One of the most special Signal Groups we feature here on SmartOptions.io is without a doubt COIN OBSERVATORY. The very active trading, the hedging strategies they use, the legacy trades – and last, but not least, the endless stream of education you can gain in their chats. This interview with their head trader George Saber became an extensive source of knowledge and you should really read it. You get true EXPERT advice, free of charge. Very valuable, don’t miss out a single word…

About George Saber

Founder, Technical Strategist, Swing Trader. Once an FXStreet.com Cryptocurrency Analysis Contributor the momentum Swing Trader, specializes in strategizing for and predicting bull runs. He published about the GOLD bull run in early 2019, before it broke out, he also published about and predicted the 2019 Bitcoin Bull run within a week; It happened just 2 days later! Think that’s impressive? Saber’s technical analysis predicted a large incoming correction across all markets in December of 2019, and 2 short months later came the COVID-19 crash. It’s no wonder Coin Observatory members call him the Wizard. Saber also mines Ethereum and has a knack for finding the next big market opportunity. By Big, we mean BIG. 1000% + return on equity for his trades is normal. He’s been featured on Tail Lopez’s Crypto Mastermind program, as well as MentorBox.com, and is an active Technical Analysis contributor to Knowledge Society. “I’m in markets so that my money does the work for me, so identifying the Market’s Structure is my top priority. Then patiently waiting for the opportune moment to strike, and disregarding chart noise is the formula for fewer clicks and bigger returns.”

SMARTOPTIONS.IO: You have an amazing company behind/beside your signal service. Tell us a bit more about your profession the amazing tools you developed.

GEORGE SABER (COIN OBSERVATORY): Coin Observatory Signals sprouted from our strategizing efforts in our previous venture Generation Crypto, along with much influence from Ray Dalio’s Bridgewater. Ray’s firm was able to compile data points to build correlations and predict future prices in various industries. One example, they would take into consideration rain, to hay production, cattle, and feed. Then Bridgewater could accurately build correlations and systematically profit from trading 3 futures markets based on their algorithm.

As the name states “Observatory” – (the action or process of observing something or someone carefully or in order to gain information). Fast forward to the age of digital assets, otherwise known as Cryptocurrencies, we couldn’t quite follow the steps of Dalio, but we drew much inspiration from him.

We now build cloud computing screening resources for Coin Observatory and family offices, that include correlation models, strategy screeners, and execution signals. Our main quantitative strategist comes from an intensive business intelligence background, and throughout the bear market, we’ve utilized his edge, and have been developing market intelligence resources by quantifying technical strategies and applying them to proven BI models into a unique custom universe.

We’re able to screen the entire Altcoin Marketcap for any and-or any combination of technical strategies to determine sustainably profitable trades. We’re also able to narrow down strategies for profitability relating to current market conditions. Our Market Intelligence Interface generates reports, data points, and signals that better help us navigate the market. Currently, we are working on implementing a trade execution solution to automate trading. As well as make automated quantitative trade execution available to our trading community, so everyone can profit from passive income.

SMARTOPTIONS.IO: You educate traders to learn while they earn. What are the methods you teach? Hedging plays an important role in your strategy.

Our mentorship program is modeled to be comprehensive; covering all aspects of trading, we offer trade signals yet emphasize education and growth. As our objective is to have the most well-rounded and best-armed trading community.

Upon sign-up we recommend several resources along with our trading library, these prepare our traders to better understand their role in the market.

The first outside resource covers trading psychology, Mark Douglas’ “Trading in The Zone” is an audiobook that we push on everyone. Our veterans refer to it as the “TITZ”; it is a crowd favorite.

Once a trader has their mindset in tune they are now ready to tackle the market. We dive then dive into technical analysis. Our workshops cover everything from the basics of reading a chart, to Fibonacci extension and retracement, momentum oscillators, moving averages, to building strategy templates, custom indicators, and compiling combinations of the above into confirmation strategies.

Our mentoring team is diverse with several specialists. Cover many aspects of the market, with the best Elliott Wave trader I’ve encountered, an MDRP trader, to gem picking fundamentals.

Hedging is our Bitcoin leveraged trading imperative!

It is the only way to always be on the right side of the market every time while limiting risk and maintaining proper exposure.

This is where my quote comes into play “history is two-sided, there are winners and there are losers.” Though most of the time winners and losers are temporary in the form of Bull-Bear battles, volatility can push prices in either direction during a certain time frame; Hedging when done properly with appropriate stop-losses, allows us to be on both sides of the trade, so we’re profitable by capturing the volatility and the breakout.

