We are in a bear market right now, and whilst there are first signs for a starting uptrend that will take us all to 40, 60, 100k (of course), we likely will see a few dumps until this is going to happen. When we started with Cryptos everything was so easy – money was lying literally on the street. You bought some coin or token you never heard before, just held it and one day, magically, it’s value has doubled, tripled, quadrupled and we all have been able to feel a bit like a modern Warren Buffet. Yeah. Those have been the good times – and then the bears took over. Bitcoin goes down and tears all the altcoins along with it. Too bad, we can’t profit from falling prices, right? But who said, we can’t actually? There is Bitmex… (and with the opportunity comes also a very sad story, read on…)

This seems to be the time of Bitmex, the time of the impatient short-attention-span investors, that has enough of the bear markets and lost his patience. Those guys that read 20 reviews before buying a battery charger but throw 20k into dodge because someone in a facebook group has shilled it.

What we typically see, is that people have all their funds locked into many different altcoins, which all equally are losing in value over time while this crash. This does not feel good, this is not what we wanted when we came to crypto – no good feelings of ever-rising accounts for us anymore. Difficult. Out of such emotions, where one can’t keep up with a suffering portfolio or bear with the lack of action and thrill, we often do our worst mistakes. Bitmex saw a massive increase in new users over the last days, and we are pretty sure, a massive amount of rek’t accounts as well. Bitmex offers a dangerous leverage of factor 100, which can literally make you rich in seconds – and also burn all your money in the blink of an eye. Let’s take an almost classical example of the average Bitmex user in this dark period of the bear market.

Keep this word of warning a hand, when you think about playing with the 100x leverage. It is teasing, but it is no option. Let’s take a look at Bitmex.

If you register with Bitmex and deposit your Bitcoins (only available deposit method) you might be confused at first. Those of you that always traded on Bittrex or Binance, will find a different level of the trading interface. There will likely be new words for you and you might feel insecure – please, before you ask the Reddit guys or in forums, take the few minutes to browse the Bitmex help database and read. You will get it, bull or bear market, makes no difference. Take your time and read it slowly, all the answers you are searching for are right in front of you. There are thousands of tutorials online, yes even those digest YouTube videos.

How To Short Cryptos with Bitmex?

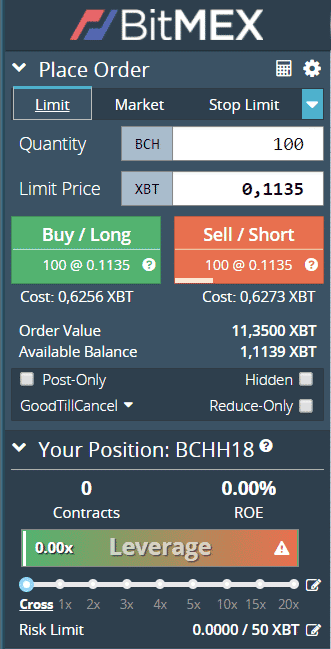

Bitmex offers a few cryptos as futures: ADA (ADAXBT as ADAH18), Bitcoin Cash (BCHXBT as BCHH18), Ethereum Classic (ETCXBT as ETC7D), DASH (DASHXBT as DASH8), Ethereum (ETHXBT as ETHH18), Ripple (XRPXBT as H18), Monero (XMRXBT as XMRH18), Litecoin (LTCXBT as LTCH18), Stellar Lumens (XLMXBT as XLMH18) and ZCash (ZECXBT as ZECH18). And of course Bitcoin (XBTUSD).

Don’t get in hibernation mode because of the futures thing, as you can see they are offering mostly H18 future contracts, which you are trading (the only exception is ETC with a Day 7 contract). These futures are the anticipated prices in for a defined point of time (like 18 hours from start) by traders that hold those contracts. If you place an order with Bitmex, you don’t have to hold until the end of the contract, but can short or long until your exact bear market target.

On Bitmex you are trading altcoins against almighty Bitcoin($XBT), what makes it more easy to short them. A general learning for altcoins in the last years was: Bitcoin up = Altcoins down; Bitcoin down = Altcoins down; Bitcoin sideways = Altcoins up). What did we see in this year? We saw a dramatic fall of Bitcoin and with it, actually, all altcoins saw a massive price decrease. However, most of the volume goes to Bitcoin here, so this is mostly where the dance is.

