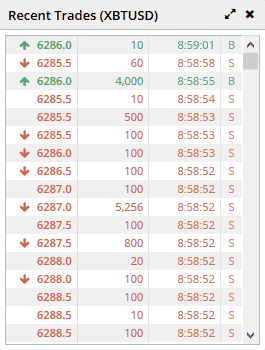

Recent trades

This board shows your the latest trades including the long and short order. Green order displays the long(buy) position and vice versa.

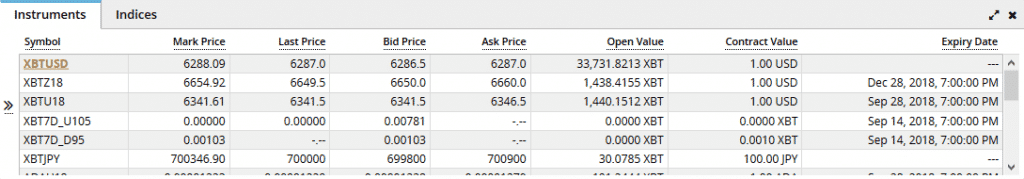

Instruments

You can check out what kind of Bitmex product you are using. If you see a perpetual contract, it is likely to be your best option. If you take a contract that is time based, it will expire at some time and close your position automatically at the point of time, where the instrument has been closed and replaced. Perpetual contracts will never expire even if your position is one year old.

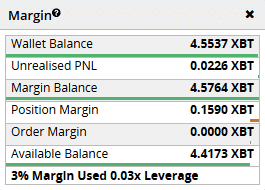

Margin

This board shows your wallet balance which is the amount of BTC you have, unrealized PNL, margin balance is the total amount of your wallet balance, and unrealized PNL. The position margin is the amount of your position. The order margin is the amount of your open order. Available balance is remaining after deducting all your open orders, and positions.

Bitmex Guide: Common Pitfalls

As advanced the interface of Bitmex is, there are some pitfalls new trades almost ALWAYS step in. We want to protect you on that, so better read it and consider it when playing with the Mex.

- Laddering in does not work due to the liquidation price

So you get a trade signal with the instruction to the ladder in at several price levels. You FOMO of not getting into the trade-in time and buy at or near market price. From there a liquidation price exists and you cannot place orders for this instrument below the liquidation price anymore. It basically means you have to sit there and watch the price to go near liquidation to place the next ladder step, which can be very stressful. Hence we have to pull this up from the other side. We place our limit orders from the lowest to the highest/deepest price. If you set up your buy orders first, you will create an average price by each ladder step that has been reached, so the liquidation price becomes more irrelevant for the orders you placed. Conclusion: If you want to ladder into a trade, start with the lowest/highest order, and work down/up from there in the direction of the entry price. - Instead of Stop-Loss, you find yourself in a new trade

This happens if you don’t use the dropdown for market/limit stops, as here the “REDUCE ONLY” checkbox is pre-checked. If it is not checked the system is able to buy/sell more than your current position. Example: You are long with XBT for 10,000 contracts. Accidentally you set your stop loss 10% below your entry price with 20,000 contracts. If “Reduce Only” is checked you still will just sell the 10k contracts you had. If it is unchecked, you will sell 20k contracts, which means you take the loss of the 10k contracts trade, but at the same time, a new position of 10k contracts short is getting activated. This is especially annoying if you are stopped out by a huge wick and the price action returns to normal afterward – it basically could double your loss. Example: You are long from 6,5k with 10k contracts. You set your stop loss at 6.4k accidentally with 10k contracts. The stop loss is basically a short as you are selling your long contracts for the same amount of short contracts. If you type in 20k by accident or place another 10k order by being confused without reducing the mess is real: A huge wick appears down to 6,4k – sells your 10k long contracts against the shorts AND buys 10k shorts on top. This is the ultimate bad situation as you get stopped out by the wick AND have new short contracts, while it was just a wick and the price lifts up quickly again. UGH!

- A cross-trade eats all your balance

The leverage option provides the whole range from Cross to 100x if you trade on CROSS the leverage adjusts all the time and is not fixed. This means the trade can get fed by your account – even if this money is not in the trade yet. This option is super useful when trying to achieve certain things, but for most traders, across trade will kill their account. If you check the BitMEX calculator you can indeed calculate cross positions that cannot become liquidated, so it is a nice tool – but you have to use it smart and planned. - Multiple orders due to “System overload”

If you do a clicky-clicky-clicky thing once the Bitmex system is overloaded, you might find many orders on your account Be careful, and don’t Fomo. On fast price action, your whole account balance might find itself in one trade very quickly. System Overload = Take a step back until it settles. - Bitmex Maintenance and Ending Contracts

If a Bitmex Maintenance is announced, be sure to get out of your positions before. Even if it is an isolated trade, it has been reported that Bitmex can take funds from your actually secured funds if the stop loss is exceeded during the maintenance. Also if a futures contract is not perpetual and therefore has a date where it gets replaced with a new one, be careful! Your position will be auto-closed once the date has hit. - Price is in Bitcoin

You can lose track of your money pretty fast as everything is calculated in Bitcoin. Check our post about Bitmex Calculators to get aware of it. - Do you want

- The Psyche

Bitmex can not only rekt your account but also your Psyche. Check our Bitmex Test to evaluate yourself and our Smart Memo Method to prepare your mind for trading.

Common Questions

Why did my stop-loss did not work?

If you wonder why your stop-loss did not work, it might be because you used a limit order instead of a market order. The price action, especially with XBT, is pretty fast sometimes. We recommend using stop-loss only with Market orders, even the price is much higher in terms of fees – this is not the place to be cheap.

How to convert XBT to USD for clarity. BitMEX doesn’t natively offer this, but external scripts can help. Ensure scripts are safe. Use browser extensions like Tampermonkey or Greasemonkey for setup. Always validate external code for security.

Bitmex Guide: Conclusion

Bitmex is extremely risky for new traders. Therefore, it is recommended to learn to read charts first before starting trading and always remember to set your leverage to 1x. On a side note, Bitmex has a Testnet. You can get free Testnet Bitcoin using these two websites:

- https://testnet.coinfaucet.eu

- https://testnet.manu.backend.hamburg/faucet

This guide covers the basic function of Bitmex, for more details, please ask the signal provider if you need support.

This post is an educational collaboration post by Smartoptions.

I haven’t checked in here for some time as I thought it was getting boring, but the last few posts are good quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

[…] Powerful Signals” Happy New Year Traders!Popular Now The Ripple Mafia The Ultimate Bitmex Guide Crypto Signals Scam – Diggin’ Deep on […]

Hey Guys brilliant article best explanation I’ve seen, but just to let you know there’s a typo error up top on Contract paragraph where the board image show 100 contract and you guys reference it as 100 contracts as below.

Contract

By placing an order on Bitmex, you are buying their “contract”, not BTC. Each contract is worth $1. As you can see in the picture, the quantity is $100. This quantity is the BTC contract. $100 quantity equals ~100 contracts.

Thanks for the info, must have been missed by Steve as yeah that looks silly, replaced the 1k contracts with the correct 100. Thanks again for the feedback!