The main principle is long support and short resistance utilizing various futures, setting proper stops, and letting the market do the heavy lifting.

Hedging also allows us to “catch the knife” we’ve been notorious for buying the riskiest swing lows, as we’re able to do so with minimal risk. Any losses that our long entry incurs, our short-sided trade generates profits to counter and the inverse is applicable.

The above strategy also allows us to capture a range without profit taking a position, so we can ride our swing low or swing high entry further through the breakout as prices move away from our stop loss, without the risk of liquidation, or having to hunt down another entry point.

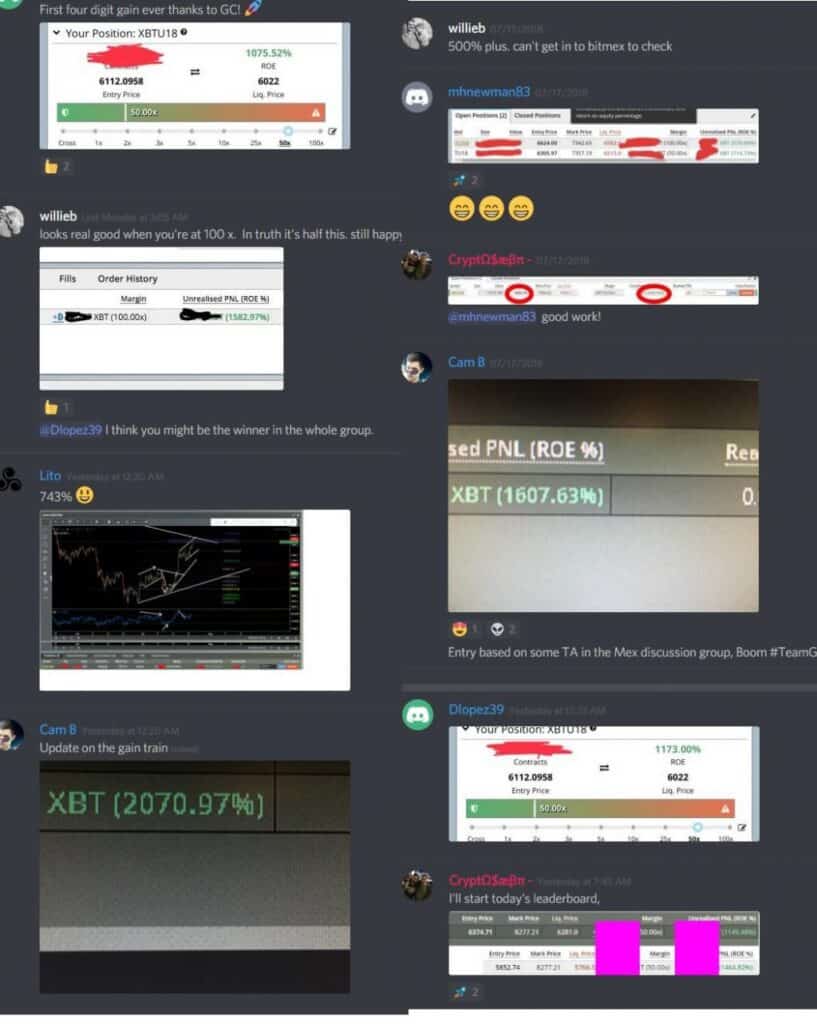

Following our hedging strategy, we’ve been able to capture Bitcoin swings from swing low to swing high on margin for astronomical returns.

GEORGE SABER (COIN OBSERVATORY): You also offer trades for legacy markets. Please explain to our readers why and how they can profit from this side service of yours.

I always highlight to our community that a trader only has one role; “extract value from the market”.