While we hold our altcoin purchases, there is no reason not to short altcoins or bitcoin on Bitmex. You can’t deposit your alts, so you can just keep holding them. You deposit your spare Bitcoins or Satoshis and after 1 network confirmation, it becomes available in your account.

Bear Market Window

The integrated Tradingview charts will show you the futures and the actual price against BTC. So let’s say we think BitcoinCash (BCHH18) will continue to fall. The left side box on the Bitmex interface will let you place your order. We short 100 BCHH18 here, means we get 0,6273 BTC deducted from our available funds for -100 BCH. Once the order is filled we can set up a take profit order once the price has reached 0,100 bitcoin. If the price is hit and the bear market order becomes filled, we shorted an altcoin and made a profit on it, like on any exchange where we would have bought BCH at 0,100 and sold it at 0,1135 ( to put it into versa vice – exchange perspective).

Same goes for Bitcoin, which we trade against the US dollar here. You think it will go up again from 8,200K USD you set up a buy / long order at that price and an according sell order with your target. Also versa vice, BTC is soaring around 12k and you think it will drop back to 9k, you simply short the amount you can afford and are willing to lose.

So far so good, but there is a dangerous topic on Bitmex, just as we speak of being able to afford something…

Buying and Selling with Leverage on Bitmex

The beauty with crypto is that it usually is (was?) volatile enough, so you trade with nice profits without the need to leverage. Most of the crypto traders are familiar with exchanges where they buy an actual coin. This means if you purchase 1 ETH for 0.1 BTC, this is exactly the deal. You really get 1 ETH into your wallet for that 0.1 BTC and the deal is closed and you could withdraw to any wallet. Trading on Bitmex is a different concept you should know about before spending your satoshis there. You don’t buy any coins on Bitmex, you purchase contracts, hence the futures. Let’s say you think BTC will start a big upmove from 8,9k.You have 0.1 BTC in your account and use a leverage of x10. This would enable you to purchase 10 times more contracts, in this case for 1 BTC. As long as it is rising, it is wonderful, you take part 10x from each satoshi increase, which means you can significantly increase your account’s value in no time. But of course, there is a catch… Bear Market or Bull Market makes no difference.

100x “No” to 100x

And the catch is that it works the same way in the other direction. If you sell the top of a big green candle, you can make extreme profits. But if your trade turns out bed, and the candle breaks out to another, even bigger bullish candle you might get rek’t in no time. If you went all in or did not isolate the trade your complete account can go zero in no time. OK, this is unlikely (read unlikely, not impossible) with a 10x leverage, but the loss would be one that hurts. The most teasing thing to the most newbies might be the 100x leverage, which is nothing but insane. If you have limited equity on Bitmex, one false move of BTC will burn your account. Recall the sad story posted above and don’t be that guy. We recommend a leverage of x3 as maximum if you are new to this. Only clever planned trades, never a trade in a rush as you have to “exploit that drop” – these things go wrong most of the times. The more adrenaline is kicking in, the more stupid moves are taken.

Shut down that Trollbox

The trollbox by Bitmex is one of the most desperate ones I have ever seen. If you follow signals or don’t trust your own analysis this trollbox is 100% secure way to go crazy, be sure to book the rehab before you open it. What you will see is fighting kiddies, that went either long or short and try to fight the opposite direction down. The saddest thing is those users that went all in with a 100x leverage and try to convince other traders in the trollbox to take the same position with self-invented news, fake technical analysis and what else. This reminds to junkies that want to make you borrow them money for the next push. If you are not 100% confident with your position, do not open the trollbox – just skip it.

Can I kill my “bear market boredom” with Bitmex?

It is hard to hodl through this long period, it really it is. To all of us. Our amygdala was used to become teased and pampered by crypto in a positive way and now we get nothing but depressive hits. Yes, sure it is normal that we are in search for the next 100x kick. Sweaty palms and $$ eyes. But use your brain, the best way will be to stay strong and hodl through the dry time. Chances are that many people will gamble their equity and flush it down the toilet. Crypto funds which could be the base of a bright financial future.

If you want to try out leveraged trading on Bitmex one needs extensive TA or fundamentals knowledge (which BTC is known to give a flying f*ck about most often), you need much powder in your account to keep up with the leverage and you need a game plan for each trade about when to get out – otherwise, you will get rek’t. So if you are in for the Bitmex-thrill, be prepared for a risky gamble – we wish you good luck and hope we will keep meeting in crypto world tomorrow.

Let’s close this post with a nice heads up from our friends over Verified Crypto News