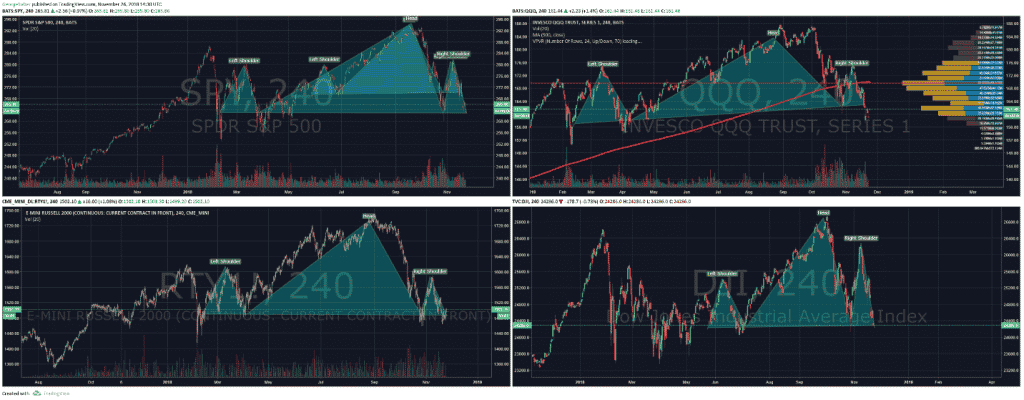

Legacy and Traditional markets have been on my radar since August 23rd, 2017. As all indices made their third divergent high, I highlighted that we’re going to short the stock market. It wasn’t until a month later that indices such as the SPY, RUT, IXF, NDX, DJI, QQQ started their “correction”.

Then Warren Buffet made a bold statement about Bitcoin being “rat poison squared”, and I didn’t take that very lightly, and decided I wanted to prove him right. Except the “poisoned rats” didn’t die, they adapted. Bitcoin’s yearlong bear market taught us a valuable lesson, and hence we are thankful for the “poison”. When we see an incoming “correction”, we profit take, then short-sell, short early, short everything, and keep shorting until the market reaches a decisive turning point.

Our team believes that legacy markets more specifically indices are headed for a massive correction. As of today, September 23rd 2018, I see further downside on the RUT, Russell 2000, in the form of 17% and another 9.5% downside in the SPY. And these numbers are conservative.

Our community has been made aware and we’re currently long on 2x and 3x inverse ETFs to several indices and in good profits. If this is anything like the 2008 correction, we would don’t want to miss out on the short-selling opportunity of a lifetime. Bitcoin’s bear market taught us that during a bear market there’s only one group profiting and smiling, and it’s the sellers.

Our overall Stock Market portfolio is in 17% + profits and for every 1% loss, an index makes us gain 3%. That being said we’ve dedicated much time and resources to studying, monitoring, and building correlations to track this correction in accordance with previous ones. My background in legacy markets has me homing in on other opportunities of grandeur. Such as natural gas prices have surged 187% in the past week, we are also trading gas-related 3x ETFs.

SMARTOPTIONS.IO: Which are the most important trading rules you want to give out to our readers?

GEORGE SABER (COIN OBSERVATORY): Trading rules, I prefer to call them systems; And it all starts with a checklist and a “demon book”. The checklist’s role is to keep the trader in check, and the demon book is where the trader logs losing trades or winning trades that turned into losing trades. As trading is a practice, and one must always work on improving their practice.

Some suggestions for the checklist,

- Why is this a valid trade:

- Is my risk defined:

- Are my targets defined:

- How does market sentiment affect my trade:

- What are the current setup confirmations:

- What will invalidate this trade:

- When can I move my stop loss to entry:

- How will I trail my stop loss:

SMARTOPTIONS.IO: Tell us about the gems you hold and don’t think about selling in the short term? How does your personal portfolio look like at coin observatory signals?

GEORGE SABER (COIN OBSERVATORY): Before diving into gems, I’d like to highlight the nature of my portfolio.

Portfolio in Markets:

35% Legacy Markets, currently net short.

65% Crypto

Cryptocurrency portfolio allocation:

-25% Hedging BTC

-30% Momentum Altcoins

-25% Cash (Exited into cash was made at the break of $6200 for a buyback at the head turn.)

-10 long-term Hold

-10% liquid BTC

Current momentum altcoin picks:

QKC

FCT

XEM

REP

MONA

ARK

MANA

Long-Term Holdings:

LSK

STRAT

BAT

XLM

SMARTOPTIONS.IO: Dear George, thank you so much for taking so much time to pass on a fraction of your knowledge. I am sure it is really valuable and helpful to many people out there. We thanks Coin Observatory Signals for their time spent with us!

Fact sheet for Coin Observatory

- Website: https://coinobservatory.com/

- Discord Contact: albinomonkey#5909

- Discount Code: Tradesmart (55% off the first month)

- Plans & Pricing: $89/month, USD recurring and VIP $189 per month

- Special Features: Power Hours education – Video Trading, active trading support, Hedging with Bitmex XTB trades, Mentorship

- Further Information: Interview with Coin Observatory

- Auto Trader: Yes, custom solution

- Exchanges: Markets on Bitmex, Binance, Bittrex

- Signals with TA: All signals include a screenshot of the Technical Analysis behind the trade and we also write a brief description of why they are taking the trade. All trades have appropriate Risk to reward

- Bitmex Signals: Yes, separate Bitmex Channel

- Trading Timezones: EST, but the analyst team is all over the globe. There’s always someone online guiding the community and supporting